MI 151 2021-2024 free printable template

Show details

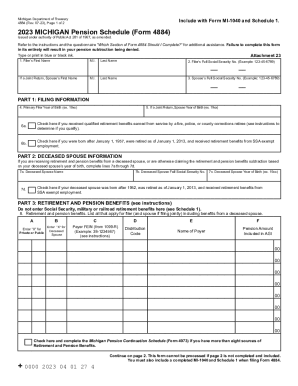

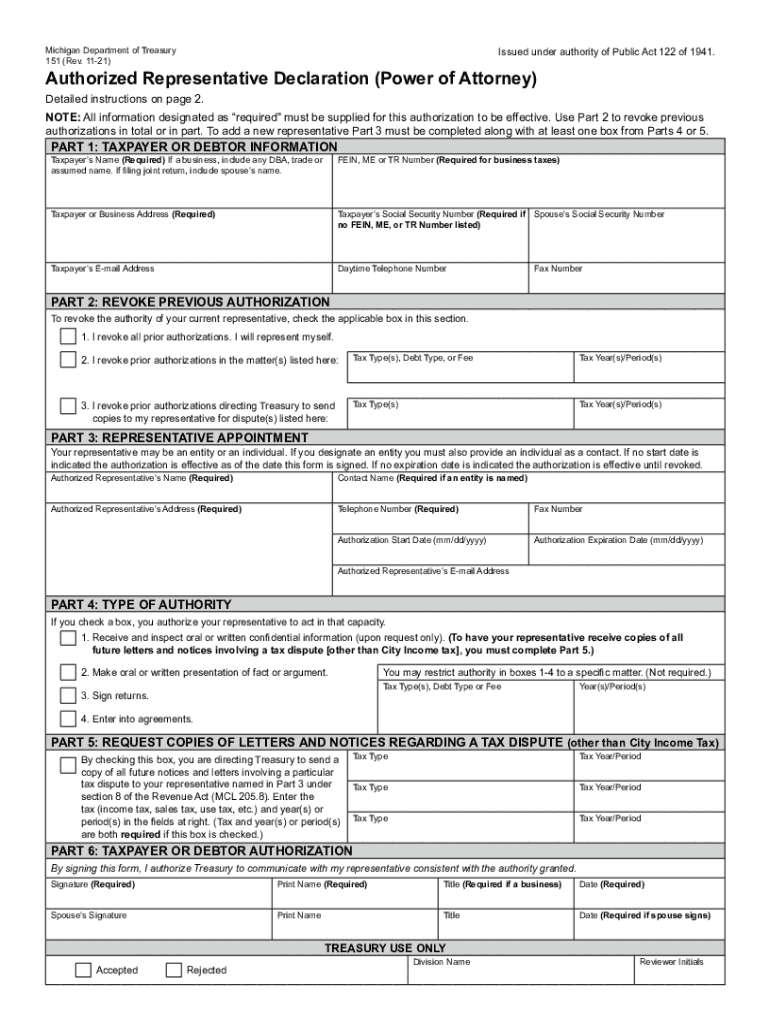

Reset Form Michigan Department of Treasury 151 (Rev. 1121)Issued under authority of Public Act 122 of 1941. Authorized Representative Declaration (Power of Attorney) Detailed instructions on page

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your michigan treasury 2021-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your michigan treasury 2021-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing michigan treasury online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit michigan treasury online form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

MI 151 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out michigan treasury 2021-2024 form

How to fill out michigan treasury?

01

Gather all necessary documents such as income statements, deduction records, and tax forms.

02

Complete the required sections of the michigan treasury form, including personal information, income details, and any applicable deductions.

03

Double-check all information for accuracy before submitting the form to the michigan treasury department.

Who needs michigan treasury?

01

Michigan residents who have earned income or owe taxes to the state.

02

Individuals or businesses who have conducted taxable activities in Michigan.

03

Anyone who receives a letter or notice from the michigan treasury department regarding outstanding taxes or filing requirements.

Fill michigan treasury printable : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out michigan treasury?

To fill out the Michigan Treasury Form 4973, you will need to provide the following information:

1. Your name and current address

2. Your Social Security Number

3. Your employer’s name and address

4. Your employer’s Federal Employer Identification Number

5. The total amount you are requesting from the State of Michigan Treasury

6. Your bank routing and account number, if applicable

7. The reason for your request

8. Your signature

Once you have filled out all of the required information, you can submit the form online or through the mail.

What information must be reported on michigan treasury?

Michigan Treasury requires taxpayers to file an annual return of their income, which includes required information such as wages, salaries, and other income, as well as deductions, exemptions, and credits. For certain credits, taxpayers may also need to provide information about qualifying expenses or other documentation. Additionally, taxpayers must report any changes in their address, as well as other information related to their tax filing status.

When is the deadline to file michigan treasury in 2023?

The deadline to file your Michigan Treasury tax return for the 2023 tax year is April 15, 2024.

What is the penalty for the late filing of michigan treasury?

The penalty for late filing of a Michigan Treasury return is 5% of the amount due for each month or part of a month that the return is late, up to a maximum of 25% of the amount due.

What is michigan treasury?

The Michigan Treasury, also known as the Michigan Department of Treasury, is a government agency in the U.S. state of Michigan. It is responsible for managing and overseeing various financial operations, including tax administration, state investments, banking services, and debt management. The Michigan Treasury works to ensure the effective and efficient management of the state's financial resources, including the collection of taxes and the disbursement of funds for various government programs and services.

Who is required to file michigan treasury?

The required individuals or entities to file Michigan Treasury forms depend on the specific form being referred to. There are several different forms that may need to be filed with the Michigan Department of Treasury, including:

1. Michigan Individual Income Tax Return: This form must be filed by every resident of Michigan who has income subject to Michigan income tax, regardless of whether they are employed or self-employed.

2. Michigan Corporate Income Tax Return: Corporations and other business entities that are subject to the Michigan Business Tax (MBT) or the Corporate Income Tax (CIT) must file this form.

3. Michigan Annual Withholding Reconciliation Return (Form 4917): Employers in Michigan are required to file this return to report the annual reconciliation of income tax withheld from employees' wages.

4. Michigan Sales and Use Tax Return (Form 5080): Businesses that make sales in Michigan and are subject to sales tax must file this return to report and remit the sales and use tax collected from customers.

5. Michigan Withholding Tax Return (Form 5080): Employers who are required to withhold income tax from their employees' wages must file this return to report and remit the withheld taxes.

It is important to review the specific requirements and guidelines provided by the Michigan Department of Treasury to determine the applicable filing requirements for each form.

What is the purpose of michigan treasury?

The purpose of the Michigan Treasury is to manage the state's finances, revenue collection, and disbursement. It is responsible for overseeing various financial operations and activities of the state government, such as tax administration, treasury investments, and managing the state's cash and debt. The Michigan Treasury also provides financial services and resources to individuals, businesses, local governments, and other entities in the state. Additionally, it aims to promote economic growth, fiscal stability, and responsible financial management within Michigan.

How can I edit michigan treasury from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your michigan treasury online form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Where do I find michigan treasury form?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific mi treasury and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for the mi treasury form in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your michigan 151 form in seconds.

Fill out your michigan treasury 2021-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Michigan Treasury Form is not the form you're looking for?Search for another form here.

Keywords relevant to michigan treasury fill form

Related to mi treasury online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.