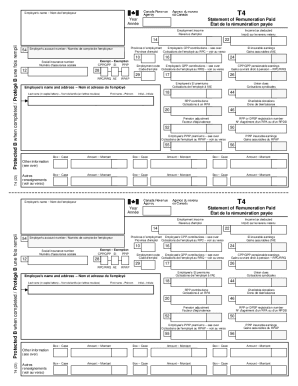

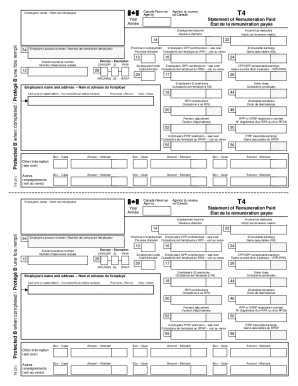

Canada T4 2023-2024 free printable template

Obtenez, créez, fabriquez et signez

Comment éditer obtenir le gratuit solved en ligne

Canada T4 Versions de formulaire

Comment remplir obtenir le gratuit solved

How to fill out solved question 1 5

Who needs solved question 1 5?

Instructions et aide à propos de obtenir le gratuit solved

Hi there my name is Michael and in this video I'm going to show you how to create some tea for information slips to give to your employees and then how to submit them to the Canada Revenue Agency now this video is meant for viewers who already have some payroll data and want to find the best way to create and submit tax slips, so we won't go into too much detail on how to fill out a t4 I should mention that the methods I'll be discussing also applied to other common CRA forms such as the t3 t4 a t5 among many others so if you intend to submit some former tax slip to CRA you'll hopefully take something away from this okay let's get started there are various ways of creating and submitting tea for us, and I'll be talking about three of the most common methods the best method for you typically depends on the volume of text slips you're submitting if you only need to file a few t4 slips let's say a dozen the simplest method is with series Phillip PDFs let's Google q4 fillable PDF download this PDF from the CRA website and enter your slip data one-by-one I've included a link below to the t4 fillable PDF the fillable PDF also exists for other common slip types such as the t4 a and T 5 you'll need to give a copy of the t4 to your employee and submit another copy to this area by mail according to the CRA employees guide on filing t4 slips and summary which I've linked below you'll want to send them alongside a t4 summary to Dean care tax center which is based in with AK CRA discourages sending in many tax slips by mail according to the guide the maximum number of tax loops you can file without incurring the penalty is 50 slips so keep that in mind the second way to submit tax slips to the CRA is through their online web forms you'll need a computer with an internet connection web forms allows you to submit up to a hundred tax slips I provided another link for web forms below to get started with web forms you'll need your business number in a web access code you can apply for the web access code on the login page if you don't have one already once you've logged in select the type of information return you're filing and a return type and start entering the slips one by one at the end of the process regenerated, and you'll be able to print your slips for your employees make sure to record the confirmation number as a proof of submission at the end of the process for filing larger numbers of tax slips the last method I want to show you is Internet file transfer there's no limit to the amount of tax loops you could submit with this method, but you will need tax preparation software to create a file in the required XML formats there are several advantages to using tax preparation software especially for larger tax emissions instead of having to manually input your slips one at a time certain tax preparation software will allow you to import your data from a spreadsheet or an XML file which can be generated by a payroll program such as QuickBooks these...

Remplir form : Essayez sans risque

Les gens demandent aussi à propos de obtenir le gratuit solved

Our user reviews speak for themselves

Pour la FAQ de pdfFiller

Vous trouverez ci-dessous une liste des questions les plus courantes des clients. Si vous ne trouvez pas de réponse à votre question, n'hésitez pas à nous contacter.

Remplissez votre obtenir le gratuit solved en ligne avec pdfFiller !

pdfFiller est une solution de bout en bout pour gérer, créer et éditer des documents et des formulaires dans le cloud. Gagnez du temps et évitez les tracas en préparant vos formulaires fiscaux en ligne.