AFRS IMT 1327 2019-2024 free printable template

Show details

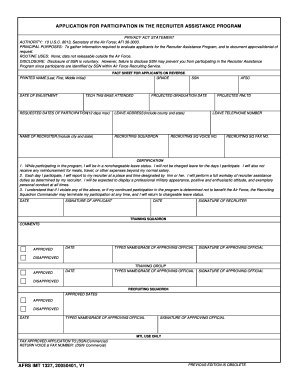

DATE SIGNATURE OF APPLICANT SIGNATURE OF RECRUITER TRAINING SQUADRON COMMENTS APPROVED TYPED NAME/GRADE OF APPROVING OFFICIAL TRAINING GROUP APPROVED DATES MTL USE ONLY EMAIL APPROVED APPLICATION TO RETURN VOICE CONTACT DSN/ Commercial AFRS FORM 1327 20190315 PREVIOUS EDITION IS OBSOLETE. Air Force Recruiter Assistance Program Fact Sheet for Applicants - The purpose of the Recruiter Assistance program RAP is to permit Air Force members primarily recent technical training and officer training...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your afrs form 1327 2019-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your afrs form 1327 2019-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing afrs form 1327 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit government website form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

AFRS IMT 1327 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out afrs form 1327 2019-2024

How to fill out a government federal form:

01

Begin by carefully reading the instructions provided with the form. Understand the purpose of the form and the information required.

02

Ensure that you have all the necessary documents and information readily available. This may include personal identification documents, financial statements, tax records, or any other relevant paperwork.

03

Start by filling out the basic information section, including your name, contact details, and any requested identification numbers.

04

Follow the form's structure and proceed to provide the required information in each section. Be precise and accurate while entering data. Double-check the entries to avoid errors.

05

If you come across terms or fields that seem unclear, refer to the instructions or seek assistance from a government agency or helpline.

06

Attach any supporting documents or evidence as requested. Make sure these documents are properly labeled and organized.

07

Review the completed form before submitting it. Look for any mistakes or missing information. Correct any errors and ensure that all required sections are filled out.

08

After reviewing, sign and date the form if required. Some forms may also require additional signatures from witnesses or authorized individuals.

09

Make a copy of the filled-out form and store it for your records. It may be necessary to refer back to it in the future.

Who needs a government federal form:

01

Individuals or entities who are required to report specific information or provide certain documentation to the government.

02

Examples of those who may need government federal forms include individuals filing income tax returns, businesses submitting financial reports, applicants for government benefits or permits, and organizations reporting their activities or finances.

03

The specific form required will depend on the nature of the information or transaction being reported. Various government agencies and departments have their own forms tailored to their specific requirements.

Fill recruiter assistance program form : Try Risk Free

People Also Ask about afrs form 1327

What is federation form?

What does federal mean in government?

What is federal form of government?

What is federal form of government explain with an example?

Why is it called federal?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is government federal form?

Federalism is a form of government where power is divided between a central government and regional or state governments. In a federal system, both levels of government have their own sovereign powers and responsibilities, and they exist alongside each other. This distribution of power helps to ensure a balance of authority and authority-sharing between different levels of government. Examples of countries with a federal government form include the United States, Canada, Germany, Australia, and Brazil.

Who is required to file government federal form?

Many individuals and businesses are required to file federal forms with the government. Here are some common examples:

1. Individuals: Most individuals are required to file a federal tax return using Form 1040 or its variants, depending on the complexity of their financial situation.

2. Businesses: Various types of businesses, including sole proprietorships, partnerships, limited liability companies (LLCs), and corporations may be required to file tax returns using different forms such as Form 1120, Form 1065, or Form 1120S.

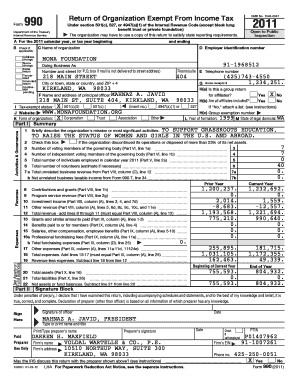

3. Non-profit organizations: Non-profit organizations, also known as tax-exempt organizations, must file Form 990 to report their financial information to the government.

4. State and local governments: These entities may be required to file various forms to report their financial activities and comply with government regulations.

5. Employers: Businesses that have employees are required to file employment-related forms such as Form W-2 (reporting wages paid to employees) and Form 941 (reporting quarterly payroll taxes).

6. Financial institutions: Banks and other financial institutions may be required to file certain forms, such as Form 1099-INT (reporting interest income) and Form 1099-MISC (reporting miscellaneous income).

7. Immigration-related forms: Non-U.S. citizens residing in the United States may be required to file various forms related to their immigration status, such as the Form I-485 for adjustment of status.

It is important to note that these examples are not exhaustive, and the specific forms required may vary depending on factors such as individual circumstances, nature of the business, and applicable laws and regulations. It is recommended to consult with a tax professional or visit the official government websites for accurate and up-to-date information regarding required filings.

How to fill out government federal form?

Filling out a government federal form can seem intimidating, but it is usually a straightforward process. Here are some general steps to help you:

1. Read the instructions: Start by carefully reading the instructions that accompany the form. This will give you an overview of what information is required and how to fill out the form correctly.

2. Gather necessary documents: Collect all the relevant documents and information required for the form. This may include identification documents, social security number, tax records, financial statements, and any other supporting documentation mentioned in the instructions.

3. Provide accurate information: Ensure that all the information you provide is accurate and up to date. The government may verify the details you provide, so it is crucial to be honest and thorough.

4. Follow the form layout: Government forms are usually designed with clear sections and spaces for specific information. Fill in the required details in each section, using clear and legible handwriting or typing if applicable.

5. Use additional sheets if needed: If you run out of space on the form, use additional sheets specifically labeled with your name, form number, and the page or section where the information should be included. Attach these sheets securely to the form.

6. Check for completeness: Before submitting the form, review each page thoroughly to ensure you have provided all the necessary information. Verify that every question has been answered, and all relevant sections are completed.

7. Sign and date the form: Many federal forms require your signature and date to validate the submission. Make sure to sign the form at the designated area and include the current date.

8. Keep copies: It is essential to make copies of the completed form and supporting documents for your records. This will help you reference the information later and serves as proof of submission if needed.

9. Submit the form: Determine the appropriate method of submission stated in the form's instructions. Some forms can be submitted online, while others may need to be mailed or delivered to specific addresses. Ensure you follow the correct submission procedure to avoid delays or errors.

Remember, various government forms may have specific requirements and processes. Always refer to the accompanying instructions provided by the government agency responsible for the form to ensure accurate completion.

What is the purpose of government federal form?

The purpose of a federal form of government is to distribute political power and responsibilities between a central authority (federal government) and constituent units (states or provinces). It aims to create a balance between a strong and unified national government and regional autonomy. This form of government allows for the sharing of authority, laws, and resources, while granting certain powers and jurisdiction to both levels of government. It is designed to provide a framework for effective governance and decision-making while serving the diverse needs and interests of a nation.

What information must be reported on government federal form?

The information required to be reported on a federal government form can vary depending on the specific form and the purpose for which it is being filed. However, generally, federal government forms often require the following types of information:

1. Personal Information: This includes details such as name, address, social security number or taxpayer identification number, date of birth, and contact information.

2. Income Information: Individuals may be required to report various types of income, including wages and salaries, business income, rental income, investment income, unemployment compensation, alimony received, pensions, and any other sources of income.

3. Deductions and Expenses: Taxpayers may need to indicate deductions they are eligible for, such as mortgage interest, student loan interest, medical expenses, or contributions to retirement accounts or charitable organizations.

4. Tax Credits and Exemptions: Individuals may need to report any tax credits they are eligible for, such as the Child Tax Credit, Earned Income Credit, or Education Credits. They might also be required to report any exemptions they are eligible for, such as dependents.

5. Financial Accounts and Assets: Some forms may require individuals to report information about their bank accounts, investments, foreign accounts, or certain assets.

6. Employment Information: Forms related to employment might require details about the employer, wages earned, and taxes withheld.

7. Health Insurance Coverage: Some forms may require individuals to report their health insurance coverage details, such as whether they had coverage throughout the year or if they were exempt from the requirement.

8. Capital Gains and Losses: If individuals sold any investments or property during the tax year, they might be required to report the details of those transactions and calculate any capital gains or losses.

It is important to note that the information required can vary, and individuals should refer to the specific form instructions provided by the federal government for accurate reporting.

What is the penalty for the late filing of government federal form?

The penalty for late filing of a government federal form can vary depending on the specific form and the reason for the delay. Here are some examples:

1. Late filing penalty for individual income tax return (Form 1040): If you do not file your income tax return by the deadline (usually April 15th), you may be subject to a penalty of 5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum penalty of 25% of the unpaid taxes.

2. Late filing penalty for corporate tax return (Form 1120): If a corporation fails to file its tax return by the due date (usually the 15th day of the 4th month after the end of the tax year), the penalty can be up to 5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum penalty of 25% of the unpaid taxes. However, if the corporation has gross receipts of more than $5 million, the penalty amount can be higher.

3. Late filing penalty for information returns (e.g., Form W-2, Form 1099): The penalty for late filing of information returns can range from $50 to $550 per form, depending on the size of the business and how late the filing is.

It's worth noting that these penalties can change, so it's important to consult the specific instructions and guidelines for each federal form to determine the current penalty amounts.

How can I send afrs form 1327 to be eSigned by others?

When you're ready to share your government website form, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I edit afrs 1327 on an iOS device?

Create, modify, and share government information website using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Can I edit af form 1327 on an Android device?

You can make any changes to PDF files, such as air force rap form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your afrs form 1327 2019-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Afrs 1327 is not the form you're looking for?Search for another form here.

Keywords relevant to afrs imt 1327 form

Related to government information federal

If you believe that this page should be taken down, please follow our DMCA take down process

here

.