Our top-rated tool is like working with a professional every step of the way.

Create Pay Stub in less than 5 minutes.

Professionally reviewed

Print and export to word or PDF in seconds

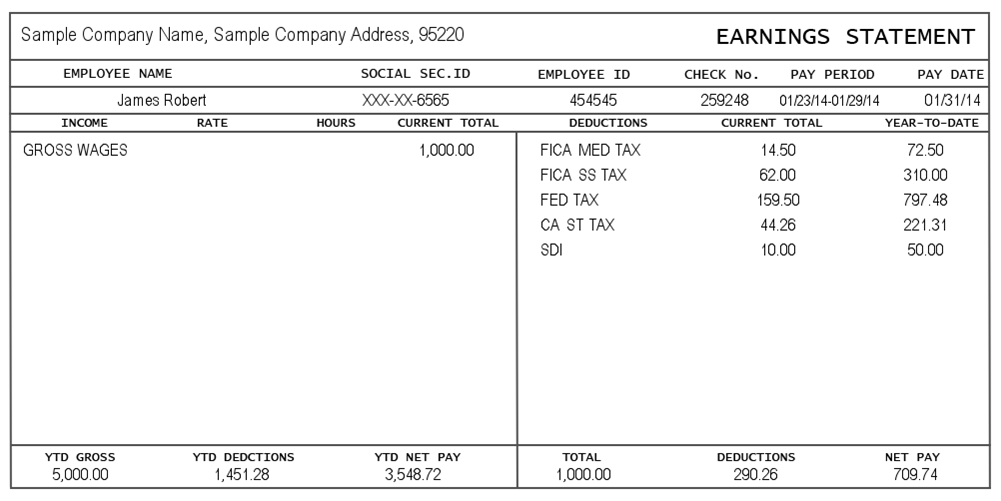

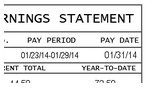

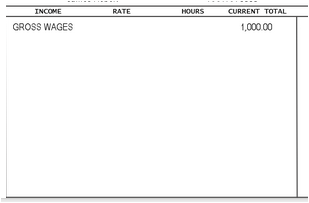

A pay stub is a document related to an employee's paycheck. If an employee receives direct deposit, a pay stub is a separate document that is given to the employee to document their earning for that pay period and for the year-to-date. If an employee receives a paper paycheck for deposit, the pay stub will typically be attached to the check.

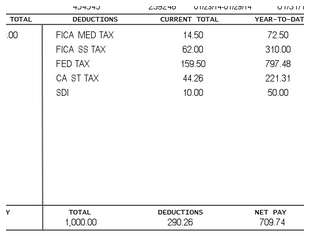

A pay stub will have several financial details about the employee's salary, taxes, and other contributions. This will include how much they earned for the current period and for the year so far. The stub will also list the federal and state taxes that have been withheld from the employee's earnings. Social security contributions as well as payments to employee benefits such as health insurance are also shown, ensuring the employee can see where their money is going.

Click here to get started now!

“I am very pleased with FormSwift products and have already recommended them to a number of my friends. The ease of creating documents has saved me countless hours.”

-Carrie L.

"I love FormSwift. There have been so many new documents added since first signing up. They walk you through every step. Great job and thanks for everything you guys do for making this happen."

-John M.

"FormSwift was very easy to use, even for someone who is not very tech savvy like me. Will use again."

-Phil T.