Get the free employee earnings record form

Show details

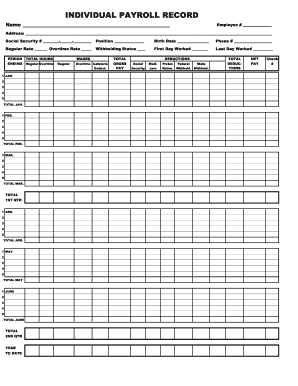

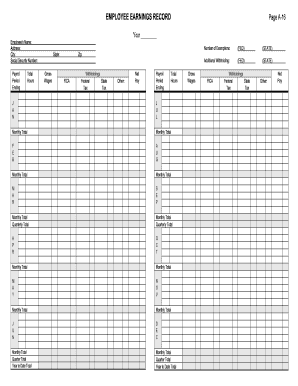

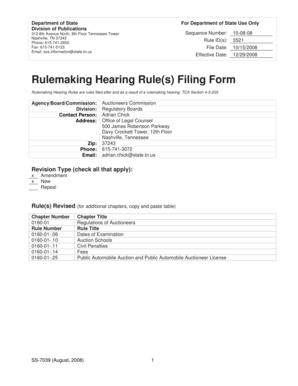

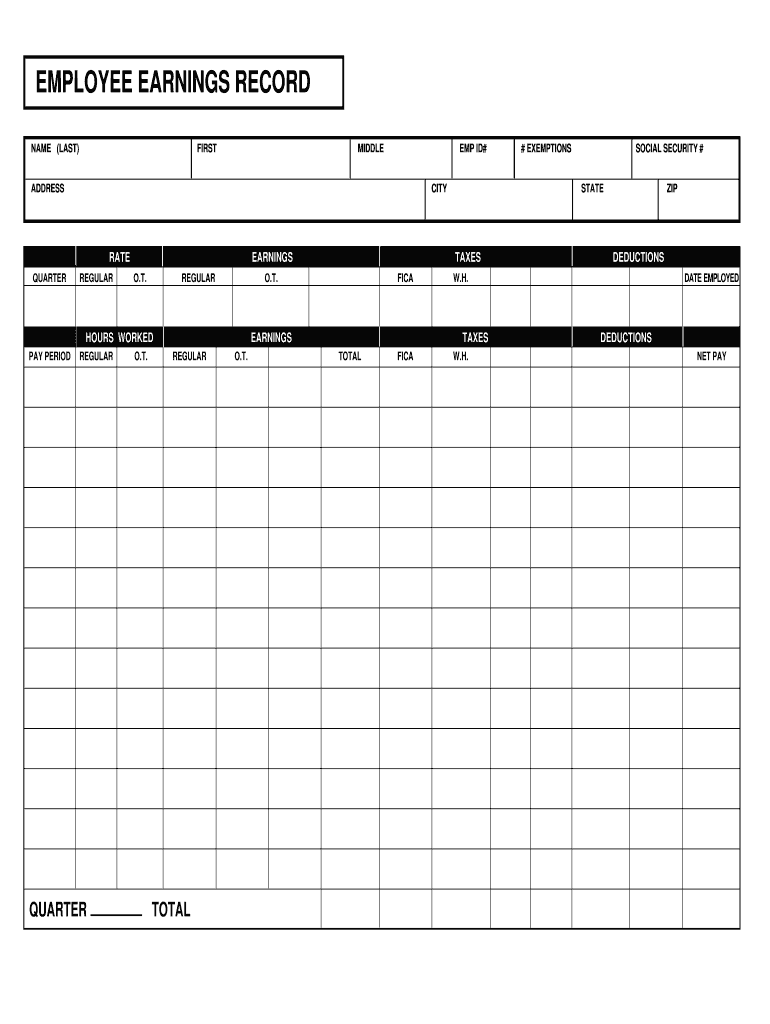

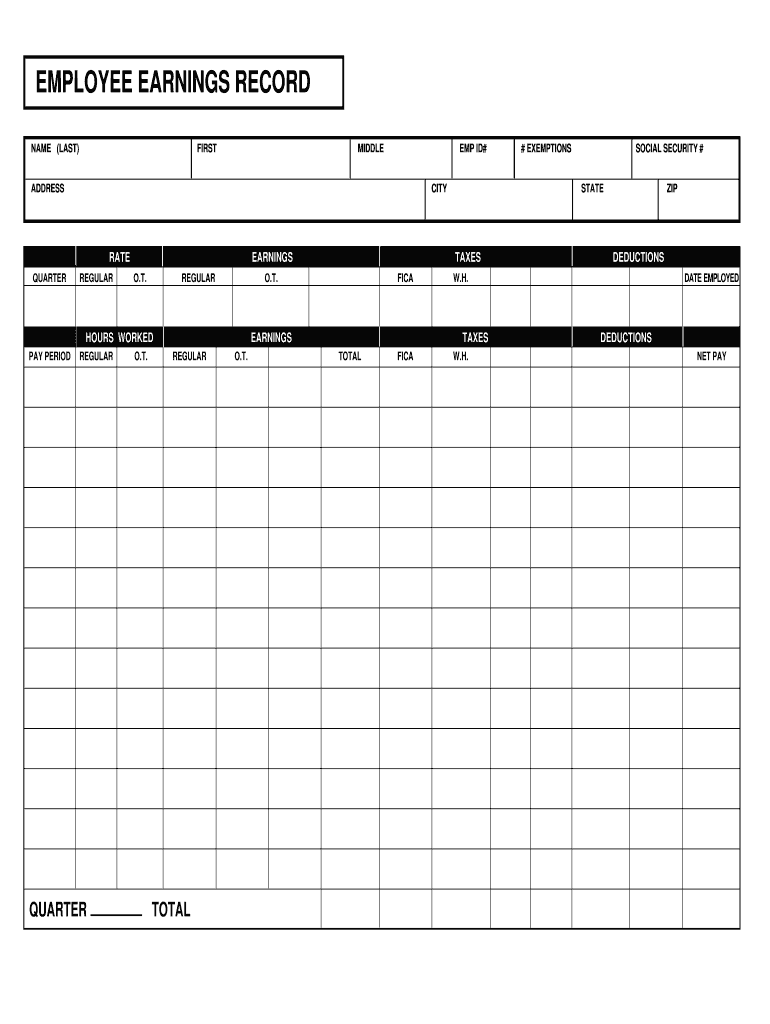

RATE REGULAR O.T. HOURS WORKED FIRST TOTAL EARNINGS EMPLOYEE EARNINGS RECORD NAME LAST ADDRESS QUARTER PAY PERIOD MIDDLE FICA CITY EMP ID TAXES W.H.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your employee earnings record form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee earnings record form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employee earnings record online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit employee earnings record template form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

How to fill out employee earnings record form

How to fill out employee earnings record:

01

Start by gathering all the necessary information such as the employee's name, social security number, and employment details.

02

Record the employee's earnings for a specific period, including regular wages, overtime, bonuses, and any other additional compensation.

03

Deduct all applicable taxes and contributions, such as federal and state income tax, social security, Medicare, and any other withholdings.

04

Calculate the net earnings by subtracting the deductions from the total earnings.

05

Include any fringe benefits, such as health insurance contributions or retirement plan contributions.

06

Ensure accurate recording of hours worked, including any overtime hours and rates.

07

Keep track of any paid time off, such as vacation or sick leave, and include the corresponding hours and pay.

08

Double-check all calculations and information entered to avoid any errors.

Who needs employee earnings record:

01

Employers: It is essential for employers to maintain accurate employee earnings records for tax purposes, payroll processing, and compliance with labor laws.

02

HR departments: HR departments require employee earnings records to monitor employee compensation, calculate benefits, and generate reports for management purposes.

03

Employees: Employees may also need access to their earnings records to review their pay, verify deductions, and address any discrepancies.

Fill employee earning record template : Try Risk Free

People Also Ask about employee earnings record

What information is on an employee earnings record?

What is a detailed earnings report?

What is employee earnings record?

Which items are included in the employees earnings records?

What is the difference between an employee earnings record and a payroll register?

What is included in the employee earnings record?

What information is on an earning record?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is employee earnings record?

Employee earnings records are documents that a business compiles to track the total amount of money earned by each employee. They typically include wages, salaries, bonuses, overtime, reimbursements, commissions, and any other form of compensation that is taxable income. These records are used for payroll purposes, to ensure accurate and timely payments to employees, and for tax compliance.

What is the purpose of employee earnings record?

The purpose of an employee earnings record is to document the wages and other compensation earned by an employee for a specific period of time. It is used to record and track the employee’s income, deductions, and other payroll information. It can also be used for tax filing and to calculate the employee’s year-end total earnings.

What information must be reported on employee earnings record?

1. Employee name

2. Employee address

3. Social Security number

4. Pay rate

5. Hours worked

6. Pay period

7. Gross pay

8. Deductions

9. Net pay

10. Year-to-date totals for federal income tax, Social Security, and Medicare

What is the penalty for the late filing of employee earnings record?

The penalty for the late filing of employee earnings records will depend on the jurisdiction and employment laws in your country or state. Generally, employers can be fined for failing to comply with legal requirements for filing or updating records. Penalties may include fines, back pay, or other administrative or judicial action.

Who is required to file employee earnings record?

Employers are required to file employee earnings records.

How to fill out employee earnings record?

To fill out an employee earnings record, follow these steps:

1. Obtain the necessary information: Gather the employee's personal details, including their full name, social security number, address, and date of birth.

2. Identify the pay periods: Determine the frequency of pay periods, such as weekly, bi-weekly, or monthly. Ensure you have the correct dates for each pay period.

3. Record gross wages: Enter the total amount earned by the employee before any deductions during each pay period. This includes regular wages, overtime pay, bonuses, commissions, and any other forms of compensation.

4. Deductions: List all deductions made from the employee's paycheck, such as income tax, social security contributions, Medicare, retirement contributions, health insurance premiums, or any other authorized deductions. Calculate and subtract these amounts from the gross wages to obtain the net pay.

5. Calculate hours worked: If the employee is paid hourly, record the number of regular and overtime hours worked during each pay period. Multiply the hours by the applicable hourly rate to obtain the gross wages.

6. Update year-to-date totals: At the end of each pay period, update the employee's year-to-date totals for gross wages, deductions, and net pay. These totals represent the cumulative earnings and deductions for the entire year.

7. Record pay history: Maintain a record of previous pay periods, including dates, gross wages, deductions, and net pay. This information will help to ensure accuracy and assist with payroll tax reporting.

8. Include additional information: Depending on the requirements of your organization, you may need to enter additional information such as the employee's department or job title.

9. Review and verify: Double-check all figures and calculations to ensure accuracy. Make sure all required fields are filled out appropriately.

10. Keep it organized: Store the completed employee earnings record in a secure location, according to your company's record-keeping policies. Update the record regularly with each new pay period.

Remember to comply with your country's taxation and labor laws, as they may dictate specific information or documentation requirements for employee earnings records.

When is the deadline to file employee earnings record in 2023?

The deadline to file employee earnings record for 2023 may vary depending on the country and its respective tax regulations. It is advisable to consult with the relevant tax authority or a professional tax advisor in your jurisdiction to determine the specific deadline.

How do I edit employee earnings record online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your employee earnings record template form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I make edits in individual earnings record without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing employee earnings record example and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I edit employee earning record on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing earnings employee record form.

Fill out your employee earnings record form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Individual Earnings Record is not the form you're looking for?Search for another form here.

Keywords relevant to record of earnings form

Related to social security wage base 2024

If you believe that this page should be taken down, please follow our DMCA take down process

here

.