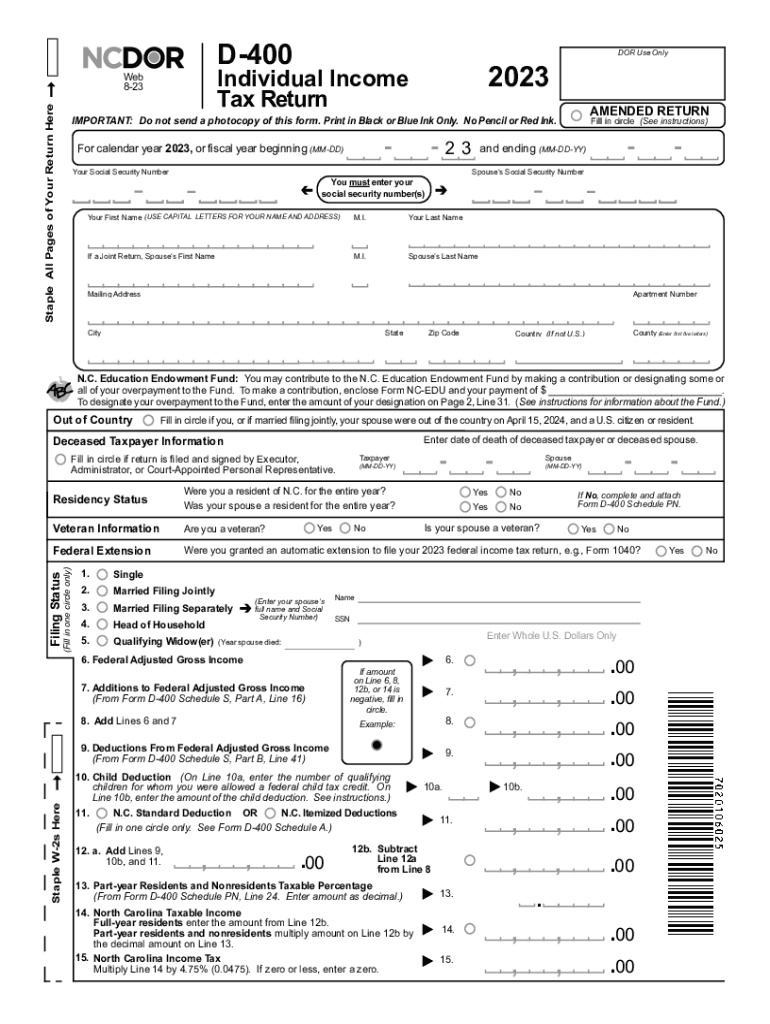

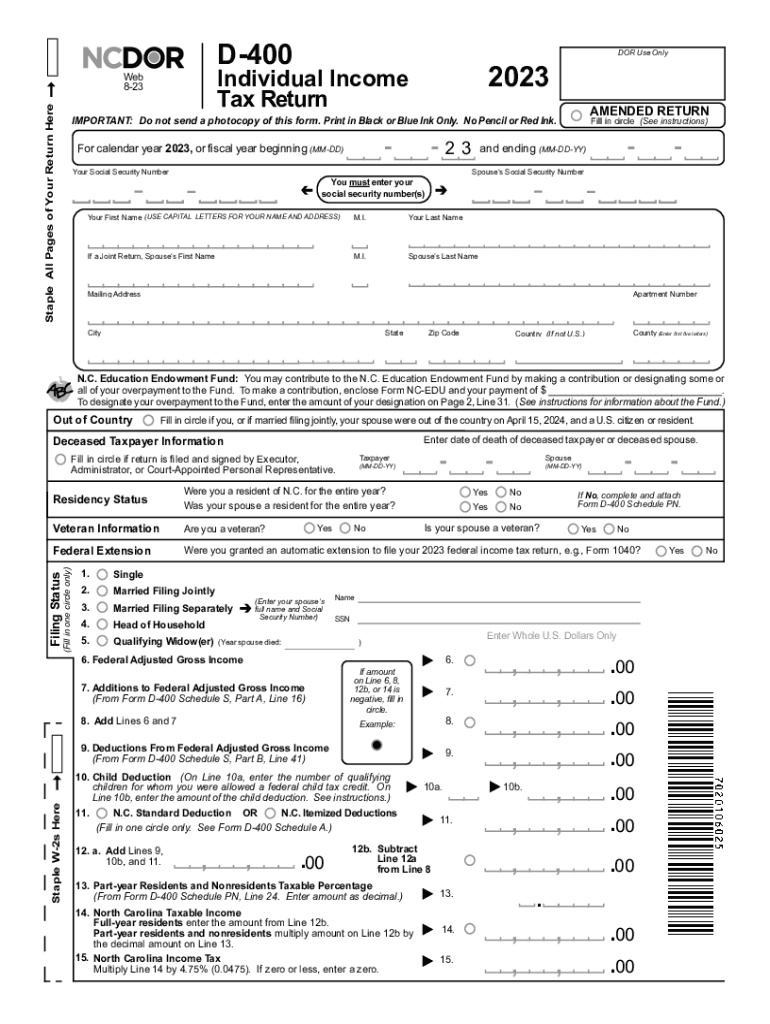

NC DoR D-400 2023-2024 free printable template

Get, Create, Make and Sign

Editing nc tax form d 400 online

NC DoR D-400 Form Versions

How to fill out nc tax form d

How to fill out d 400

Who needs d 400?

Video instructions and help with filling out and completing nc tax form d 400

Instructions and Help about d400 form

Laws dot-com legal forms guide form D 400 individual income tax return North Carolina individual residents paying their state income tax do so using a form D 400 if you are claiming tax credits for a child tax paid to another state or country or on another basis a separate tax credits form must be completed these forms can be found on the website of the North Carolina Department of Revenue step 1 if you are not filing on a calendar year basis and to the starting and ending dates of your fiscal year step 2 enter your social security number name and address if filing jointly with a spouse enter their name and social security number as well step 3 note if you are filing an amended return are filing a return on behalf of a deceased taxpayer or are making contributions to either the state public campaign fund or to specific political parties funds step 4 enter your federal adjusted gross income where indicated step 5 indicate whether you and your spouse were full-time residents of the state if no you must complete only lines 1 through 11 and 54 through 56 step 6 indicate your filing status by filling in the Oval next to the appropriate statement on lines one through five step 7 enter your taxable income on line six step 8 complete lines 31 through 41 on page three to determine your additions on line 7 add line six and seven and enter the sum on line eight complete lines 42 through 53 to determine your deductions on line nine and subtract this from line eight and to the difference on line 10 step 9 complete lines 11 through 25 to determine your tax do step 10 lines 26 through 30 concern refunds to for overpayments step 11 sign and date the bottom of page four to watch more videos please make sure to visit laws comm

Fill d400 tax form : Try Risk Free

People Also Ask about nc tax form d 400

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your nc tax form d online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.