Get the free kyc form

Show details

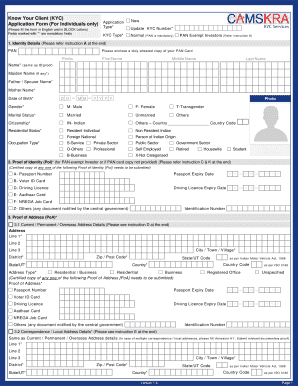

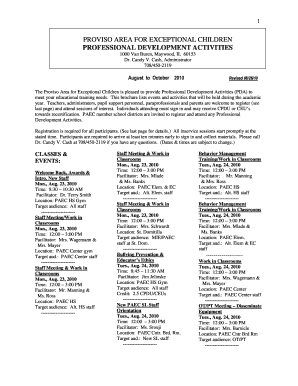

Name address of the applicant mentioned on the KYC form should match with the documentary proof submitted. 5. N Know Your Client KYC Application Form For Non-Individuals Only Place for Intermediary Logo Please fill in ENGLISH and in BLOCK LETTERS A. NAME SIGNATURE S OF AUTHORISED PERSON S Place Date FOR OFFICE USE ONLY AMC/Intermediary name OR code Originals Verified Self Certified Document copies received Attested True copies of documents received Seal/Stamp of the intermediary should...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your kyc form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kyc form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kyc form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form kyc. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

How to fill out kyc form

How to fill out KYC form?

01

Start by carefully reading the instructions provided with the KYC form.

02

Gather all the necessary documents and identification proofs mentioned in the form.

03

Fill in your personal details accurately, including your full name, date of birth, address, and contact information.

04

Provide your identification details, such as your passport number, driver's license, or social security number.

05

Attach copies of the required documents, ensuring they are clear and legible.

06

Review the form thoroughly to make sure all the information is correctly filled in.

07

Sign and date the form in the designated spaces provided.

08

Submit the completed KYC form along with the necessary documents to the relevant authority or institution.

Who needs KYC form?

01

KYC forms are required by financial institutions, such as banks, credit unions, and insurance companies, to verify the identity of their customers.

02

Other businesses, such as investment firms and payment processors, also need KYC forms to comply with anti-money laundering regulations.

03

Government agencies may also require individuals to fill out KYC forms for various purposes, including tax filings and benefits applications.

Fill what is kyc form in sbi : Try Risk Free

People Also Ask about kyc form

What is the KYC form?

How do I create a KYC form?

What should be included in a KYC form?

Who to fill KYC form?

How do I prepare a KYC form?

What is an example of a KYC?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file kyc form?

Individuals who wish to open a bank account, obtain a loan from a financial institution, purchase financial products, or invest in securities are typically required to file KYC forms.

When is the deadline to file kyc form in 2023?

The exact deadline for filing KYC forms in 2023 has not yet been announced. Generally, KYC forms must be updated every year. It is recommended that you check with your financial institution or regulator for the exact deadline.

What is kyc form?

KYC (Know Your Customer) form is a document or set of documents that individuals or entities have to complete to verify their identity and provide information about themselves. It is a regulatory requirement primarily for financial institutions, banks, and other organizations to prevent money laundering, fraud, identity theft, and other illegal activities.

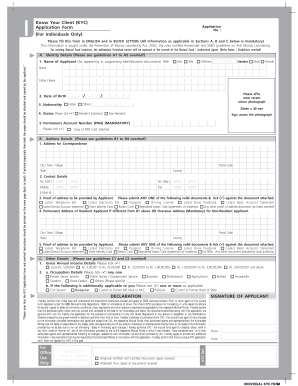

The KYC form typically includes personal information such as name, address, date of birth, social security number, passport or driver's license details, contact information, occupation, and financial details. In addition, it may require supporting documents such as identity proofs, address proofs, and proof of income.

By completing and submitting the KYC form, individuals allow the concerned organizations to verify their identity and conduct due diligence on their financial activities. This helps in establishing a transparent and trustworthy relationship between the customer and the organization, ensuring compliance with legal and regulatory obligations.

How to fill out kyc form?

Filling out a KYC (Know Your Customer) form may vary depending on the specific institution or organization requiring it. Nevertheless, here is a general guide to help you complete a KYC form:

1. Read the instructions: Carefully go through the instructions provided with the KYC form. Familiarize yourself with the requirements and any supporting documents you may need to provide.

2. Personal information: Start by providing your full legal name, date of birth, gender, nationality, and contact details (address, phone number, and email).

3. Identification details: Fill in the type of identification document you will be using (e.g., passport, driver's license, national ID) and provide the document number, issue and expiry dates, and issuing authority.

4. Proof of identity: attach a clear, legible copy of the identification document you selected. Ensure the copy is not expired and shows all the necessary details.

5. Residential address: Enter your current residential address, including city, state or province, country, and postal code. If your mailing address is different, provide the necessary details.

6. Proof of address: Submit a document that verifies your residential address. This can include utility bills, bank statements, rental agreement, or any other valid document issued within a specific timeframe (often within the last three months).

7. Occupation and financial information: State your occupation, employer's name, and address. Additionally, provide details about your annual income, source of funds, and other financial information as requested.

8. Tax-related information: Depending on the form, you may be asked to provide tax-related information, such as your tax identification number or national insurance number.

9. Signature: Sign and date the form, confirming that all the information you provided is true and accurate.

10. Supporting documents: Ensure that you have attached copies of all the necessary supporting documents as requested by the form.

11. Review: Before submitting, carefully review your form to ensure accuracy and completeness. Incorrect or incomplete information may delay the KYC verification process.

12. Submission: Submit the completed KYC form and any accompanying documents through the designated channel, such as by mail, in-person, or electronically, depending on the instructions provided.

Remember, since KYC requirements can vary, it's essential to follow the specific instructions given by the institution or organization you are dealing with.

What is the purpose of kyc form?

The purpose of KYC (Know Your Customer) forms is to verify and collect essential information about individuals or entities before starting a business relationship or providing specific services. The primary goals of KYC are to prevent identity theft, fraud, money laundering, terrorist financing, and other illicit activities. By obtaining detailed customer information such as identification documents, address proof, financial history, and risk assessment, businesses can assess the legitimacy and suitability of their customers to ensure compliance with regulatory requirements. Additionally, KYC helps establish trust, manage risks, protect the company's reputation, and maintain a secure and transparent business environment.

What information must be reported on kyc form?

The information required to be reported on a Know Your Customer (KYC) form may vary depending on the regulations and policies of the specific organization or industry. However, generally, a KYC form typically includes the following information:

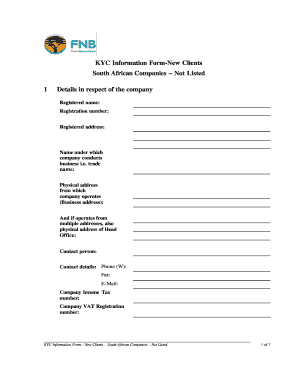

1. Personal Information: Full legal name, date of birth, residential address, contact details (phone number, email address), social security number or national identification number.

2. Identification Documents: Details of government-issued identification documents such as passport, driver's license, or national ID card. This may include the document number, issue and expiry dates, and issuing authority.

3. Employment Information: Occupation, employer name, job title, and work address.

4. Financial Information: Income details, source of funds, estimated net worth, and details of bank accounts or other financial assets.

5. Beneficial Ownership: For companies or entities, the form may require information on beneficial owners, including their names, addresses, and percentage of ownership.

6. Risk Assessment: Information about the client's risk tolerance and investment objectives.

7. Background Information: Any criminal history, politically exposed person (PEP) status, or any sanctions or legal proceedings the person has been involved in.

8. Declaration: The form usually requires a declaration by the customer confirming the correctness and completeness of the provided information.

It's important to note that this list is not exhaustive and additional information may be requested depending on specific circumstances, legal requirements, or risk-based assessments.

What is the penalty for the late filing of kyc form?

The penalty for the late filing of a Know Your Customer (KYC) form can vary depending on the jurisdiction and the specific circumstances. In some cases, there may not be a specific penalty outlined, but it could result in the suspension or closure of a customer's account with the relevant financial institution. KYC regulations are in place to prevent money laundering, terrorist financing, and other illicit activities, so it is important to comply with the requirements in a timely manner. It is advisable to consult with the relevant regulatory authorities or financial institution for specific information on penalties for late filing of KYC forms.

How can I manage my kyc form directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your form kyc along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit kyc form download from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like kyc form sbi, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit kyc form pdf online?

The editing procedure is simple with pdfFiller. Open your kyc application form in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Fill out your kyc form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kyc Form Download is not the form you're looking for?Search for another form here.

Keywords relevant to forms kyc

Related to download kyc form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.