TX LL-1 2017-2024 free printable template

Show details

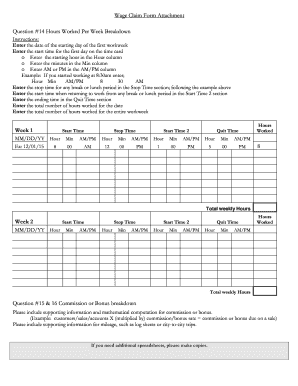

Please attach a copy of your most recent payroll check or stub. For regular hours and overtime hours please attach a breakdown of the days and hours of work or complete the Wage Claim Form Attachment. You Must Fill Out the Form Completely. Information You Should Consider Before Filing a Wage Claim If you feel your rights under the Payday Law have been violated you may file a written wage claim. You should know that a wage claim cannot be accepted if Your wage claim is not filled out...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your texas workforce commission form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas workforce commission form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit texas workforce commission form wage online

Follow the guidelines below to use a professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form wage claim. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

TX LL-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out texas workforce commission form

How to fill out form wage claim:

01

Obtain a copy of the form wage claim from the relevant labor department or website.

02

Carefully read the instructions provided with the form to understand the requirements and procedures for filling it out.

03

Begin by entering your personal information, such as your full name, contact details, and address.

04

Provide the necessary details about your employer, including their name, address, and contact information.

05

Specify the dates of your employment and the period for which you are claiming unpaid wages.

06

Indicate the hours worked and the rate of pay for each period, clearly stating any overtime or additional compensation.

07

Describe the nature of the work performed and provide any relevant documentation, such as timesheets or contracts, to support your claim.

08

Calculate the total amount owed to you, including any additional entitlements, such as vacation pay or bonuses.

09

Sign and date the form, confirming the accuracy of the information provided.

10

Make copies of the completed form for your records before submitting it to the appropriate labor department.

Who needs form wage claim:

01

Employees who have not received proper compensation for their work.

02

Workers who have encountered wage theft or unpaid wages.

03

Individuals who believe their employer has violated labor laws regarding wages and want to seek legal recourse.

04

Those seeking to claim unpaid overtime or additional entitlements from their employer.

05

Workers who are looking to resolve disputes related to their wages through the labor department or a legal process.

Fill unpaid wages claim texas : Try Risk Free

People Also Ask about texas workforce commission form wage

What to do if a job doesn t pay you?

What to do if your employer refuses to pay you in Texas?

How much can I sue for unpaid wages in Texas?

How do I report an employer for not paying my wages in Texas?

What is the labor wage law in Texas?

Can I sue my employer for not paying me on time in Texas?

What is unfair treatment in the workplace Texas?

How do I file a complaint against a hostile work environment in Texas?

How do I report my employer for not paying me in Texas?

Can I sue my employer for unpaid wages in Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is texas wage and labor?

The Texas Wage and Labor law, also known as the Texas Payday Law, is a set of regulations governing the payment of wages to employees in the state of Texas. It establishes the minimum wage, overtime pay requirements, timing and manner of wage payments, and various other provisions related to employee compensation. The law is administered and enforced by the Texas Workforce Commission (TWC) and applies to most private sector employers in the state.

Who is required to file texas wage and labor?

It is the responsibility of employers in Texas to file wage and labor reports.

How to fill out texas wage and labor?

To properly fill out the Texas Wage and Labor Report, follow these steps:

1. Obtain the appropriate form: The Texas Wage and Labor Report is usually provided by your employer or can be downloaded from the Texas Workforce Commission website.

2. Provide employer information: Start by entering your employer's name, address, phone number, and Employer Identification Number (EIN) if applicable.

3. Employee information: Provide your personal information, including your full name, Social Security number, address, and contact details.

4. Pay period dates: Indicate the pay period dates for which you are reporting. This typically includes the start and end dates of the pay period.

5. Hours worked: Enter the number of hours you worked during the pay period. This should be broken down by regular hours and any overtime hours.

6. Wages earned: Specify the amount of money earned during the pay period. This should include regular wages, any overtime pay, bonuses, commissions, or any other types of earnings you received.

7. Deductions: List any deductions made from your wages, such as taxes, insurance premiums, retirement contributions, or any other authorized deductions.

8. Signature and date: Sign and date the form to certify that the information provided is accurate to the best of your knowledge.

9. Submit the form: Give the completed form to your employer or submit it as instructed by your employer or the Texas Workforce Commission.

Remember to keep a copy of the filled-out form for your records and to verify that your employer submits the report if required.

What is the purpose of texas wage and labor?

The purpose of the Texas Wage and Hour Division, which falls under the Texas Workforce Commission, is to enforce labor laws related to minimum wage, overtime pay, child labor, and other provisions in order to ensure fair and lawful working conditions for employees. They aim to protect workers' rights by investigating complaints, providing education and outreach programs, and conducting audits to ensure compliance with labor laws in Texas.

What information must be reported on texas wage and labor?

On the Texas Wage and Labor website, the following information must be reported:

1. Minimum Wage: The current minimum wage in Texas is $7.25 per hour. Any changes or updates to the minimum wage must be reported.

2. Overtime Pay: Employers must report the rules and regulations regarding overtime pay, including the rate of pay for overtime hours and the criteria for determining eligibility.

3. Child Labor Laws: Information about the specific laws and regulations related to employment of minors, including age limits, work hours, and permitted occupations.

4. Workers' Compensation: Reporting requirements for workers' compensation insurance coverage, including information on how to obtain coverage and the obligations of employers.

5. Unemployment Insurance: Information about unemployment insurance taxes, reporting requirements, and benefits available to eligible workers who have lost their jobs.

6. Discrimination Laws: Employers must report information about anti-discrimination laws and regulations, including those related to hiring, promotion, termination, and workplace harassment.

7. Occupational Safety and Health: Reporting requirements related to workplace safety and health, including standards, inspections, and reporting of workplace accidents or injuries.

8. Employee Benefits: Employers must provide information on mandatory benefits such as leave policies, health insurance, retirement plans, and other employee benefits.

9. Wage and Hour Laws: Reporting requirements about the Texas Wage and Hour laws, including information on breaks, meal periods, and other wage and hour regulations.

10. Employment Notices: Employers must report information about required employment posters and notices, including those related to minimum wage, equal employment opportunity, and rights under various labor laws.

It is important for employers in Texas to visit the Texas Commission on Labor Law website for detailed and up-to-date reporting requirements and to ensure compliance with all applicable labor laws.

What is the penalty for the late filing of texas wage and labor?

The penalty for late filing of the Texas Wage and Labor report can vary depending on the specific circumstances. However, the Texas Workforce Commission (TWC) may impose penalties as follows:

1. Late filing fee: A late filing fee may be assessed if the report is not filed by the due date. The fee can range from $50 to $500, depending on the number of employees and the duration of the delay in filing.

2. Civil action: The TWC has the authority to pursue civil action against employers who fail to file the report or substantially underreport wages. This can result in substantial penalties, including fines and potential criminal charges.

3. Loss of coverage: Employers who do not file the required wage and labor report may lose their eligibility for Unemployment Insurance (UI) tax coverage. This can result in higher UI tax rates or even disqualification from the UI program.

It is important to note that penalties and consequences may vary on a case-by-case basis, and it is recommended to consult with the Texas Workforce Commission for specific details related to your situation.

How can I get texas workforce commission form wage?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific form wage claim and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit texas wage claim form online?

With pdfFiller, it's easy to make changes. Open your texas workforce commission form claim in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out texas form wage claim using my mobile device?

Use the pdfFiller mobile app to fill out and sign wage claim form texas on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your texas workforce commission form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Wage Claim Form is not the form you're looking for?Search for another form here.

Keywords relevant to twc wage claim form

Related to texas workforce wage claim form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.