Get the free employer registration form

Show details

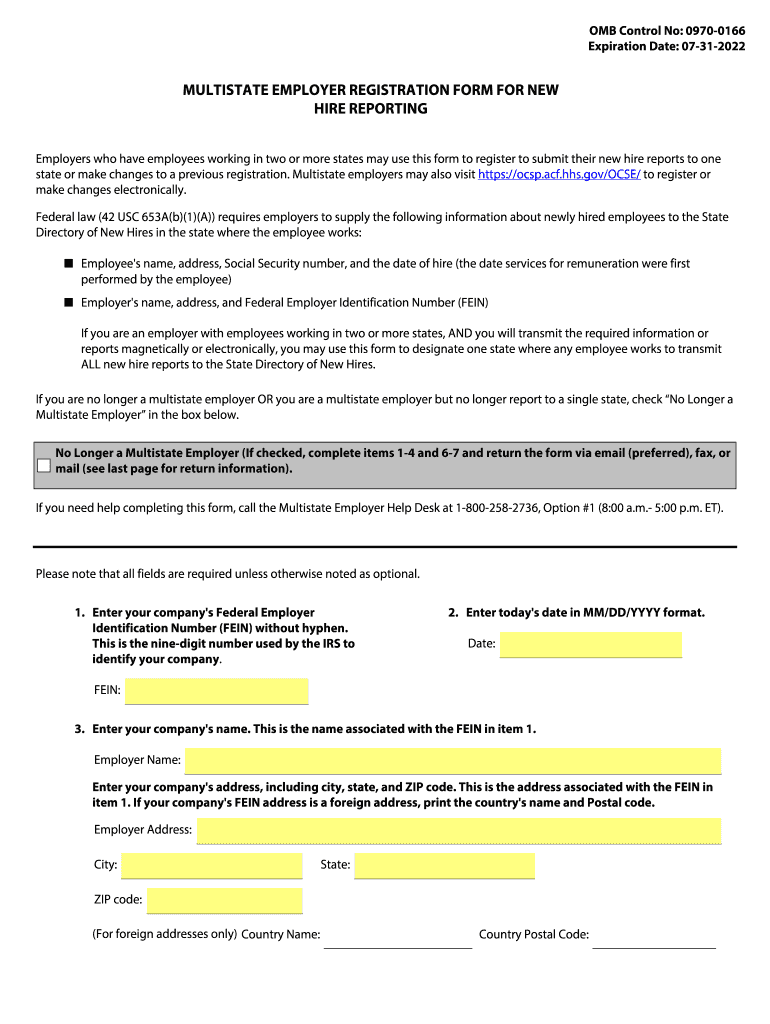

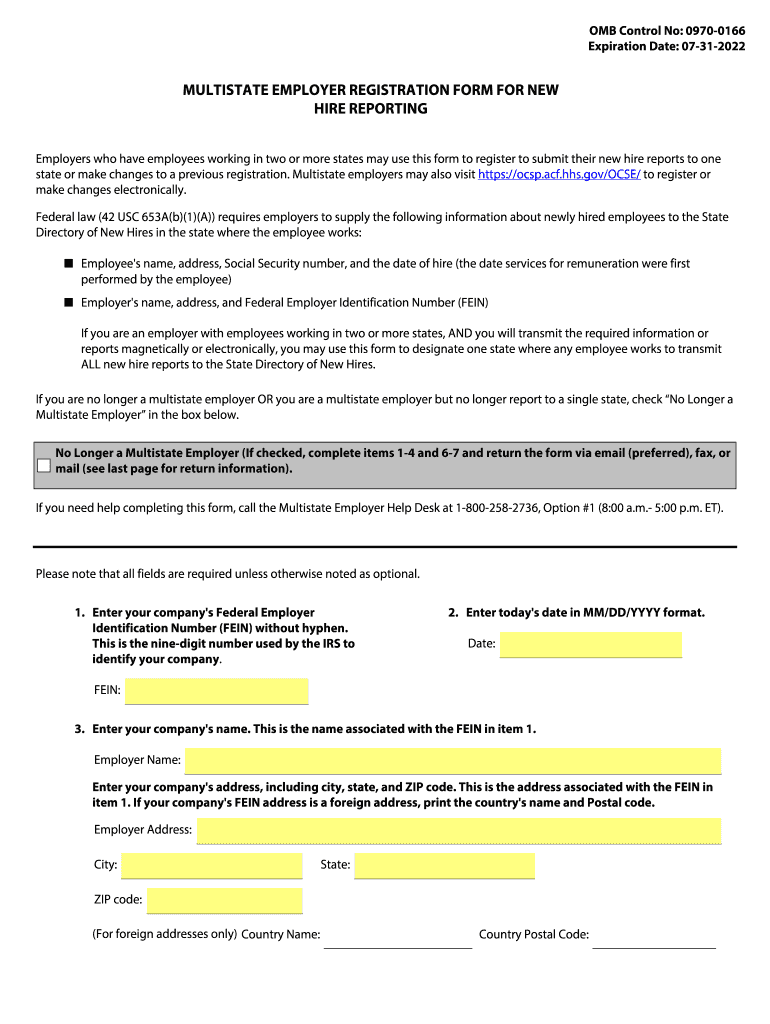

OMB Control No: 09700166

Expiration Date: 07312022MULTISTATE EMPLOYER REGISTRATION FORM FOR NEW

HIRE REPORTING

Employers who have employees working in two or more states may use this form to register

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your employer registration form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer registration form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

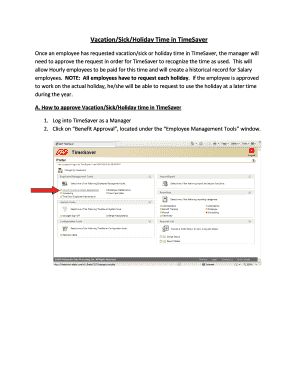

How to edit employer registration form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit registration new hire form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

How to fill out employer registration form

How to fill out employer registration form?

01

Make sure to carefully read all the instructions provided on the form. It is essential to understand the requirements and gather all the necessary information before starting the registration process.

02

Begin by filling out the basic information section, such as the company's name, address, contact details, and any legal identification numbers required.

03

Provide details about your organization's structure and ownership. This may include information about partners, shareholders, or parent companies, if applicable.

04

Include information about the nature of your business, such as the industry you operate in, the products or services you offer, and the number of employees you have.

05

If your business involves any specific licenses or certifications, make sure to mention them in the appropriate section of the form.

06

Fill out the tax-related information, including your company's tax identification number and any applicable tax exemptions or deductions.

07

If your business provides any benefits or insurance to employees, disclose relevant details about these programs in the appropriate section.

08

Review all the information provided on the form to ensure its accuracy and completeness. Consider double-checking the form before submitting it to avoid any potential errors.

Who needs employer registration form?

01

Employers who are starting a new business and plan to hire employees need to fill out an employer registration form. This form helps establish their legal presence and provides the necessary information to comply with employment regulations.

02

Companies that expand their operations and require additional workforce also need to complete an employer registration form. This ensures that they have all the necessary documentation in place and are compliant with employment laws.

03

Employers who undergo a change in ownership or structure may also need to update their registration details by filling out the employer registration form. This helps maintain accurate records and ensures smooth transitions during such changes.

Overall, any employer who plans to hire employees or operates a business that falls under employment regulations should complete the employer registration form. It is crucial to be aware of the specific requirements in your jurisdiction and to submit the form accurately and on time.

Fill employer registration form new : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is employer registration form?

An employer registration form is a document that an employer uses to register themselves with relevant authorities or organizations. It typically includes information such as the employer's business name, address, contact details, tax identification number, type of industry, and other necessary details. The purpose of this form is to establish a formal relationship between the employer and the relevant regulatory bodies or agencies. It may also be required for taxation purposes or compliance with labor laws.

Who is required to file employer registration form?

Employers are required to file an employer registration form.

How to fill out employer registration form?

Filling out an employer registration form typically requires providing your company's information and details about your business. Below is a step-by-step guide on how to fill out an employer registration form:

1. Read the instructions: Carefully go through the form's instructions before starting to fill it out. Make sure you understand the requirements and gather the necessary information beforehand.

2. Company details: Start by providing basic information about your company, including the legal name, registered address, contact details, and any other requested identification numbers (e.g., tax identification number or Employer Identification Number).

3. Ownership and legal structure: Indicate the type of legal structure for your company (e.g., partnership, sole proprietorship, corporation) and provide additional information if necessary, such as the names and contact details of company owners or partners.

4. Industry and nature of business: Specify the industry sector your business operates in. Provide a brief description or summary of the nature of your business activities and any relevant details regarding the services or products you offer.

5. Employment details: Describe the number of employees you currently have or anticipate hiring in the near future. This information may include the number of full-time and part-time employees or any other categories that apply to your workforce.

6. Tax information: Provide tax-related details as required. This may include your tax filing status, tax jurisdiction, and any relevant tax forms or documentation.

7. Insurance and benefits: If the form requires information about employee insurance or benefits programs, fill in the details accordingly. Provide any applicable insurance policies you offer, such as health insurance, workers' compensation, or retirement plans.

8. Signature and date: Finally, sign and date the form to confirm the accuracy of the information provided. Ensure the form is signed by an authorized representative of the company, such as the owner, CEO, or director.

9. Review and submit: Before submitting the form, review all the information you provided to ensure its accuracy and completeness. Make any necessary corrections or additions if needed. Once verified, submit the form as instructed, either by mailing a physical copy or submitting an electronic version, depending on the method specified in the form's instructions.

Remember, the specific requirements of an employer registration form may vary depending on the organization or jurisdiction. It's essential to carefully read and follow the instructions provided with the form to ensure complete and accurate submission.

What is the purpose of employer registration form?

The purpose of an employer registration form is to collect necessary information from employers that will enable them to recruit and hire employees in a legal and organized manner. This form typically gathers details such as the company's name, contact information, employer identification number, nature of business, number of employees, and other relevant details. The employer registration form helps establish a legal and official relationship between the employer and the government or relevant authorities, ensuring compliance with labor laws and regulations. It also allows the employer to access resources, benefits, and services that are specific to registered employers, such as job posting platforms, tax incentives, workforce training programs, and more.

What information must be reported on employer registration form?

The specific information required on an employer registration form may vary depending on the jurisdiction and the purpose of the form. However, some common information that may be typically included are:

1. Business name and legal structure: The full legal name of the employer and the type of business entity (e.g., corporation, partnership, sole proprietorship).

2. Business address: The physical location of the employer's main office or place of business.

3. Employer identification number (EIN): A unique identifier assigned by the tax authorities to identify the employer for tax purposes.

4. Contact information: Name, phone number, and email address of a representative who can be contacted regarding employment matters.

5. Industry classification: The industry or sector in which the employer operates (e.g., healthcare, construction, financial services).

6. Nature of business: A brief description of the employer's principal activities or services.

7. Date of establishment: The date the business was established or commenced operations.

8. Ownership information: Details about the owner(s) or majority shareholder(s) of the business, including names, addresses, and ownership percentages.

9. Number of employees: The approximate number of individuals currently employed by the employer.

10. Payroll information: Total annual payroll expenses or estimated payroll for the upcoming year.

11. Regulatory information: Any licenses, permits, or certifications required for the employer's industry.

It is important to note that the above information is a general guideline, and the actual requirements may vary based on the specific jurisdiction and purpose of the employer registration form.

What is the penalty for the late filing of employer registration form?

The penalty for the late filing of an employer registration form can vary depending on the specific jurisdiction and regulations in place. In some cases, a fixed amount may be specified as the penalty for late filing, while in others it may be a percentage of the taxes owed or a combination of both. It is recommended to refer to the local tax authority or regulatory body to determine the exact penalty for late filing in a specific jurisdiction.

How can I send employer registration form to be eSigned by others?

Once your registration new hire form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit employer registration new in Chrome?

Install the pdfFiller Google Chrome Extension to edit registration form hire and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for the registration new reporting in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your employment registration form in minutes.

Fill out your employer registration form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employer Registration New is not the form you're looking for?Search for another form here.

Keywords relevant to employe ment registration form

Related to multistate employer

If you believe that this page should be taken down, please follow our DMCA take down process

here

.