Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

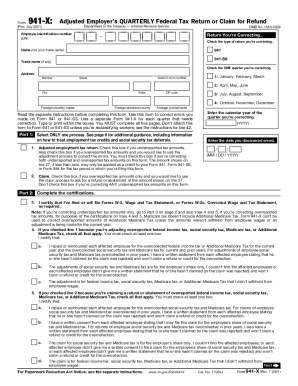

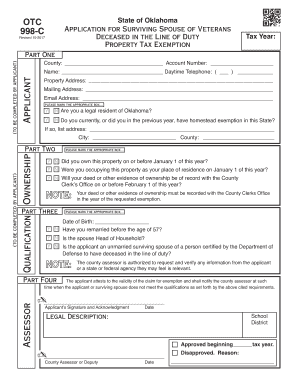

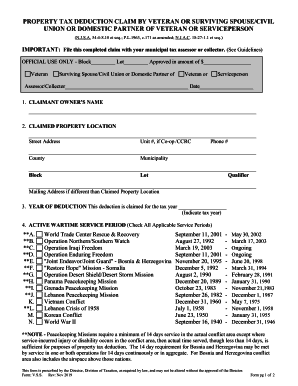

What is the purpose of irs forms?

The purpose of IRS forms is to provide taxpayers with the necessary information to accurately report their income, deductions, credits, and other tax-related information. The forms also provide the IRS with the information they need to accurately calculate and collect taxes.

IRS forms are official documents provided by the Internal Revenue Service (IRS) to individuals and businesses to report financial information and fulfill their tax obligations. These forms are used to report income, claim deductions and credits, and calculate the amount of tax owed or refunded. Examples of commonly used IRS forms include Form 1040 for individual tax returns, Form 1120 for corporate tax returns, and Form W-4 for withholding information from employees. The IRS website provides a comprehensive list of various forms and instructions for specific tax filing needs.

Who is required to file irs forms?

Individuals, businesses, and nonprofit organizations may be required to file IRS forms based on their specific circumstances. Specifically, the following entities typically need to file IRS forms:

1. Individuals: U.S. citizens or residents who earn income above a certain threshold are generally required to file a federal income tax return. The exact filing requirements depend on factors like filing status, age, and income level.

2. Businesses: Different types of businesses, such as sole proprietorships, partnerships, corporations, and S corporations, have specific forms they need to file. For instance, a sole proprietor may file a Schedule C as part of their personal income tax return, while partnerships generally need to file a Form 1065 and corporations may be required to file a Form 1120.

3. Nonprofit Organizations: Tax-exempt nonprofit organizations, such as charities, social clubs, and religious organizations, are also required to file various IRS forms. The most common form for nonprofits is the Form 990, which provides information about the organization's finances and activities.

It's important to note that these are general guidelines, and there may be exceptions and additional forms based on specific circumstances or special situations. It's advisable to consult with a tax professional or refer to the IRS website for accurate and up-to-date information regarding filing requirements.

How to fill out irs forms?

Here is a general step-by-step guide on how to fill out IRS forms:

1. Gather all the necessary documents: Before you begin filling out an IRS form, make sure you have all the required documents like W-2s, 1099s, receipts, or any other supporting documentation.

2. Obtain the correct form: Identify which IRS form you need to complete. The form number can usually be found in the form's instructions, or you can search for it on the IRS website.

3. Read the instructions: Each IRS form comes with specific instructions to help you fill it out accurately. It is important to read and understand these instructions thoroughly before you start filling out the form.

4. Provide your personal information: Usually, the first section of an IRS form requires personal information such as your name, address, Social Security number (SSN), and other identifying details. Fill in this information accurately.

5. Income reporting: Depending on the form, you may need to report your income from different sources like wages, self-employment, investments, or rental properties. Use the appropriate lines or sections to report your income accurately.

6. Deductions and credits: If you qualify for any deductions or credits, follow the instructions to claim them. Deductions and credits can help reduce your overall tax liability.

7. Calculate your tax liability: Use the provided calculations or accompanying worksheets to determine your tax liability. If you are unsure about any calculations, refer to the instructions or seek professional assistance.

8. Double-check and review: Carefully review all the information you entered on the form for accuracy. Small errors or omissions can cause delays or result in additional penalties.

9. Sign and date: Sign and date the form where required. If you are filing jointly, ensure that your spouse also signs the appropriate areas.

10. Attach any required documentation: If there are supporting documents or schedules that need to be attached to the form, make sure you include them before submitting.

11. Make copies: Before you send the form to the IRS, make copies of everything for your records. It is always helpful to have a copy of the completed form in case any issues arise later.

12. File the form: Depending on the type of form, you can file it electronically through tax software or by mail. Follow the instructions provided on the form or consult the IRS website for filing options and addresses.

It's worth noting that some forms may require additional steps or have specific requirements, so carefully review the instructions to ensure you accurately complete and file the form. If you are uncertain about any aspect of filling out the form, consider consulting a tax professional for guidance.

What information must be reported on irs forms?

The specific information that must be reported on IRS forms can vary depending on the form being filed. However, some common types of information that may need to be reported include:

1. Personal Information: This includes your name, social security number, address, and other identifying details.

2. Income: You are generally required to report all types of income, including salaries, wages, self-employment income, rental income, investment income, and any other income sources.

3. Deductions: You may need to report certain deductions, such as expenses related to self-employment, business expenses, medical expenses, mortgage interest, state and local taxes, and charitable contributions.

4. Tax Credits: If you are eligible for any tax credits, such as the Child Tax Credit, Earned Income Credit, or education-related credits, you will need to report the necessary information.

5. Foreign Assets and Accounts: If you have foreign financial accounts or certain foreign assets, you may need to report them to the IRS under the Foreign Bank Account Reporting (FBAR) rules.

6. Healthcare Coverage: You may need to report information about your health insurance coverage or coverage exemptions under the Affordable Care Act.

These are just a few examples, and the specific reporting requirements can vary greatly depending on the individual's circumstances and the form being filed. Therefore, it is important to carefully review the instructions for the specific IRS form you are filing to ensure that you provide all the necessary information accurately.

When is the deadline to file irs forms in 2023?

The deadline to file IRS forms in 2023 depends on the specific form you need to file. However, the general deadline for individual taxpayers to file their federal income tax returns, including Form 1040, is typically April 15th each year. In case April 15th falls on a weekend or holiday, the deadline may be extended to the following business day. It's worth noting that extensions can be filed if more time is needed, allowing taxpayers to file their forms by October 15th. For precise information, it's recommended to check the IRS website or consult with a tax professional closer to the specific tax year.

What is the penalty for the late filing of irs forms?

The penalty for late filing of IRS forms varies depending on the specific form and the length of the delay. Here are a few common penalties:

1. Late filing penalty: This penalty is applicable when you fail to file your tax return by the due date (including extensions), and it's typically charged as a percentage of the unpaid taxes. The penalty is 5% of the unpaid tax amount per month, with a maximum penalty of 25% of the unpaid taxes. However, if you file more than 60 days after the due date, the minimum penalty is either $435 or 100% of the unpaid tax, whichever is less.

2. Late payment penalty: If you fail to pay your taxes by the due date, the IRS imposes a penalty of 0.5% of the unpaid tax amount per month, up to a maximum of 25%.

3. Failure to file penalty: If you fail to file certain information returns or filings, such as W-2 forms, 1099 forms, or employment tax returns, the penalty can be up to $540 per form for each month the filing is late or missing.

It's important to note that penalties and interest can accrue over time, making it more costly the longer you delay filing. Additionally, certain circumstances may qualify for reasonable cause relief, where penalties may be waived or reduced based on valid reasons for the late filing.

How do I fill out the irs forms 2021 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign 20 941 claim printable form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How can I fill out us gov tax forms 941 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your irs form 941 x, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I complete 941 c print on an Android device?

Use the pdfFiller Android app to finish your 941 claim blank form and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.