Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file small estate with no?

Small estates with no will typically require the closest living relative to file for the estate's administration. This is usually the decedent's spouse, child, parent, or sibling.

What is the purpose of small estate with no?

The purpose of a small estate with no will is to provide a simplified process for transferring the assets of a deceased individual who did not leave a will. Typically, small estate affidavits are used when a deceased individual had little or no property. This process allows the deceased's surviving family members or other interested parties to transfer the assets quickly and efficiently, without the need for costly and time-consuming probate proceedings.

What information must be reported on small estate with no?

If a small estate has no assets or liabilities, then no information needs to be reported. However, if the small estate does have assets or liabilities, then the executor or administrator of the estate must report the value of the estate's assets and liabilities, the payment of any outstanding debts, and the distribution of any remaining assets.

When is the deadline to file small estate with no in 2023?

The exact deadline to file a small estate without an executor will vary by state, but in general, the deadline is typically within three months of the decedent's date of death.

What is the penalty for the late filing of small estate with no?

The penalty for late filing of a small estate with no will varies by state. Generally, if the estate is not filed within the time limit established by the state, the estate may be subject to additional fees, late filing penalties, or the assets may be distributed without the benefit of probate.

What is small estate with no?

Small estate with no refers to a legal term used to describe an estate that is of limited value and has no will. In such cases, the laws of intestate succession will determine how the assets of the estate are distributed among the heirs. The specific laws regarding small estates with no will can vary by jurisdiction. It is advisable to consult with an attorney or probate court for guidance in handling a small estate with no will.

How to fill out small estate with no?

To fill out a small estate with no will, you will need to follow a specific set of steps depending on the jurisdiction you are in. Here is a general outline of the process:

1. Determine if the estate qualifies as a small estate: Each jurisdiction has its own definition of a small estate, but generally, it refers to estates with a low total value of assets.

2. Obtain the necessary forms: Contact the probate court or visit their website to obtain the forms required to administer a small estate with no will. These forms may include an affidavit of small estate or a similar document.

3. Gather information about the estate: Make a list of the deceased person's assets, including bank accounts, real estate, vehicles, and personal property. Include details such as account numbers, property descriptions, and approximate values.

4. Obtain necessary documentation: Gather any relevant documentation, such as death certificates and property deeds, to support your claim as the administrator.

5. Complete the forms: Fill out the required forms accurately and truthfully. Provide all requested information about the deceased person and their assets.

6. Sign and notarize the forms: The forms may require your signature, and some jurisdictions may require notarization. Ensure that you follow the specific requirements of your jurisdiction.

7. File the forms with the probate court: Submit the completed and notarized forms to the probate court along with any accompanying documentation. Pay any required filing fees.

8. Wait for approval: The probate court will review your forms and documentation. If everything is in order, they will approve the small estate administration and issue any necessary documents granting you the authority to distribute the assets.

9. Distribute the assets: With the court's approval, you can proceed to distribute the assets to the rightful heirs and beneficiaries of the estate, according to the laws of your jurisdiction. Keep detailed records of all distributions made.

It is important to note that the process may vary depending on the jurisdiction, and it is recommended to consult with an attorney or a legal professional to ensure compliance with specific local laws and regulations throughout the process.

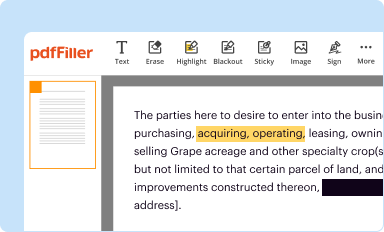

How can I edit illinois small estate affidavit form from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including small estate make form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

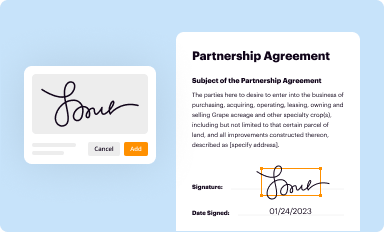

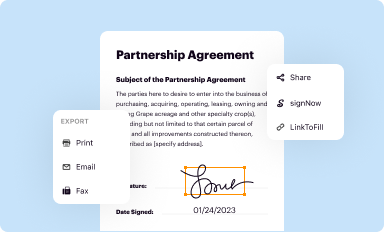

Can I create an electronic signature for signing my small estate affidavit illinois printable in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your small state affidavit for illinois and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

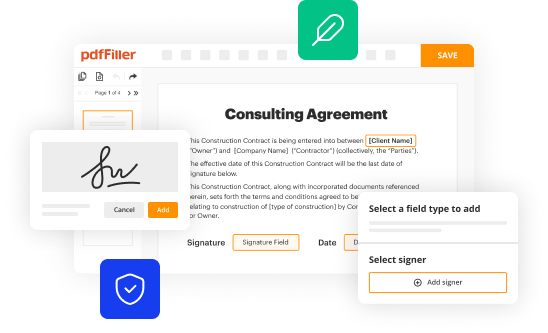

How do I complete small estate affidavit form illinois on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your il small estate affidavit 2019 form. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.