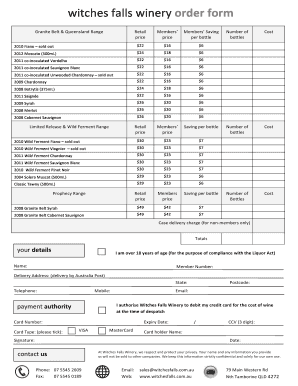

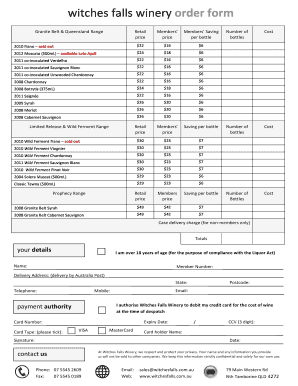

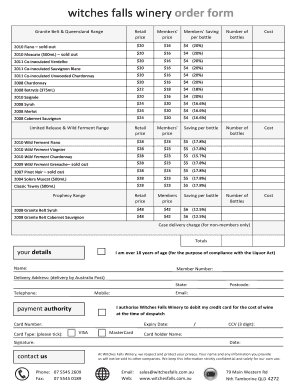

Get the free child care receipt pdf form

Show details

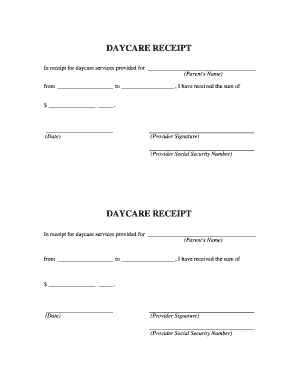

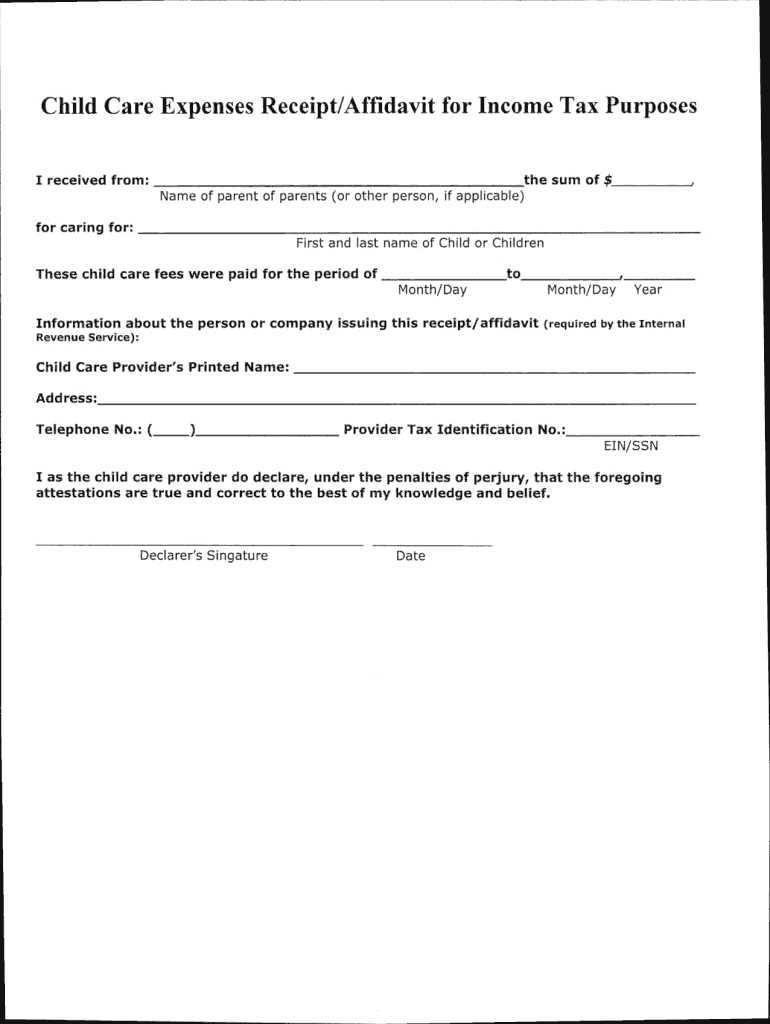

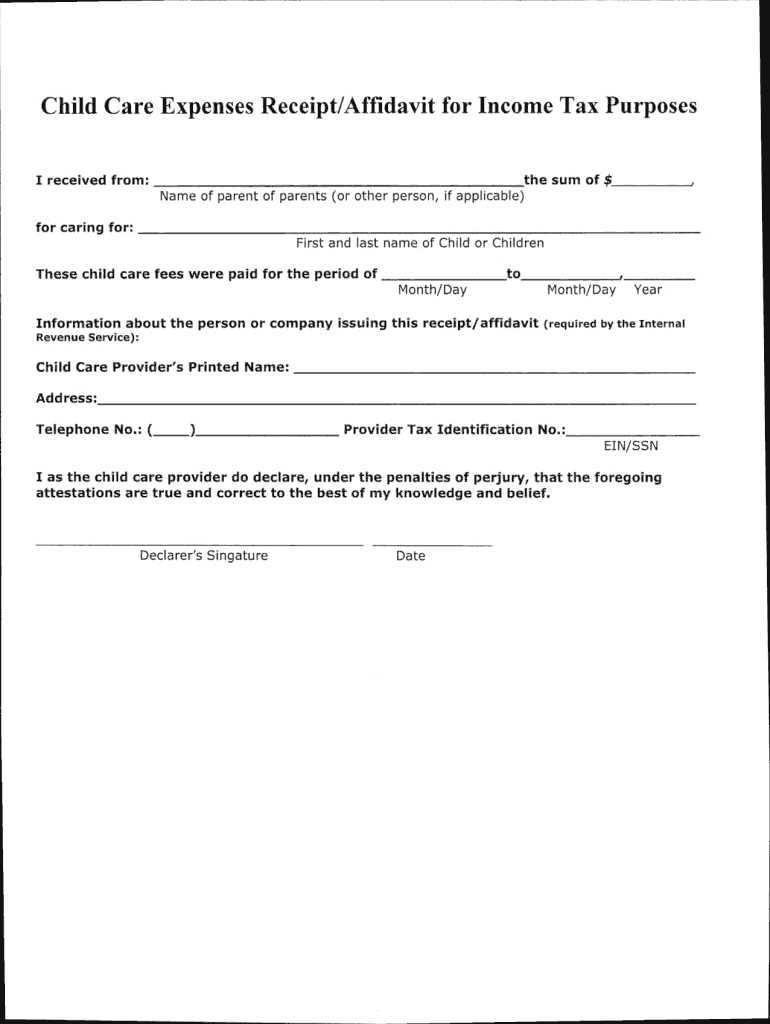

Child Care Expenses Receipt/Affidavit for Income Tax Purposes I received from: the sum of $ Name of parent of parents (or other person, if applicable) for caring for: First and last name of Child

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

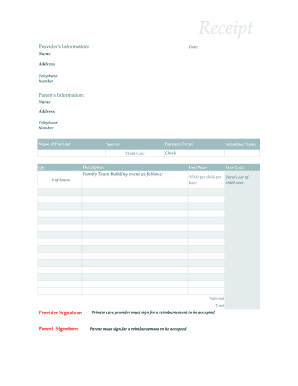

Edit your child care receipt pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your child care receipt pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit child care receipt pdf online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit child care receipt form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out child care receipt pdf

How to fill out tax return:

01

Gather all necessary documentation, such as W-2 forms, 1099 forms, receipts, and records of deductible expenses.

02

Determine your filing status (single, married filing jointly, etc.) and gather any pertinent information related to dependents or exemptions.

03

Choose the method of filing that best suits your situation, whether it be filing electronically or by mail.

04

Follow the instructions provided by the tax authority or use a tax preparation software to accurately complete the various sections of the tax return form.

05

Double-check all calculations and ensure that all required information is included before submitting the tax return.

06

If applicable, consider consulting a tax professional for assistance or to answer any specific questions related to your tax situation.

Who needs tax return:

01

Individuals who have earned income from various sources, including wages, self-employment, rental income, dividends, or interest.

02

Business owners, including sole proprietors, partnerships, LLCs, or corporations, who are required to report their business income and expenses.

03

Individuals who have received certain forms of income that are subject to tax reporting, such as unemployment benefits, pensions, annuities, or alimony.

04

Individuals who may be eligible for tax credits or deductions, such as education-related expenses, homeownership expenses, or medical expenses.

05

Non-residents or foreign nationals who have earned income within the country and are subject to tax reporting or filing requirements.

06

Individuals who have had federal or state taxes withheld from their income and are eligible to claim a refund.

Note: This is a general answer and may vary based on the tax laws and regulations of specific countries or regions. It is always recommended to consult with a tax professional or refer to the specific guidelines provided by the tax authority in your jurisdiction.

Fill daycare receipt pdf : Try Risk Free

People Also Ask about child care receipt pdf

When should I expect my tax refund 2023?

Are tax refunds delayed 2023?

When can I expect tax return?

What tax return means?

How to get a tax refund?

Is it better to owe or get a refund?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax return?

A tax return is a form submitted to the Internal Revenue Service (IRS) or other tax authority that reports a person or organization's income, expenses, and other details related to their tax liability. It is used to calculate the amount of taxes owed or to receive a refund for taxes paid in excess of what was owed.

What information must be reported on tax return?

On a tax return, you must report all income you have received during the tax year, such as wages, salaries, tips, interest, dividends, capital gains, and other income. You must also report any deductions or credits you are claiming, such as charitable donations, mortgage interest, and child care expenses. Additionally, you must provide detailed information about any dependents you are claiming. Finally, you must sign and date the return to affirm that the information you have provided is accurate.

How do I edit child care receipt pdf online?

With pdfFiller, it's easy to make changes. Open your child care receipt form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I complete child care receipt template on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your daycare tax statement pdf, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Can I edit printable daycare receipt on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute daycare receipt form from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your child care receipt pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Child Care Receipt Template is not the form you're looking for?Search for another form here.

Keywords relevant to childcare tax form

Related to child care expenses tax

If you believe that this page should be taken down, please follow our DMCA take down process

here

.