CT AU-724 2022-2024 free printable template

Show details

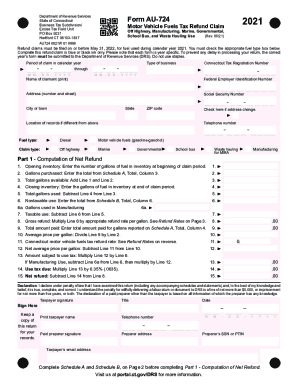

Department of Revenue Services State of Connecticut Business Tax Subdivision/ Excise Tax Field Unit PO Box 5031 Hartford CT 061025031 AU724 0622W 01 9999Form AU7242022Motor Vehicle Fuels Tax Refund

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your connecticut fuel tax 2022-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your connecticut fuel tax 2022-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit connecticut fuel tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit au 724 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

CT AU-724 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out connecticut fuel tax 2022-2024

How to fill out Connecticut fuel tax:

01

Obtain the necessary forms: To fill out Connecticut fuel tax, you will need to acquire the appropriate forms from the Connecticut Department of Revenue Services (DRS) website or by contacting their office directly.

02

Provide personal information: On the form, you will be required to provide your personal information, such as your name, address, and contact details. Make sure to fill in these fields accurately and legibly.

03

Report fuel sales: Indicate the details of your fuel sales, including the type of fuel sold, the quantity, and the date of sale. It is important to accurately report this information to ensure compliance with Connecticut tax regulations.

04

Calculate gallons sold: Calculate the total gallons of fuel sold during the reporting period. Ensure that your calculations are accurate and double-check your math to avoid any discrepancies.

05

Determine tax due: Use the provided tax rate or applicable tax tables to calculate the amount of tax due. Connecticut fuel tax rates may vary and change over time, so it is crucial to refer to the most recent information provided by the DRS.

06

Fill in payment information: If you owe fuel tax, provide the necessary payment information on the form. This may include your bank account details for electronic transfer or a check/money order if paying by mail.

Who needs Connecticut fuel tax:

01

Fuel distributors: Connecticut fuel tax is primarily applicable to fuel distributors who sell fuels such as gasoline, diesel, propane, or alternative fuels within the state.

02

Retailers and dealers: Businesses that sell fuel to end consumers or retailers that operate fuel pumps are also responsible for reporting and remitting Connecticut fuel tax.

03

Individual consumers: While individual consumers do not directly file Connecticut fuel tax, they indirectly contribute to it through purchasing fuel from retailers who factor in the tax in the price per gallon.

Please note that this information is a general overview and it is important to consult the official forms and guidelines provided by the Connecticut Department of Revenue Services (DRS) for specific instructions on how to fill out Connecticut fuel tax.

Fill au724 form : Try Risk Free

People Also Ask about connecticut fuel tax

Did CT reinstate the gas tax?

Do all 50 states have a gas tax?

Does Texas have the highest gas tax?

Which state in the US out of the 50 states currently has the highest gasoline tax per gallon including state and federal excise taxes )?

What state has the highest fuel tax?

What state has the highest gas price currently?

What state has the highest excise tax on gasoline?

What state has the highest taxes?

What is the federal tax on gasoline in the United States?

What state has the largest gas tax?

Who has the second highest gas tax?

Which state has the highest gas prices 2022?

Which state in the US out of the 50 States currently has the highest gasoline tax per gallon including state and federal excise taxes )?

Who has the second highest gas tax?

What state has the highest gas gas tax?

How much is gasoline tax in Texas?

Which state has the lowest gas tax?

How much is Connecticut fuel tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of connecticut fuel tax?

The purpose of the Connecticut fuel tax is to generate revenue for the state government. It is a tax imposed on the sale or use of fuel within the state of Connecticut. The revenue generated from this tax is used to fund various transportation-related expenses, such as the construction and maintenance of roads, highways, bridges, and other transportation infrastructure projects. The fuel tax helps fund transportation initiatives, improve connectivity, and ensure the availability of safe and efficient transportation systems throughout the state.

What is connecticut fuel tax?

As of April 2021, the fuel tax in Connecticut is $0.431 per gallon for gasoline and $0.501 per gallon for diesel fuel. These rates are subject to change, so it is advisable to check with official sources for the most up-to-date information.

Who is required to file connecticut fuel tax?

In Connecticut, people or businesses that operate motor vehicles and use taxable fuels are required to file and pay the Connecticut fuel tax. This includes gasoline and diesel fuels used in highway vehicles, as well as fuels used in off-highway vehicles such as boats and construction equipment.

How to fill out connecticut fuel tax?

To fill out the Connecticut fuel tax form, follow these steps:

1. Obtain the necessary form: The Connecticut Department of Revenue Services (DRS) provides the "State of Connecticut Petroleum Products Gross Earnings Tax Return" form (Form OP-152). You can download it from the DRS website or request a copy by calling their office.

2. Provide general information: Fill in the introductory section of the form, including your name, address, phone number, and the period for which you are filing the return.

3. Calculate gross earnings: Figure out your total gross earnings from sales of petroleum products subject to Connecticut fuel tax during the filing period. This includes gasoline, diesel, and other taxable fuels. Provide this value in the appropriate box on the form.

4. Calculate exemptions and deductions: Determine any allowable exemptions and deductions from your gross earnings. For example, certain sales may qualify for a lower tax rate or be exempt altogether. Subtract these exemptions and deductions from your gross earnings.

5. Calculate net earnings: Subtract the amount of exemptions and deductions from the gross earnings to calculate your net earnings.

6. Calculate the tax due: Apply the appropriate fuel tax rate (which may vary depending on the type of fuel and the filing period) to your net earnings to calculate the tax due.

7. Complete payment information: Provide the necessary information for making the tax payment. This may include your payment method (check, ACH debit, etc.) and any required payment vouchers.

8. Sign and submit: Sign the form to certify its accuracy. Make a copy for your records and submit the original form along with the applicable payment to the address provided on the form.

Note: It is advisable to consult the instructions provided along with Form OP-152 or seek professional tax advice to ensure compliance with any specific requirements or changes in the tax laws.

What information must be reported on connecticut fuel tax?

The information that must be reported on Connecticut fuel tax includes:

1. Total gallons of motor fuel received or purchased, including both gasoline and diesel fuel.

2. Total gallons of motor fuel delivered or sold, including both retail and wholesale.

3. Total gallons of motor fuel used in non-highway applications, such as agricultural and off-road use.

4. Total gallons of motor fuel used in exempt purposes, such as government-owned vehicles or vessels.

5. Total gallons of motor fuel exported or removed for sale outside of Connecticut.

6. The tax rate applied to each type of motor fuel.

7. Total taxes due on motor fuel received or purchased, including both state and federal taxes.

8. Total taxes collected on motor fuel delivered or sold.

9. Any adjustments or refunds related to motor fuel taxes.

10. Any penalties or interest incurred for late or non-payment of motor fuel taxes.

It is important to note that this information may vary or be updated by the Connecticut Department of Revenue Services, and further guidance can be found on their official website.

What is the penalty for the late filing of connecticut fuel tax?

The penalty for the late filing of Connecticut fuel tax depends on the amount of unpaid tax and the period of delay. Generally, the penalty is calculated as a percentage of the unpaid tax and is applied for each month or part thereof that the return is late. As of 2021, the penalty rates are as follows:

- For delays up to 1 month: 10% of the unpaid tax

- For delays between 1 to 2 months: an additional 10% (total penalty of 20%)

- For delays between 2 to 3 months: an additional 15% (total penalty of 35%)

- For delays between 3 to 4 months: an additional 15% (total penalty of 50%)

- For delays more than 4 months: an additional 5% per month (maximum penalty of 75%)

It is important to note that interest may also be charged on the unpaid tax amount. Additionally, intentional failure to file a tax return or pay the tax can result in criminal penalties. It is advisable to consult the Connecticut Department of Revenue Services or a tax professional for specific and up-to-date information regarding fuel tax penalties.

How can I send connecticut fuel tax for eSignature?

When you're ready to share your au 724 form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Where do I find form au 724?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the ct au 724 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I edit state of connecticut form au 724 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing ct fuels tax form right away.

Fill out your connecticut fuel tax 2022-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Au 724 is not the form you're looking for?Search for another form here.

Keywords relevant to 724 2022 form

Related to ct motor fuels tax

If you believe that this page should be taken down, please follow our DMCA take down process

here

.