KS DoL K-PUA 730 2020-2024 free printable template

Show details

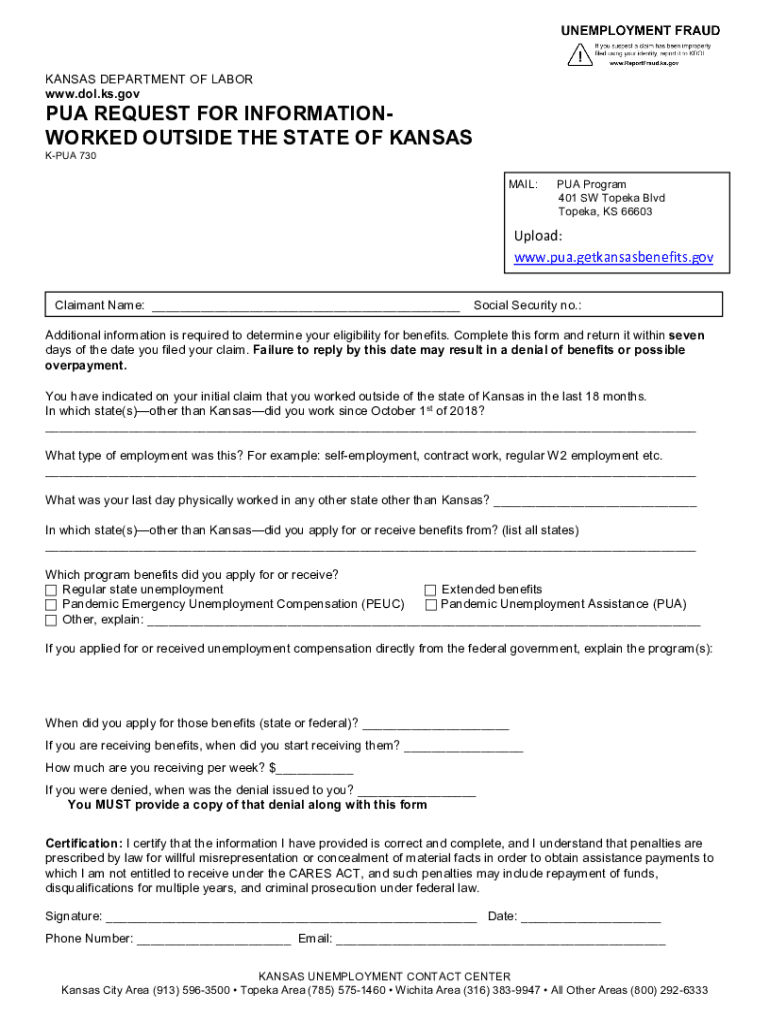

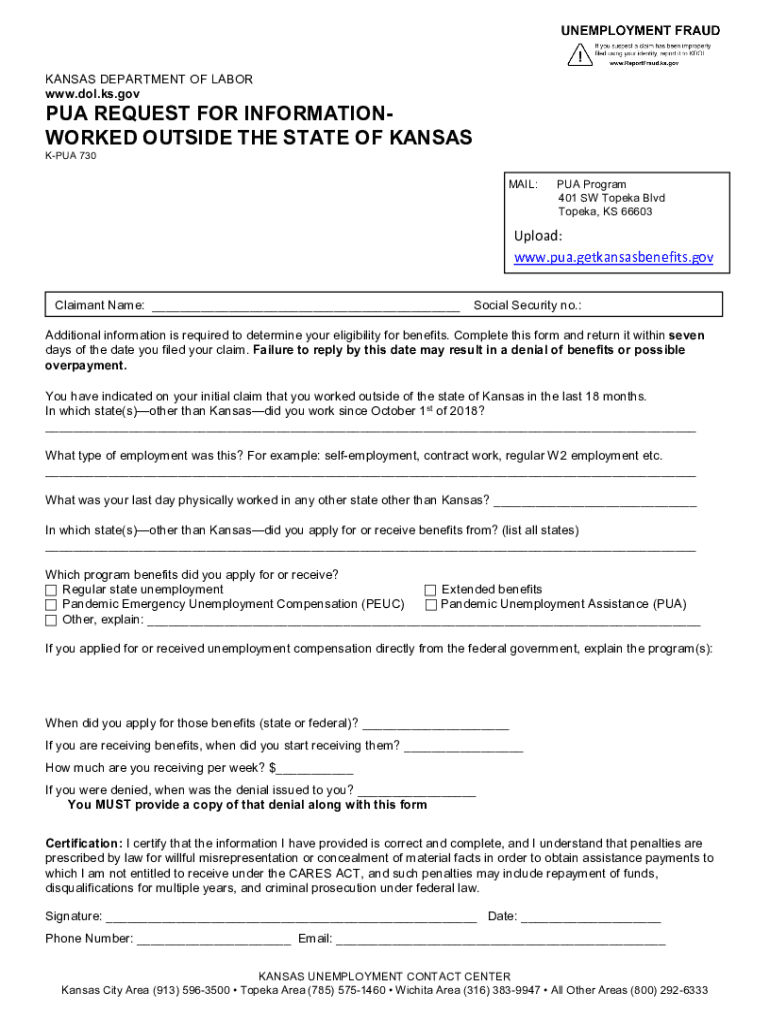

KANSAS DEPARTMENT OF LABOR www.dol.ks.govPUA REQUEST FOR INFORMATIONWORKED OUTSIDE THE STATE OF KANSAS KPU 730MAIL:PUA Program 401 SW Topeka Blvd Topeka, KS 66603Upload: www.pua.getkansasbenefits.gov

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your kansas kpua 730 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kansas kpua 730 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kansas kpua 730 online

Follow the steps below to benefit from a competent PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fee security social form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out kansas kpua 730 form

How to fill out k pua 735 form?

01

First, gather all the required documents and information needed to fill out the form, such as your personal information, employment details, and any supporting documentation.

02

Start by carefully reading the instructions provided with the form to ensure you understand the requirements and process.

03

Begin filling out the form with your personal information, including your full name, address, contact details, and social security number.

04

Provide accurate and detailed information about your employment history, including the names and addresses of previous employers, job titles, dates of employment, and reasons for separation.

05

If applicable, provide information about any other sources of income or benefits you receive, such as unemployment compensation or disability benefits.

06

Complete any other sections or questions on the form that are relevant to your situation, ensuring you provide accurate and truthful information.

07

Review the completed form carefully, checking for any errors or omissions. Make any necessary corrections before submitting the form.

08

Sign and date the form to certify that the information provided is accurate to the best of your knowledge.

09

Submit the completed form as instructed, either online or by mail, according to the specific guidelines provided by the relevant authority.

Who needs k pua 735 form?

01

Individuals who have experienced a loss of employment or reduced work hours due to the COVID-19 pandemic and are eligible for Pandemic Unemployment Assistance (PUA) may need to fill out the k pua 735 form.

02

It is specifically designed for those who are self-employed, independent contractors, gig workers, or have other forms of employment not covered by traditional unemployment insurance.

03

Eligible individuals who wish to claim unemployment benefits through the PUA program will be required to complete and submit the k pua 735 form to provide necessary information and documentation to determine eligibility and benefit amount.

Fill disbursed claimants accruing : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is k pua 735 form?

K PUA 735 form refers to the document that individuals need to complete to apply for Pandemic Unemployment Assistance (PUA) benefits in the state of Kansas. PUA is a federal program established to provide unemployment benefits to self-employed individuals, gig workers, independent contractors, and others who are not eligible for regular state unemployment benefits. The K PUA 735 form collects information about the applicant's employment status, income, and eligibility criteria required for PUA benefits in Kansas. It is necessary to complete this form accurately and submit it to the Kansas Department of Labor to initiate the application process.

Who is required to file k pua 735 form?

The K PUA 735 form is a form specific to the State of Hawaii's Pandemic Unemployment Assistance (PUA) program. Individuals who are self-employed, independent contractors, gig workers, and others who are not eligible for traditional unemployment benefits may be required to file the K PUA 735 form to apply for PUA benefits in Hawaii. It is recommended to check with the Hawaii Department of Labor and Industrial Relations (DLIR) for specific eligibility criteria and filing requirements.

How to fill out k pua 735 form?

To fill out the K-PUA 735 form, follow these steps:

1. Start by downloading the form from the website of the Kansas Department of Labor.

2. Begin by providing personal information, including your full name, Social Security number, address, phone number, and email address.

3. Section A requires you to provide information about your employer, including the name and address of the business where you were employed before becoming unemployed due to the COVID-19 pandemic.

4. In Section B, you will need to provide details about your employment, such as your occupation, the date you were hired, and the reason for separation from your job.

5. Section C allows you to report any additional employers where you were employed within the past 18 months.

6. If you are self-employed or an independent contractor, use Section D to provide details about your business, including the business name, address, dates of operation, and gross income details.

7. Section E requires you to report any income received during the weeks you are claiming benefits. This includes wages, vacation pay, pension, or any other form of income.

8. If you received any form of benefits or compensation, such as unemployment insurance or workers' compensation, during the weeks you are claiming benefits, report them in Section F.

9. Section G is for reporting any leave or severance payments received, including severance pay, vacation pay, or any similar payments.

10. At the end of the form, you need to verify the information provided is true and accurate by signing and dating the document.

11. Ensure you have gathered all the necessary supporting documents, such as pay stubs, bank statements, or any other relevant documentation, before submitting the form.

12. Once you have completed filling out the form, save a copy for your records and submit it as per the instructions provided by the Kansas Department of Labor. This might involve mailing the form or submitting it electronically through their online portal.

Remember, it is important to carefully review the instructions provided with the form and double-check all the information provided to ensure accuracy.

What is the purpose of k pua 735 form?

The purpose of the KPua 735 form is to apply for the Pandemic Unemployment Assistance (PUA) program in the State of Hawaii. This form is used by individuals who are self-employed, independent contractors, gig workers, and others who are not eligible for regular unemployment insurance benefits. The form collects necessary information from applicants to determine eligibility and calculate the amount of assistance they may receive.

What information must be reported on k pua 735 form?

The K PUA 735 form is used for applying for Pandemic Unemployment Assistance (PUA) benefits in the state of Kentucky. The form requires the following information to be reported:

1. Personal Information: This includes your name, social security number, mailing address, phone number, and email address.

2. Language Capability: You need to indicate if you require assistance in a language other than English.

3. Employment Information: You must provide details about your last employer, including their name, address, phone number, and dates of employment. You also need to mention the reason for job separation, which could be COVID-19 related (e.g., business closure, reduction in hours, etc.).

4. Self-Employment Information: If you are self-employed, you must provide information about your business, including its name, address, phone number, and the type of work you do. Additionally, you need to provide details about any affected business operations due to COVID-19.

5. Additional Income: You have to report any other sources of income you may have, such as Social Security benefits, retirement benefits, or workers' compensation.

6. Proof of Income: You may need to submit documents showing your income, such as tax returns, 1099 forms, or other financial statements.

7. Basis for Eligibility: You will need to certify and provide information on the reason you are eligible for PUA benefits. This may include being self-employed, an independent contractor, or not being eligible for regular unemployment benefits.

It is important to consult the specific instructions provided by the Kentucky Office of Employment and Training or seek assistance from their helpline if you have any concerns or questions regarding the K PUA 735 form.

What is the penalty for the late filing of k pua 735 form?

The penalty for late filing of the K PUA 735 form may vary depending on the specific regulations and guidelines set by the relevant authorities in your jurisdiction. It is recommended to consult the particular rules and regulations provided by the state or federal government that oversee the program to determine the exact penalties for late filing.

Where do I find kansas kpua 730?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the fee security social form in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit file form straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing security benefits file.

How do I fill out benefits security on an Android device?

Complete fee social file form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your kansas kpua 730 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

File Form is not the form you're looking for?Search for another form here.

Keywords relevant to worked kpua 730 form

Related to overpayment attn applicable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.