SF 270-102 1996-2024 free printable template

Show details

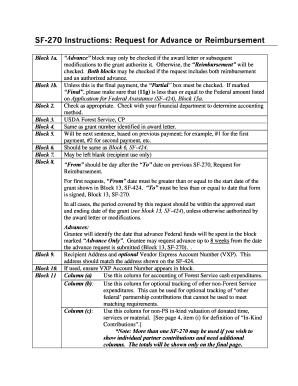

Email SF-270 to HMEP. Grants dot. gov. PHMSA-SF-270 Approved by Office of Management and Budget. No. 80-R0183 REQUEST FOR ADVANCE OR REIMBURSEMENT See instructions on back 3. FEDERAL SPONSORING AGENCY AND ORGANIZATIONAL ELEMENT TO WHICH THIS REPORT IS SUBMITTED 6. EMPLOYER IDENTIFICATION NUMBER 7. RECIPIENTS ACCOUNT NUMBER OR IDENTIFYING TYPE OF PAYMENT REQUESTED PAGE a* x one or both boxes ADVANCE OF 2. BASIS OF REQUEST CASH b. x the appropriate box ACCRUAL FINAL PARTIAL 4. FED GRANT OR...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your sf270 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sf270 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sf270 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit request advance reimbursement sf form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out sf270 form

How to fill out the sf270 form excel:

01

Open the sf270 form excel file on your computer.

02

Fill in the relevant information in the designated fields of the form, such as the project title, project start date, and project end date.

03

Provide the project description and objectives in the appropriate section.

04

Enter the budget information, including the estimated costs for each budget category.

05

Review the form for accuracy and completeness.

06

Save the filled-out sf270 form excel file.

Who needs sf270 form excel:

01

Organizations or individuals applying for federal grants or contracts.

02

Project managers or financial officers responsible for tracking and reporting project expenses.

03

Government agencies or departments requiring financial information for project oversight and accountability.

Fill answer identify : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sf270 form excel?

The SF270 Form Excel is an Excel template created by the U.S. Department of Health and Human Services (HHS) to help organizations easily track their financial progress and report it to the government. It is used by organizations that receive funding from the federal government to track their expenses, income, and other financial information associated with their grants and contracts.

What is the purpose of sf270 form excel?

The SF-270 Form Excel is a financial request and report form designed to help federal agencies manage their financial transactions. It is used to request and track payments, as well as to report activity, receipts, and disbursements. The form is available in both Microsoft Excel and PDF format.

What is the penalty for the late filing of sf270 form excel?

The penalty for late filing of SF270 form varies depending on the individual situation. Generally, the penalty for late filing is up to $50 per month for each month or part of a month that the report is late. The penalty can be avoided if the filer can demonstrate that the late filing was due to reasonable cause and not intentional disregard of the filing requirements.

Who is required to file sf270 form excel?

The SF270 form is used by federal agencies and organizations that receive federal funding to report their expenditures for a particular project or program. It is required to be completed and filed by the recipients of federal funds, such as state and local government agencies, universities, nonprofits, or other entities.

How to fill out sf270 form excel?

To fill out an SF270 form in Excel, you can follow these steps:

1. Open Microsoft Excel and create a new spreadsheet.

2. Set up the columns and rows to match the form's format. This may involve merging cells, adjusting column widths, and adding borders to create the required sections and fields.

3. Enter the necessary information into each field. Depending on the form's requirements, you may need to input data such as project details, budget estimates, and cost breakdowns.

4. Use Excel's formatting options to ensure the data is correctly displayed and organized. You can apply formatting to cells, such as currency or percentage formatting, as needed.

5. Double-check your entries to ensure accuracy and completeness.

6. Save the completed form in Excel format for future use or convert it to a PDF or another appropriate file format as required by your organization.

Remember to refer to the specific instructions provided with the SF270 form to complete it accurately and fully.

What information must be reported on sf270 form excel?

The SF270 form is a Request for Advance or Reimbursement, and it is typically used by federal agencies to request funding or reimbursement for expenses related to a specific project or grant. When creating an SF270 form in Excel, the following information should be reported:

1. Agency or organization name: This is the name of the federal agency or organization submitting the form.

2. Project or grant information: Provide details about the specific project or grant for which funding or reimbursement is being requested, including the project or grant number.

3. Date: Enter the date of the request or reimbursement claim.

4. Vendor or Payee information: Identify the vendor or payee receiving the funds. Include the name, address, and contact information.

5. Invoice or voucher number: If applicable, include the invoice or voucher number issued by the vendor or payee.

6. Expenses: Report the expenses incurred by the agency or organization. Include the date of each expense, a description of the expense, the amount, and any applicable taxes or fees.

7. Total amount: Calculate the total amount of expenses being claimed or requested for reimbursement.

8. Certification: Include a certification statement confirming that the information provided is true and accurate.

9. Authorized signature: Obtain the authorized signature of the individual submitting the form on behalf of the agency or organization.

Note: The specific information required on the SF270 form may vary depending on the federal agency's guidelines and requirements. It is important to refer to the agency's instructions or guidelines for accurate and complete reporting.

How can I send sf270 to be eSigned by others?

To distribute your request advance reimbursement sf form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I sign the sf270 form electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your sf270 form excel.

How do I fill out request for advance or reimbursement 270 on an Android device?

Complete your form sf 270102 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your sf270 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

sf270 Form is not the form you're looking for?Search for another form here.

Keywords relevant to sf 270 fillable form

Related to sf 270102 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.