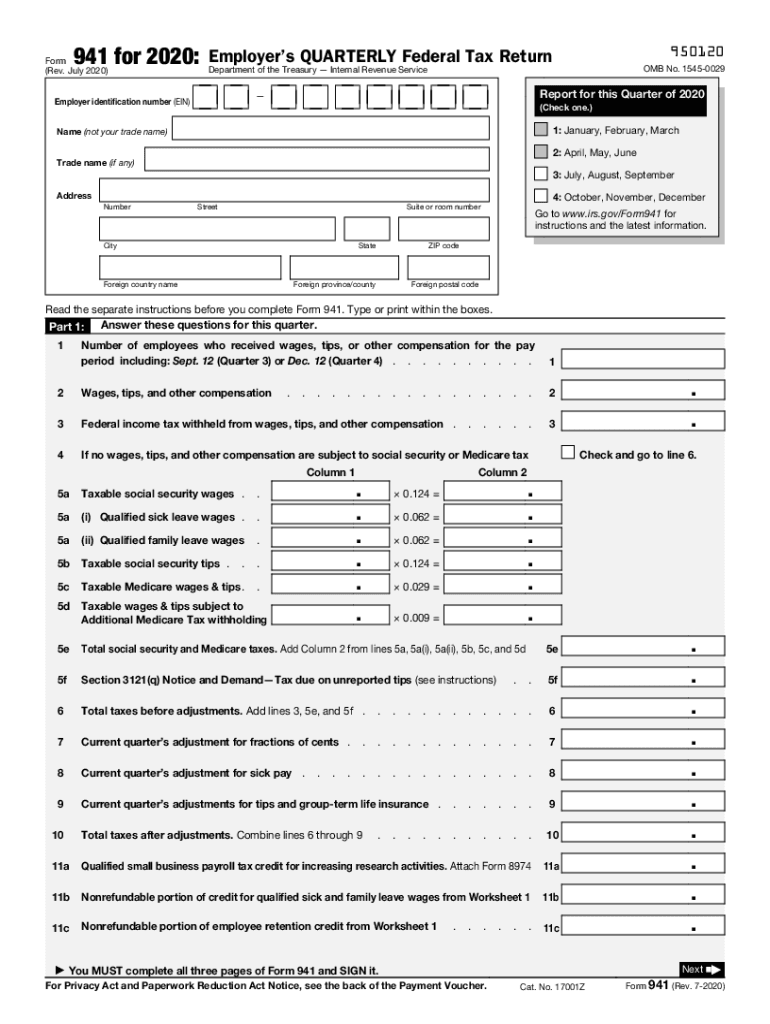

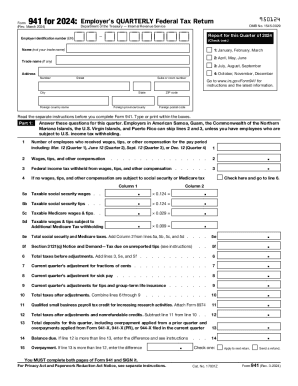

Who needs a 941 form 2016?

This form is used by the employers to report income taxes, social security tax, and Medicare tax withheld from employees wages. The second part of the form is the Payment Voucher — it has to be completed if the employer makes a payment with the 941 form. This form shouldn’t be used to report income tax withholding on pensions, annuities, or gambling winnings.

What is the purpose of the 941 form 2016?

The Employer’s Quarterly Federal Tax Return is required to file the withheld taxes from the wages which the employer pays to his employee. These taxes include federal income tax, social security tax and Medicare tax.

What other documents must accompany the 941 form 2016?

This form has to be accompanied by 941-V if the employer is making a payment. This is actually in case the total taxes for the current quarter are less than $2,500,000. The check or money order payable to United States Treasury should also be enclosed.

When is the 941 form 2016 due?

The form must be submitted once in a quarter (for every three months of the 2016 year). The estimated time for completing the form is one hour.

What information must be provided in the 941 form 2016?

The form provides the following details:

-

Employer Identification Number

-

Employer’s name

-

Trade name

-

Address

-

Reporting quarter (check the appropriate box)

The employer has to answer all the questions in the form and provide the required details and figures: number of employees, wages, tips, and other compensation, deposit schedule and tax liability. The employer also should make some calculations following the instructions provided.

The form should be signed by the authorized person and dated as well.

Where do I send the 941 form 2016 after its completion?

The completed form is filed with the local IRS office.