Get the free payroll report template form

Show details

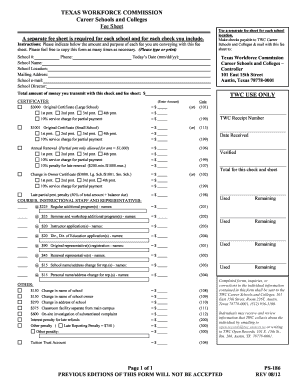

PAYROLL RECORD Employee: Social Security #: Employee # Number of exemptions: Single Married Pay Period / / DEDUCTIONS Social Security Withholding Taxes Federal State Local Insurance NET PAY CHECK

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your payroll report template form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll report template form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payroll report template online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit payroll report generator form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

How to fill out payroll report template form

How to fill out payroll report generator?

01

Start by opening the payroll report generator software on your computer.

02

Enter the necessary employee information such as names, employee IDs, and positions.

03

Input the hours worked by each employee, ensuring accuracy and double-checking any overtime or special circumstances.

04

Include any additional earnings or deductions for each employee, such as bonuses or taxes.

05

Review the entered data for each employee to ensure it is correct and complete.

06

Generate the payroll report by selecting the appropriate options within the software.

07

Save the payroll report to your computer or print a physical copy for your records.

Who needs payroll report generator?

01

Small and medium-sized businesses that have a number of employees and need to efficiently manage their payroll.

02

Human resources or payroll departments within larger organizations that handle payroll processing for numerous employees.

03

Accountants or bookkeepers who offer payroll services to clients.

04

Individuals or businesses who want to automate their payroll processes and reduce the chances of errors.

05

Employers who need to generate accurate payroll reports for tax purposes or compliance with labor laws.

Video instructions and help with filling out and completing payroll report template

Instructions and Help about create payroll report form

Fill payroll sheet pdf : Try Risk Free

People Also Ask about payroll report template

What is a payroll worksheet?

Is there a payroll template in Excel?

How do I create a simple payroll?

How do I make a payroll document?

How do you document payroll?

How do I create a payroll statement spreadsheet?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out payroll report generator?

1. Gather the necessary documents: Before you can begin generating your payroll report, you will need to collect the following documents: employee timecards, payroll register, employee tax forms, payroll holiday records, and any other pertinent payroll documents.

2. Input employee information: Enter the necessary employee information into the payroll report generator, such as name, address, Social Security number, date of hire, job title, hourly rate, and any bonus or commission payments they may have received.

3. Calculate wages: Enter the number of hours worked by each employee to calculate their total wages for the pay period. This can be done manually or automatically, depending on your payroll report generator.

4. Calculate taxes: You will need to calculate the applicable federal, state, and local taxes for each employee based on their wages and any deductions they may have.

5. Generate the report: Once you have entered all the necessary information, you can generate the payroll report. This will include a breakdown of each employee’s wages, taxes, deductions, and total net pay.

6. Print and distribute: Print out the report and distribute it to each employee. They will need to review it for accuracy and sign off on it.

What information must be reported on payroll report generator?

1. Employee name, address, and contact information.

2. Employee’s total number of hours worked and rate of pay.

3. Gross earnings and deductions.

4. NET pay and any applicable taxes.

5. Any employer-paid benefits such as health insurance or 401(k) contributions.

6. Year-to-date totals for earnings, deductions, and taxes.

7. Any applicable local, state, and federal taxes.

8. Relevant payroll deductions such as garnishments or child support payments.

9. Any relevant company contributions such as workers' compensation or disability insurance.

10. Year-end tax filing information such as W-2s and 1099s.

What is payroll report generator?

A payroll report generator is a software tool or application used by businesses to generate various types of payroll reports. These reports provide detailed information about employee compensation, deductions, taxes, and other payroll-related data. The generator automates the process of creating accurate and compliant payroll reports, saving time and reducing manual errors. It typically offers a range of report templates and allows users to customise and filter the data based on their specific needs. The generated reports can be used for internal record-keeping, accountant reconciliation, tax compliance, and other payroll-related purposes.

Who is required to file payroll report generator?

Employers who have employees on their payroll are generally required to file payroll reports.

What is the purpose of payroll report generator?

The purpose of a payroll report generator is to create comprehensive and detailed reports related to an organization's payroll processes. It automates the task of compiling and generating payroll reports, which traditionally required manual data collection and calculation. The reports generated by this tool provide valuable information about employee compensation, taxes, deductions, benefits, overtime, leave balances, and other payroll-related aspects. These reports help businesses effectively manage their payroll operations, ensure accurate and timely payment to employees, comply with tax regulations, track expenses, and make informed decisions related to workforce management and budgeting.

What is the penalty for the late filing of payroll report generator?

The penalty for the late filing of a payroll report generator can vary depending on the specific jurisdiction and regulations in place. In some cases, there may not be a specific penalty for the late filing of a payroll report generator, but there could be penalties for late or incorrect payroll tax filings. These penalties can include fines, interest charges, or even criminal charges in severe cases of intentional non-compliance. It is important to consult the relevant tax authorities or professional advisors to determine the specific penalties for late filing in your jurisdiction.

How can I modify payroll report template without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your payroll report generator form into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find payroll template pdf?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the payroll summary report template. Open it immediately and start altering it with sophisticated capabilities.

How do I make changes in payroll ledger template?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your payroll template form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Fill out your payroll report template form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Template Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to quarterly payroll report template form

Related to payroll sheets

If you believe that this page should be taken down, please follow our DMCA take down process

here

.