USPS PS 1199-A 1994-2024 free printable template

Show details

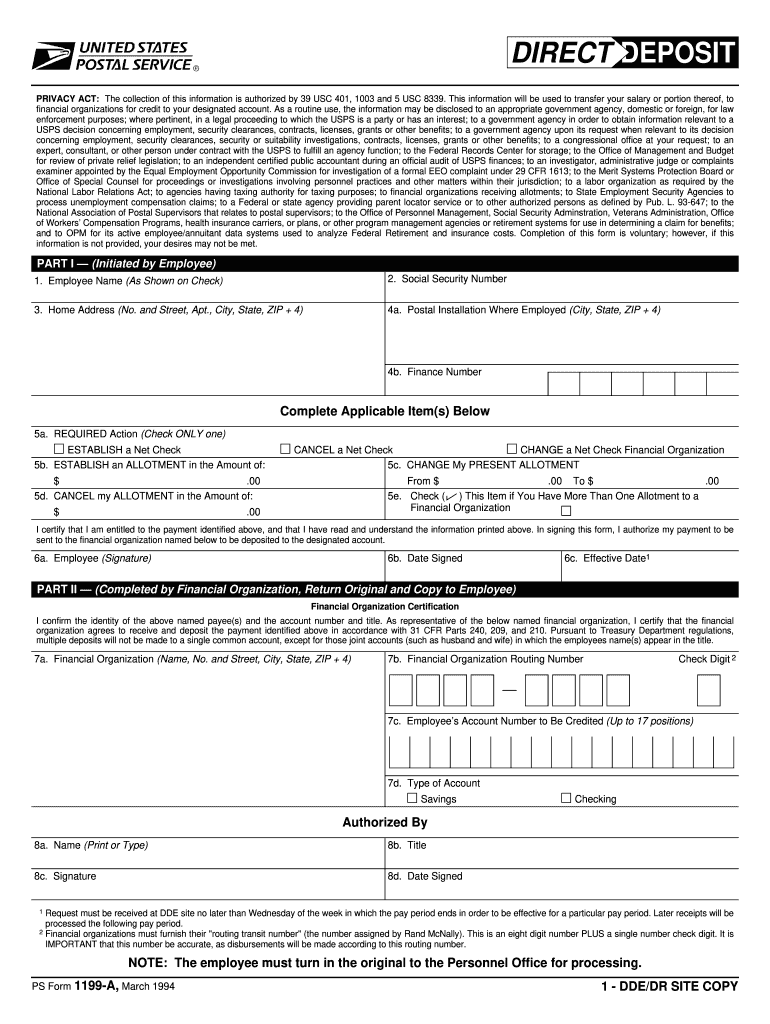

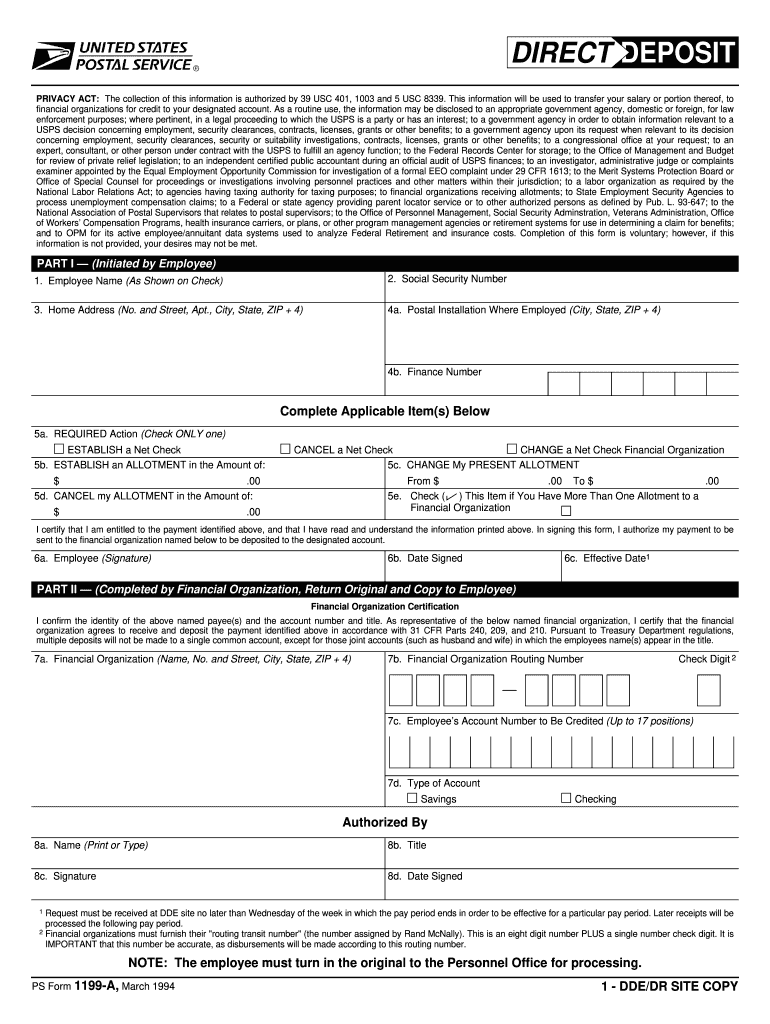

NOTE The employee must turn in the original to the Personnel Office for processing. PS Form 1199-A March 1994 1 - DDE/DR SITE COPY 2 - FINANCIAL ORGANIZATION COPY 3 - EMPLOYEE COPY. DIRECT DEPOSIT PRIVACY ACT The collection of this information is authorized by 39 USC 401 1003 and 5 USC 8339. This information will be used to transfer your salary or portion thereof to financial organizations for credit to your designated account. As a routine use the information may be disclosed to an...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

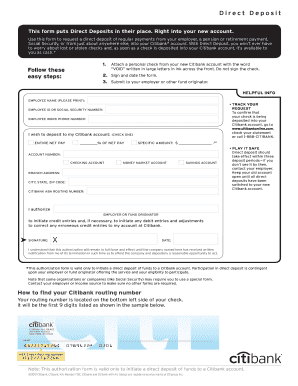

Edit your 1199 deposit form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1199 deposit form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1199 deposit online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 1199 deposit. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

How to fill out 1199 deposit form

How to fill out 1199 deposit forms form?

01

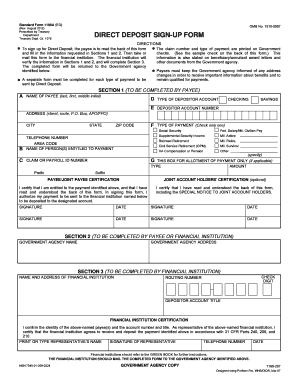

Start by entering your personal information such as your name, address, Social Security number, and date of birth.

02

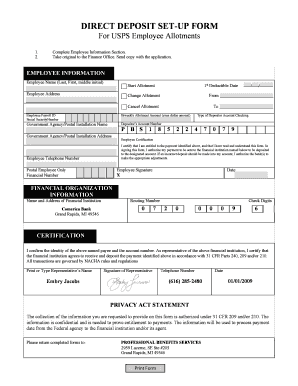

Provide the name and address of your financial institution where you want the deposits to be made.

03

Specify the type of account you have with the financial institution, whether it is a checking, savings, or other type of account.

04

Indicate the routing number and account number for the designated account.

05

If applicable, provide any additional information required by your employer or the agency making the deposits, such as your employee identification number (EIN) or agency code.

06

Review the form to ensure all the information provided is accurate and complete.

07

Sign and date the form to certify that the information provided is true and authorize the direct deposits to be made to the designated account.

Who needs 1199 deposit forms form?

01

Employees who wish to receive their salary, wages, or other income through direct deposit rather than receiving a physical check.

02

Individuals who receive government benefits, such as Social Security or unemployment benefits, and prefer to have the funds directly deposited into their bank account.

03

Recipients of pension or retirement benefits who want the convenience of having their funds deposited directly into their chosen financial institution.

Video instructions and help with filling out and completing 1199 deposit

Instructions and Help about irs taxpayer form

You you you hello this is Steve from chaotic thinking calm here today to explain how to fill out a postal form 2976

Fill 1199 deposit forms fillable : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1199 deposit forms form?

The 1199 Deposit Forms form is a document used by employees to authorize the direct deposit of their wages or salary into their bank account. It is typically associated with the 1199SEIU United Healthcare Workers East union and is used for payroll purposes. By completing this form, employees provide their employer with the necessary information to initiate electronic transfers of their pay.

Who is required to file 1199 deposit forms form?

The 1199 Deposit Forms are typically filed by individuals or organizations who are required to make regular payments to the Internal Revenue Service (IRS) or other government agencies. This may include employers for various types of taxes such as income tax withholding, Social Security and Medicare taxes, or federal unemployment tax.

How to fill out 1199 deposit forms form?

To fill out the 1199 deposit forms, follow these steps:

1. Download or obtain a copy of the 1199 deposit form from your bank or employer's Human Resource department.

2. Provide your personal information at the top of the form, including your full name, address, Social Security number, and employee identification number, if applicable.

3. Indicate the type of account you have by checking the appropriate box (e.g., checking, savings) and provide your account number.

4. If you have multiple accounts and want to split your deposit between them, indicate the percentage or amount you want to allocate to each account.

5. If you do not have an account with the bank listed on the form, you may need to provide additional information such as the bank's name, address, and routing number.

6. Next, indicate whether you want to start or change your direct deposit by checking the appropriate box.

7. Provide the effective date you want the direct deposit to begin or take effect.

8. If necessary, provide any additional instructions or notes in the space provided.

9. Review the completed form for accuracy and ensure all required fields are filled. If applicable, sign and date the form.

10. Submit the completed form to your employer or the designated department at your bank for processing. Make sure to keep a copy for your records.

Note: It's recommended to double-check the specific instructions provided by your bank or employer to ensure accuracy and compliance with their direct deposit policies.

What is the purpose of 1199 deposit forms form?

The purpose of the 1199 deposit forms is to authorize the direct deposit of funds into a bank account. This form is commonly used by employers or organizations to facilitate electronic funds transfers for employee paychecks, retirement benefits, or certain government payments. It allows the recipient to provide their banking information, such as account number and routing number, and authorizes the organization to deposit funds directly into their designated bank account.

What information must be reported on 1199 deposit forms form?

The information that must be reported on a 1199 deposit form includes:

1. Name of the account holder: The full legal name of the individual or organization that owns the account.

2. Account number: The unique identification number assigned to the account by the financial institution.

3. Depository institution information: The name, address, and routing number of the financial institution where the account is held.

4. Amount of deposit: The total amount being deposited into the account.

5. Date of deposit: The date when the deposit is made.

6. Check number (if applicable): If the deposit includes a check, the check number needs to be recorded.

7. Account type: Indication of the type of account, such as checking, savings, or money market.

8. Purpose of deposit: The reason for the deposit, which could be a paycheck, tax refund, or other sources of income.

9. Signature: The signature of the individual making the deposit, certifying the accuracy of the information provided.

It is important to note that the exact requirements and format may vary depending on the specific financial institution and the purpose of the deposit.

What is the penalty for the late filing of 1199 deposit forms form?

The penalty for the late filing of 1199 deposit forms can vary depending on the specific circumstances and regulations of the relevant jurisdiction or organization. In some cases, there may be a fixed late filing fee or penalty amount; in others, the penalty could be calculated based on the duration of the delay or the amount of the deposit. It is best to refer to the specific guidelines or contact the relevant authority to determine the exact penalty for late filing of 1199 deposit forms in a particular situation.

How do I execute 1199 deposit online?

pdfFiller has made filling out and eSigning form 1199 deposit easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an eSignature for the 1199 deposit forms in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your 1199 deposit forms form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit how to 1199 deposit on an iOS device?

You certainly can. You can quickly edit, distribute, and sign 1199 deposit forms get on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your 1199 deposit form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1199 Deposit Forms is not the form you're looking for?Search for another form here.

Keywords relevant to 1199 deposit forms online

Related to dd form 1199

If you believe that this page should be taken down, please follow our DMCA take down process

here

.