MI CF-1040PV - City of Grand Rapids 2011-2024 free printable template

Show details

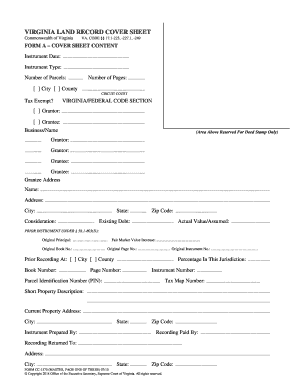

CF-1040PV CITY OF GRAND RAPIDS INCOME TAX RETURN PAYMENT VOUCHER Date to file by 4/30/2012 for tax year 2011. Include your SSN daytime phone number and 2011 Form CF-1040PV on your check or money order. DO NOT SEND CASH. Payment Payment Method Make payment by check or money order payable to Treasurer City of Grand Rapids. To pay by credit card or direct debit see income tax website of the City of Grand Rapids. Not all cities accept credit card or direct debit payments. Address for Payment CITY...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your cf 1040pv form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cf 1040pv form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cf 1040pv online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit michigan income tax return form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

How to fill out cf 1040pv form

How to fill out Michigan income tax return:

01

Gather all necessary tax documents, such as W-2 forms, 1099 forms, and any other income statements.

02

Determine your filing status, which can be single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

03

Calculate your taxable income by subtracting any deductions and exemptions from your total income.

04

Use the Michigan income tax forms or file electronically through the Michigan e-file system.

05

Fill out the required information on the tax return form, including personal details, income information, and deductions or exemptions.

06

Double-check all calculations and ensure the accuracy of the information provided.

07

Sign and date the tax return form.

08

Make a copy of the completed tax return for your records.

09

If you owe taxes, submit payment along with the tax return. If you are due a refund, you can choose to have it directly deposited into your bank account or receive a paper check.

10

File the tax return by the deadline, which is usually April 15th.

Who needs Michigan income tax return:

01

Residents of Michigan who meet the state's income requirements are required to file a Michigan income tax return.

02

Non-residents who earned income in Michigan may also need to file a Michigan income tax return.

03

Individuals who received Michigan source income, such as wages, self-employment income, rental income, or gambling winnings, should file a Michigan income tax return.

Fill mi grand rapids return : Try Risk Free

People Also Ask about cf 1040pv

What forms do I need to file Michigan taxes?

Can you download tax forms?

Where do I get Michigan income tax forms?

What is the Michigan state tax form called?

Does Michigan have a state income tax form?

Do I have to file a MI state tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is michigan income tax return?

Michigan income tax return is a form used to declare and pay taxes on income earned in the state of Michigan. It is administered by the Michigan Department of Treasury.

Who is required to file michigan income tax return?

Individuals who are required to file a Michigan income tax return include those who had Michigan taxable income of more than $6,000, regardless of filing status or age. This includes residents, part-year residents, and nonresidents of Michigan who had Michigan-source income.

How to fill out michigan income tax return?

To fill out your Michigan income tax return, you will need to obtain forms from the Michigan Department of Treasury website. Once you have the forms, you will need to have all of your income information and tax documents ready. You will need to fill out the form and submit it along with any required documents to the Michigan Department of Treasury. For more detailed instructions, visit their website or contact a tax professional.

What information must be reported on michigan income tax return?

Michigan state income tax returns require you to provide information about your income, deductions, and credits. This includes wages, taxable interest, dividends, capital gains, retirement income, alimony, unemployment compensation, and any other income you may have earned. You must also report any itemized deductions and any tax credits you are claiming.

When is the deadline to file michigan income tax return in 2023?

The deadline for filing Michigan income tax returns in 2023 is April 15, 2023.

What is the purpose of michigan income tax return?

The purpose of a Michigan income tax return is to report and calculate the amount of income tax owed to the state of Michigan for a particular tax year. It allows individuals and businesses in Michigan to reconcile their income and deductions with the state tax laws, determine their tax liability, and either request a refund if they have overpaid or submit payment if they owe additional taxes.

What is the penalty for the late filing of michigan income tax return?

The penalty for the late filing of a Michigan income tax return is calculated based on the amount of tax owed and the number of days the return is late.

If the tax return is filed less than 30 days late, the penalty is 1% of the tax due per month, up to a maximum of 25% of the tax due.

If the tax return is filed between 30 and 60 days late, the penalty is 5% of the tax due or $100, whichever is greater, plus an additional 1% per month, up to a maximum of 25% of the tax due.

If the tax return is filed more than 60 days late, the penalty is 25% of the tax due or $100, whichever is greater.

It's important to note that if the taxpayer can show reasonable cause for filing late, the penalty may be waived or reduced.

How can I send cf 1040pv to be eSigned by others?

Once you are ready to share your michigan income tax return form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit michigan tax payment voucher online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your income tax return payment voucher to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit city grand rapids tax in Chrome?

michigan income tax payment form can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Fill out your cf 1040pv form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Michigan Tax Payment Voucher is not the form you're looking for?Search for another form here.

Keywords relevant to mi income tax return form

Related to michigan tax return payment

If you believe that this page should be taken down, please follow our DMCA take down process

here

.