Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

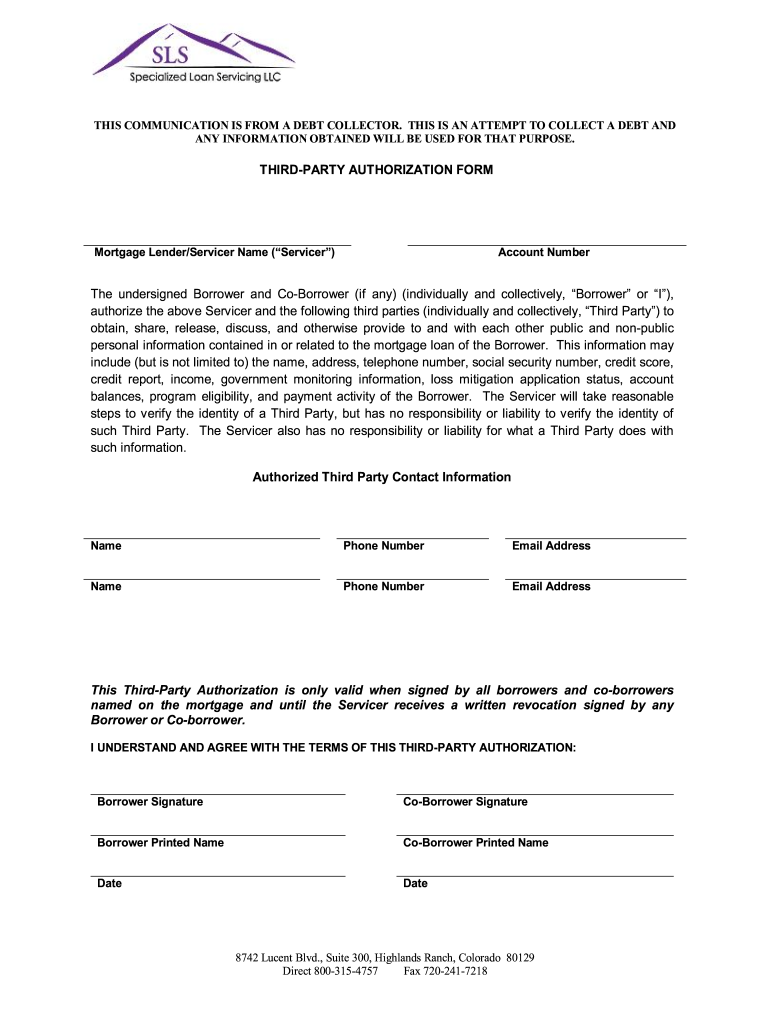

What is specialized loan servicing form?

The Specialized Loan Servicing (SLS) form is a document used by borrowers who have their loans serviced by Specialized Loan Servicing, a third-party loan servicer. The form is used to communicate with SLS, typically to request information, submit loan modification requests, report changes in financial circumstances, or initiate other loan-related requests. It is important for borrowers to use the correct SLS form to ensure their requests are properly documented and processed.

How to fill out specialized loan servicing form?

To fill out a specialized loan servicing form, you typically need to follow these steps:

1. Obtain the form: You can usually get the form from your mortgage servicer or lender. It may also be available on their website. If you can't find the form online, contact their customer service for assistance.

2. Read the instructions: Before you begin filling out the form, carefully read the instructions provided. These instructions will guide you through the various sections and requirements.

3. Provide personal information: Start by entering your personal information, including your name, address, contact details, and loan account number. This information helps identify and locate your loan in their system.

4. Indicate the reason for the form: The form will usually have a section where you need to specify the reason for completing it. This could be related to a modification, payment plan, forbearance, refinancing request, or any other specific loan servicing action.

5. Provide financial details: In this section, you may need to disclose your income, expenses, assets, and liabilities. This information helps the lender evaluate your financial situation and determine the best course of action for your loan.

6. Attach supporting documents: Depending on the purpose of the form, you may be required to attach supporting documents. These can include pay stubs, tax returns, bank statements, hardship letters, or any other documentation requested by the lender.

7. Sign and date the form: Once you have completed all the necessary sections and attached any required documents, review the form to ensure everything is accurate and complete. Sign and date the form as required.

8. Submit the form: Determine how the form needs to be submitted. Some lenders may accept electronic submissions through their website or via email, while others may require physical copies to be mailed or faxed. Follow the specific instructions provided by your lender.

9. Keep a copy for your records: Before submitting the form, make a copy for your records. This allows you to have a reference in case any issues arise or for future communication regarding the servicing of your loan.

Remember, every form may have its own unique requirements, so carefully follow the instructions provided with that specific form. If you have any doubts or questions about filling out the form, reach out to your lender's customer service for assistance.

What is the purpose of specialized loan servicing form?

The purpose of a specialized loan servicing form is to gather specific information and consent from borrowers in order to efficiently and effectively handle the servicing of their loan. These forms are typically used when a loan servicing company or a specialized department within a financial institution is responsible for managing loans that require specialized or customized handling.

The specialized loan servicing form may include details such as the borrower's contact information, loan account number, loan type, outstanding balance, and specific requests or instructions regarding the management of the loan. The form may also collect important consents from the borrower, such as authorizations for electronic communication, automatic payments, or access to credit information.

By completing the specialized loan servicing form, borrowers provide the necessary information for the loan servicing company to carry out specific tasks related to their loan account, ensuring that their needs and preferences are met and that the loan is managed effectively.

What information must be reported on specialized loan servicing form?

The information that must be reported on a specialized loan servicing form typically includes the following:

1. Borrower's information: This includes the borrower's name, address, social security number, and contact details.

2. Loan details: This includes the loan account number, loan type, loan amount, and the date the loan was originated.

3. Payment history: This includes the borrower's payment history, including the dates and amounts of each payment made, as well as any late fees or penalties incurred.

4. Loan terms: This includes the interest rate, term of the loan, and any special conditions or agreements associated with the loan.

5. Escrow account information: If applicable, the form may require details about any escrow account associated with the loan, including the amounts collected for taxes and insurance.

6. Delinquency status: The form may require information on the borrower's delinquency status, including any missed or late payments and the reasons for the delinquency.

7. Payment allocation: The form may require information on how the borrower's payments are allocated towards principal, interest, and any other fees or charges.

8. Loss mitigation efforts: If the borrower is facing financial hardship and seeking an alternative repayment plan, the form may require information on the loss mitigation efforts undertaken by the loan servicer, such as loan modification or forbearance programs offered.

9. Communications record: The form may require documentation of any communication between the borrower and the loan servicer, including letters, emails, or phone call logs.

10. Foreclosure status: If the loan is in foreclosure or the servicer has initiated foreclosure proceedings, the form may require information on the foreclosure status, including the date of the foreclosure notice and any foreclosure sale dates.

Please note that the specific information required on a specialized loan servicing form may vary depending on the regulations and requirements of the governing authority or the specific lending institution.

What is the penalty for the late filing of specialized loan servicing form?

The penalty for late filing of a specialized loan servicing form can vary depending on the specific circumstances and the governing regulations or agreements. Generally, late filing can result in financial penalties, interest charges, or other consequences. It is best to consult the specific guidelines or terms provided by the loan servicing entity to determine the exact penalties for late filing.

How can I get specialized loan servicing form?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the sls authorization blank form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for the sls authorization form in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your sls third party authorization form in minutes.

How can I fill out blank 3rd party authorization form on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your third party authorization form. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.