Get the free deduction tax form

Show details

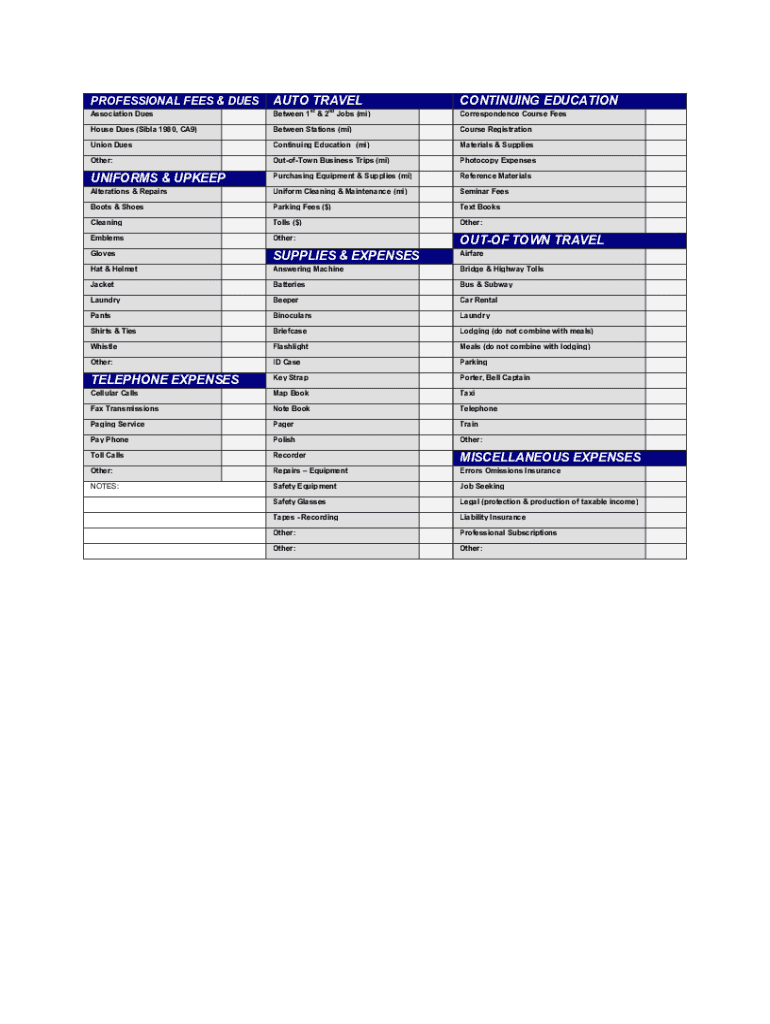

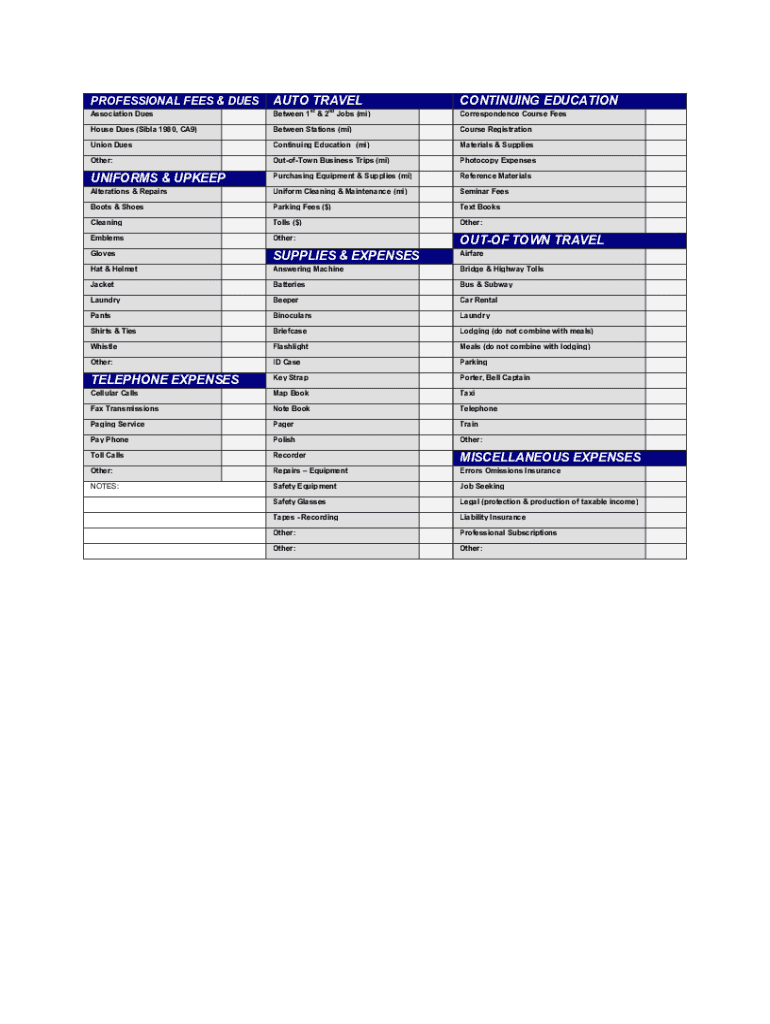

Fighter Fighters Tax Deduction Worksheet: PROFESSIONAL FEES & DUES: Dues paid to professional societies related to your occupation as a firefighter are deductible. However, the costs of initial admission

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your deduction tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deduction tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deduction tax online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit firefighter tax deductions worksheet form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out deduction tax form

How to fill out deduction tax:

01

Gather all necessary documents such as W-2 forms, receipts, and records of deductible expenses.

02

Start by completing the personal information section of the tax form, including your name, address, and social security number.

03

Calculate your total income by adding up all your sources of income, including salary, investments, and any other earnings.

04

Determine which deductions you qualify for, such as student loan interest, medical expenses, or mortgage interest.

05

Deduct the eligible expenses from your total income to determine your adjusted gross income.

06

Apply any applicable tax credits to reduce your overall tax liability.

07

Calculate your final tax due or refund by comparing the amount of tax withheld from your paychecks to the total tax owed.

08

Double-check all the information entered on the tax form for accuracy and completeness.

09

Sign and date the form before submitting it to the appropriate tax authority.

Who needs deduction tax:

01

Individuals who have various deductible expenses such as mortgage interest, student loan interest, or medical expenses may benefit from filling out a deduction tax form.

02

Small business owners and self-employed individuals who want to claim business-related deductions are also required to fill out a deduction tax form.

03

Anyone who wants to minimize their taxable income and potentially reduce their overall tax burden may choose to take advantage of available deductions.

Fill 000 tax : Try Risk Free

People Also Ask about deduction tax

How do I submit my UK tax return from overseas?

Can I download a self assessment tax form?

Where do I send my hmrc P85 form?

Should I take the standard deduction?

What tax form do I use for itemized deductions?

What is HMRC postal address?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of deduction tax?

The purpose of deduction tax is to reduce the amount of taxable income, which in turn reduces the amount of taxes a taxpayer pays. Deductions are used to reduce a taxpayer's taxable income and can include expenses such as medical expenses, charitable donations, and mortgage interest.

What information must be reported on deduction tax?

The information that must be reported on the deduction tax includes the taxpayer’s name, personal identification number, tax liability, deductions taken, total deductions, taxable income, and any tax credits or other payments.

What is deduction tax?

Deduction tax, also known as tax deductions or tax credits, refers to certain expenses or exemptions that can be subtracted from an individual's taxable income, thereby reducing the overall amount of tax they owe. These deductions are often provided by governments as a way to encourage certain behaviors or actions, such as charitable donations, education expenses, or business-related expenses. Deduction tax rules and eligibility criteria can vary between jurisdictions.

Who is required to file deduction tax?

Individuals who claim deductions or itemize their deductions are required to file a deduction tax. Deductions reduce the amount of taxable income, thereby lowering the individual's tax liability.

How to fill out deduction tax?

To fill out a deduction tax, follow these steps:

1. Gather necessary information: Collect all relevant documents and receipts that support your deductions, such as medical expenses, mortgage interest statements, charitable contributions, education expenses, etc.

2. Understand deduction eligibility: Familiarize yourself with the tax laws and regulations to determine which deductions you qualify for. Some common deductions include medical expenses, mortgage interest, state and local taxes, charitable contributions, and education expenses.

3. Choose the appropriate tax form: Select the appropriate tax form to report your deductions. Most taxpayers use Form 1040 or 1040A for itemized deductions, while others may use Schedule A if they meet specific criteria.

4. Fill out the form sections related to deductions: On your chosen tax form, locate the sections where you report your deductions. This typically involves providing the necessary details and amounts for each deduction category. Follow the instructions provided on the form to ensure correct reporting.

5. Provide accurate information: Ensure accuracy by carefully entering the correct information from your supporting documents. Double-check your calculations, and don't forget to sign the form(s) where required.

6. Seek professional help if needed: If you're unsure about any aspect of filling out deduction tax forms, consider seeking professional help from a tax advisor or accountant. They can provide guidance, ensure accuracy, and help optimize your deductions.

7. File your tax return: After completing the deduction tax form, file your tax return according to the preferred method, either electronically or by mail. Make sure to keep copies of all relevant documents and forms for your records.

Remember, tax laws and deductions can change from year to year, so it's always a good idea to stay updated and consult the latest resources or a tax professional for guidance.

What is the penalty for the late filing of deduction tax?

The penalties for late filing of deduction tax vary depending on the country and tax regulations. Usually, the penalty is calculated as a percentage of the tax owed and may increase over time. In some cases, there may also be additional interest charges applied to the unpaid tax amount. It is important to consult the specific tax laws of your country or consult with a tax professional for accurate information on penalties for late filing of deduction tax.

How can I get deduction tax?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific firefighter tax deductions worksheet form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for signing my deducted deductions in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your deduction tax employee and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit tax benefits worksheet on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share benefits worksheet form on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your deduction tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deducted Deductions is not the form you're looking for?Search for another form here.

Keywords relevant to dependents taxpayer form

Related to employee worksheet

If you believe that this page should be taken down, please follow our DMCA take down process

here

.