Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is non federal deposit enrollment?

Non-federal deposit enrollment is a type of banking service that allows customers to deposit money into accounts that are not insured by the Federal Deposit Insurance Corporation (FDIC). These accounts are generally offered by private banks or other financial institutions, and are not backed by the federal government.

What information must be reported on non federal deposit enrollment?

Non-federal deposit enrollment typically requires the following information to be reported: name, address, Social Security Number (SSN), date of birth, phone number, email address, account type, account number, and any other identifying information requested by the financial institution.

When is the deadline to file non federal deposit enrollment in 2023?

The exact deadline for non federal deposit enrollment in 2023 has not yet been determined. However, typically the deadline for non federal deposit enrollment is the close of business on the 15th of the month prior to the effective date of the enrollment. For example, if the effective date of enrollment is April 1, then the deadline would be March 15th.

What is the penalty for the late filing of non federal deposit enrollment?

The penalty for the late filing of non-federal deposit enrollment is a penalty of up to $50 per day, with a maximum penalty of $2,500.

Who is required to file non federal deposit enrollment?

The requirement to file a non federal deposit enrollment may vary depending on the specific regulations and laws governing the particular jurisdiction or organization involved. It is recommended to consult the relevant authorities or legal professionals to determine the specific requirements for filing a non federal deposit enrollment in a given situation.

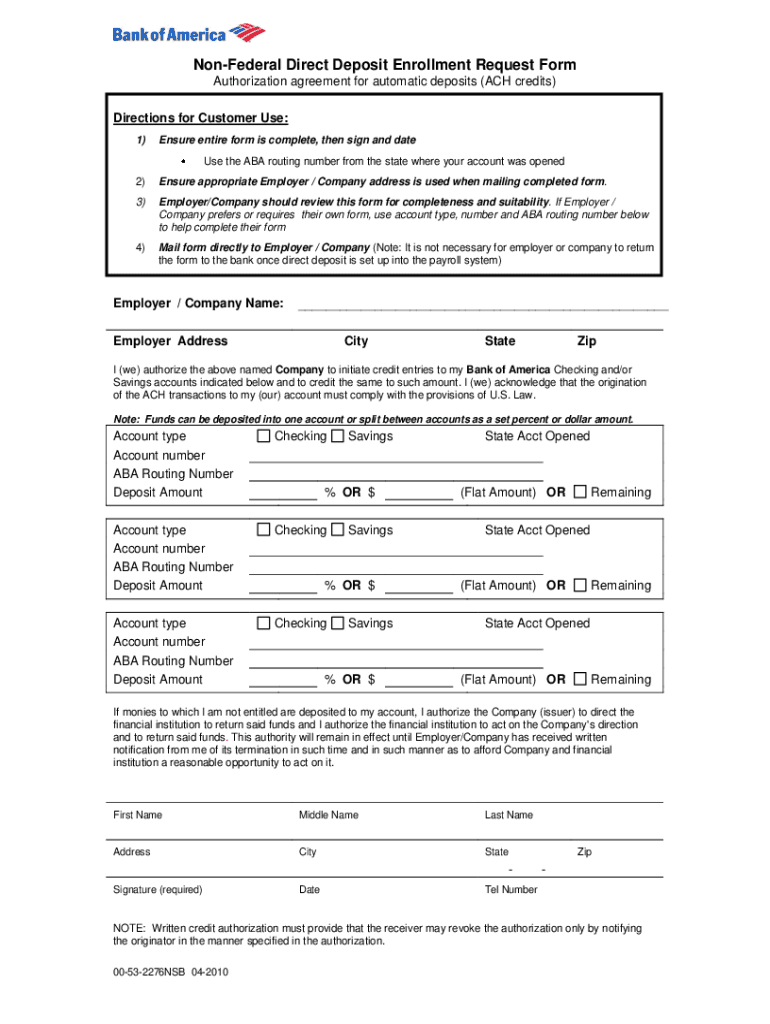

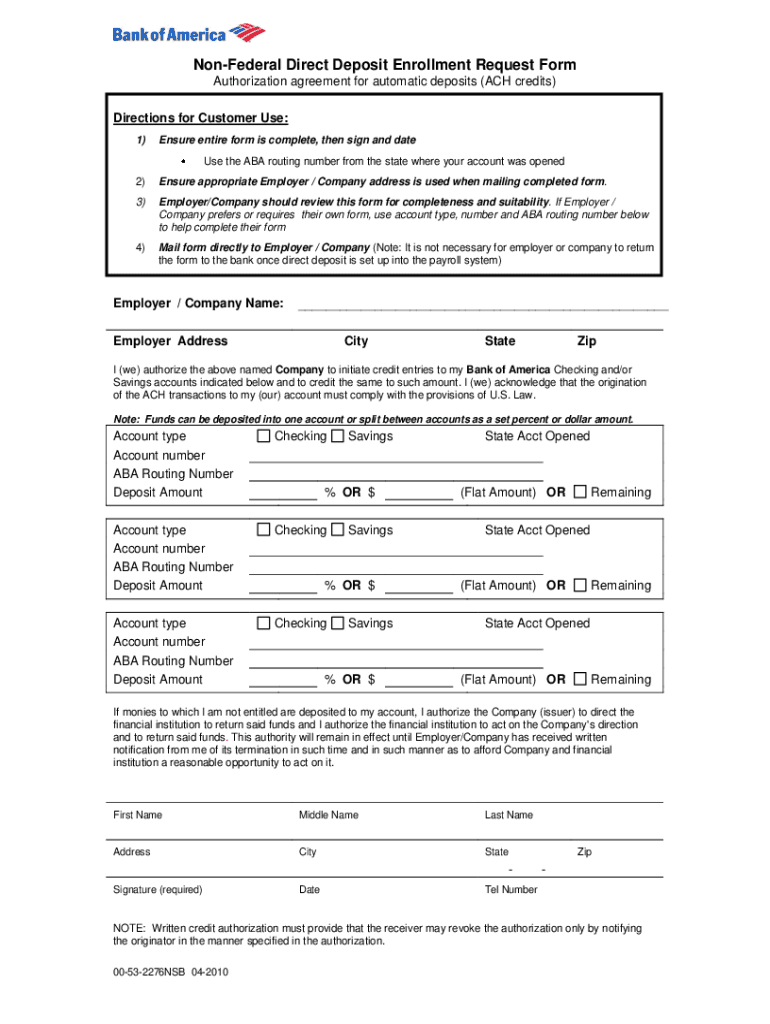

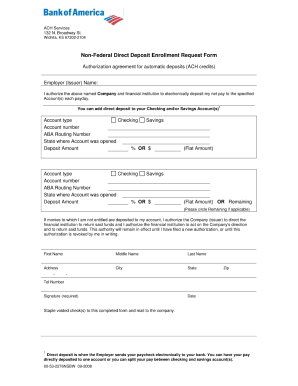

How to fill out non federal deposit enrollment?

To fill out a non-federal deposit enrollment form, follow these steps:

1. Start by gathering all the necessary information: You will typically need your personal information (name, address, contact information), banking details (bank name, account number, routing number), and any additional information required by the form.

2. Read and understand the form: Carefully go through the form and understand the purpose and sections of the form. Note any special instructions or requirements mentioned in the form.

3. Section 1: Personal Information - Fill in your full name, address, phone number, and email address. This section may also require your social security number and/or date of birth.

4. Section 2: Bank Account Information - Provide the details of the bank account where you want the non-federal deposits made. This includes the bank name, account number, and routing number. Double-check the information to ensure accuracy.

5. Section 3: Authorization and Signature - Read the authorization statement carefully. By signing this section, you are giving the organization permission to deposit funds in your designated bank account. Provide your signature, date, and any other required information.

6. Review and submission: Make sure you have completed all sections of the form accurately. Check for any errors or missing information. If required, attach any supporting documents mentioned in the form. Once you are satisfied with the form, sign and date it, and submit it as per the instructions provided in the form.

It is crucial to carefully review the form instructions and requirements before completing it, as each organization may have its own specific requirements for the non-federal deposit enrollment process.

What is the purpose of non federal deposit enrollment?

The purpose of non-federal deposit enrollment is to allow individuals or entities to deposit funds into financial institutions that are not under the jurisdiction of the federal government. This can include state-chartered banks or credit unions, private banks, or other non-federal financial institutions.

Non-federal deposit enrollment provides an alternative option for individuals who may have specific preferences for certain types of banking institutions or who want to diversify their deposit holdings across various institutions. It allows customers to access a wider range of banking services and products beyond those offered by federally insured banks.

However, it's important to note that non-federal deposits are not protected by federal deposit insurance programs such as the Federal Deposit Insurance Corporation (FDIC). Instead, the responsibility for insurance or protection of deposits at these institutions may lie with state programs or private mechanisms, depending on the specific jurisdiction and institution.

How do I execute pnc direct deposit form online?

pdfFiller has made filling out and eSigning bofa direct deposit form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit direct deposit enrollment request form straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing how to request direct deposit form right away.

How do I edit non federal direct deposit enrollment request form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like non federal direct deposit enrollment form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.