Get the free payroll deduction form template

Show details

Dragon savers Credit Union 107 But Street Theory CG42 6AU Tel: 01443 777043 Fax: 01443 777043 Payroll Payment Authorization Form Please complete the following in BLOCK CAPITALS Employers name: Employees

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

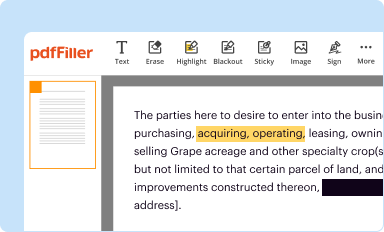

Edit your payroll deduction form template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

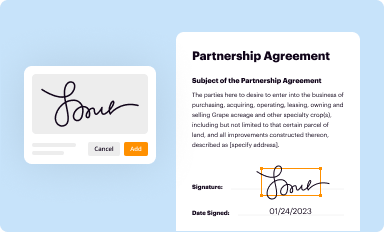

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll deduction form template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

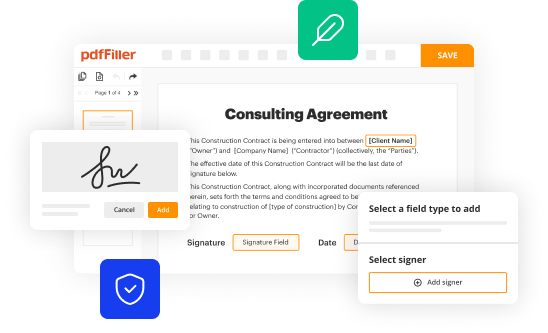

How to edit payroll deduction form template online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit payroll deduction form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out payroll deduction form template

How to fill out payroll deduction form template?

01

Obtain a copy of the payroll deduction form template from the appropriate source, such as your employer or a payroll software provider.

02

Review the instructions provided with the form to understand the specific requirements and guidelines for filling it out.

03

Start by entering your personal information accurately, including your full name, address, social security number, and contact details.

04

Specify the deduction details by indicating the type of deduction, such as health insurance, retirement contributions, or tax withholdings.

05

Provide the necessary information for each deduction, such as the amount or percentage to be deducted and any specific account or plan numbers.

06

If required, include additional details related to the deductions, such as dependent information or percentage allocation for multiple deductions.

07

Carefully review the completed form to ensure all information is accurate and complete.

08

Sign and date the form as required, indicating your consent and agreement to the deducted amounts and terms.

09

Submit the form to the appropriate party, such as your employer's payroll department or the payroll software provider, following the specified submission process.

Who needs payroll deduction form template?

01

Employees who wish to authorize specific deductions from their salary or wages.

02

Employers who require a standardized method of documenting and managing payroll deductions.

03

Payroll administrators or professionals who need a template to streamline the deduction process and ensure accuracy and consistency in payroll records.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is payroll deduction form template?

A payroll deduction form template is a pre-designed document that allows an employer to deduct certain amounts from an employee's paycheck. These deductions may include taxes, insurance premiums, retirement contributions, loan repayments, or other authorized deductions.

The payroll deduction form template typically includes fields where the employee can provide their personal information, such as name, address, and employee identification number. It also includes sections where the employee can specify the type and amount of deductions they want to have taken out of their paycheck.

The template may outline different categories of deductions and provide checkboxes or fields that the employee can complete to indicate their choices. It may also include sections for employee signatures and dates to ensure that the deductions are authorized.

Using a payroll deduction form template helps streamline the payroll process by providing a standardized and organized format for recording and implementing employee deductions. It ensures that the proper deductions are taken for each employee and facilitates easy record-keeping for both the employer and employee.

Who is required to file payroll deduction form template?

Employers are required to file payroll deduction form templates.

How to fill out payroll deduction form template?

1. Start by downloading the payroll deduction form template from a reliable source or ask your employer for a copy.

2. Read through the form carefully, paying attention to the instructions, sections, and fields that need to be completed.

3. Begin by entering your personal information in the designated fields. This usually includes your full name, address, contact information, Social Security number, employee ID, and position/title.

4. In the section related to income, enter your gross salary or wages, hourly rate, or the total amount earned within the given payment period. This information is typically found on your pay stub or employment contract.

5. Next, indicate the deductions you wish to make by checking the appropriate box/es. Common payroll deductions include federal and state income taxes, Social Security, Medicare, retirement contributions, health insurance premiums, and other voluntary deductions like childcare expenses or charitable contributions.

6. If you're requesting any additional deductions that are not mentioned in the form, specify them clearly in the provided space or attach supporting documentation if required.

7. Complete the section related to exemptions or allowances if applicable. These details will determine the amount of tax withheld from your paycheck. The number of exemptions usually corresponds to the number of dependents you claim or special circumstances such as being married or owning a home.

8. Review the completed form to ensure all sections have been filled accurately and thoroughly. Double-check that all necessary supporting documents are attached.

9. If needed, seek assistance from your employer's HR department or payroll team to clarify any doubts or get further guidance.

10. Sign and date the form to acknowledge that the information provided is accurate to the best of your knowledge. Submit the completed form to the appropriate department or person as instructed by your employer. Make sure to keep a copy for your records.

What is the purpose of payroll deduction form template?

The purpose of a payroll deduction form template is to standardize and simplify the process of deducting funds from an employee's paycheck for various purposes. This form allows employers to withhold authorized amounts from an employee's wages for purposes such as taxes, insurance premiums, retirement contributions, loan repayments, and other deductions.

The template provides a structured format for capturing relevant information, including the employee's name and identification details, the specific deduction types and amounts, start and end dates of the deduction, and any additional instructions or information. It ensures accurate and consistent deductions are made, reduces errors and disputes, and streamlines the administrative process for both employers and employees. Additionally, the form serves as a record of agreement between the employer and employee, maintaining transparency and accountability.

What information must be reported on payroll deduction form template?

The information that must be reported on a payroll deduction form template typically includes:

1. Employee information: Name, employee ID or social security number, address, and contact details.

2. Employer information: Company name, address, and contact details.

3. Payroll period: Start and end dates of the pay period.

4. Deduction details: Breakdown of the various deductions that will be made from the employee's paycheck, such as taxes, insurance premiums, retirement contributions, loan repayments, garnishments, etc.

5. Deduction amounts: The specific amounts or percentages that will be deducted from the employee's wages for each deduction category.

6. Total deductions: The sum of all the deductions mentioned above.

7. Net pay: The remaining amount the employee will receive after all the deductions have been made.

8. Authorization: A section where the employee acknowledges and authorizes the deductions to be made from their paycheck.

9. Signature and date: The employee's signature and the date of signing.

Additionally, it is important to ensure that the payroll deduction form complies with applicable labor laws and regulations, accounting for any local, state, or federal requirements. It is recommended to consult with legal or accounting professionals to ensure the form is accurate and compliant.

What is the penalty for the late filing of payroll deduction form template?

The penalties for the late filing of a payroll deduction form template can vary depending on the jurisdiction and the specific regulations in place. In general, the penalties may include:

1. Late filing fees: The agency or governing body responsible for overseeing payroll deductions may impose late filing fees for each day or month that the form is not filed on time.

2. Interest charges: In addition to late filing fees, interest charges may also be levied on any outstanding amounts or taxes owed.

3. Loss of deductions: Failing to file the form on time may result in the loss of certain deductions or benefits that the employer or employee would have otherwise been entitled to.

4. Legal consequences: Continual non-compliance or deliberate evasion of payroll deduction reporting requirements may result in more severe consequences, such as fines, audits, or legal action.

It is important to consult with the relevant local authorities or legal professionals to obtain accurate and up-to-date information on specific penalties that may apply in a particular situation.

How do I complete payroll deduction form template online?

pdfFiller has made it easy to fill out and sign payroll deduction form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in deduction form?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your payroll deduction template to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit payroll deduction form template on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share payroll deduction form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your payroll deduction form template online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deduction Form is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.