MA LCTL-ANS-CS 2013-2024 free printable template

Show details

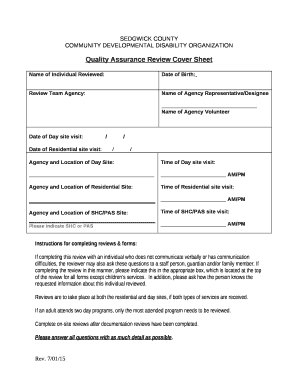

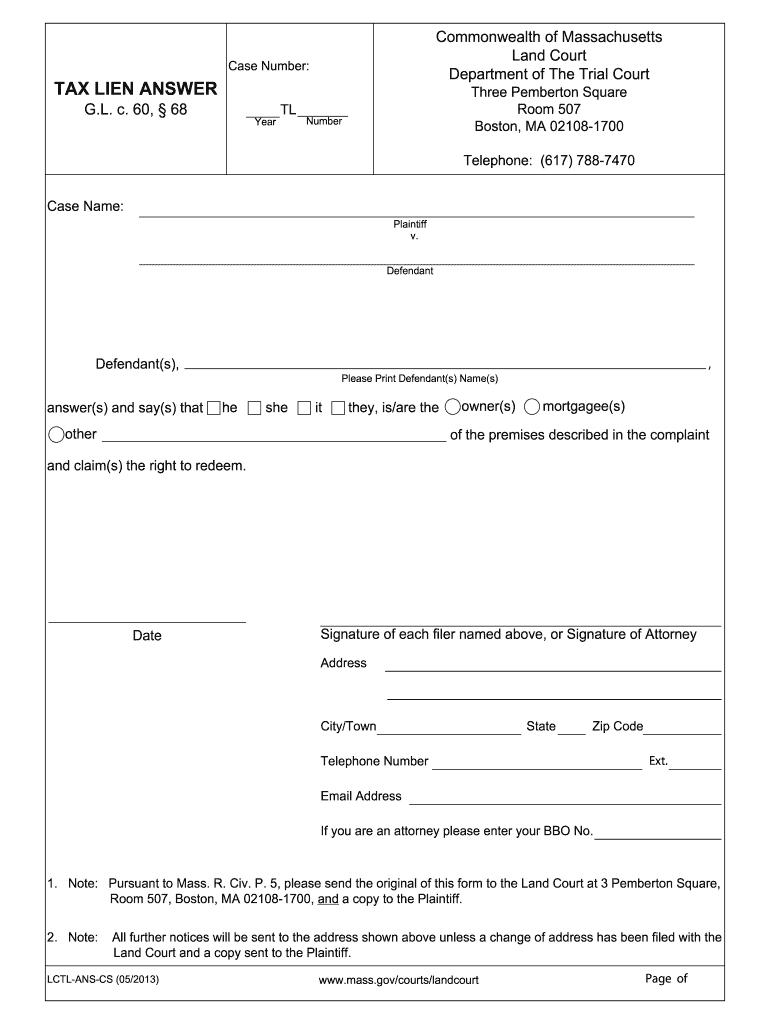

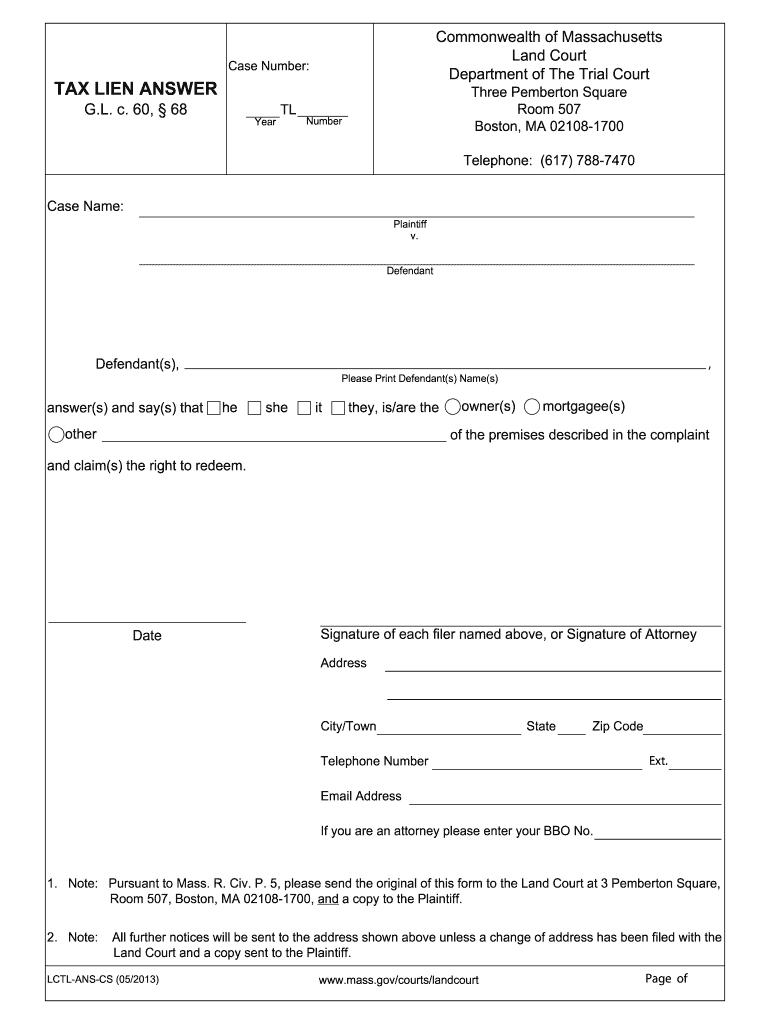

Commonwealth of Massachusetts Land Court Department of The Trial Court Case Number: TAX LIEN ANSWER G.L. c. 60, 68 Year TL Three Pemberton Square Room 507 Boston, MA 02108-1700 Number Telephone: (617)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your massachusetts cs tax lien form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your massachusetts cs tax lien form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit massachusetts cs tax lien online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ma lctl form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

How to fill out massachusetts cs tax lien

How to fill out Massachusetts CS tax lien:

01

Obtain the necessary forms from the Massachusetts Department of Revenue (DOR) website or visit a local DOR office.

02

Gather all the required information, such as your name, address, and Social Security number.

03

Fill out the form accurately, ensuring all information is complete and legible.

04

Include details about the tax liability for which the lien is being filed, including the tax year(s) and the amount owed.

05

If applicable, provide any supporting documentation or evidence to substantiate your claim.

06

Double-check the form for any errors or omissions before submitting it.

07

Sign and date the form as required.

08

Submit the completed form and any required fees to the appropriate DOR office.

09

Keep copies of all documents for your records.

Who needs Massachusetts CS tax lien:

01

Individuals or businesses who owe outstanding tax liabilities to the state of Massachusetts.

02

Those who have been notified by the Massachusetts Department of Revenue (DOR) that a tax lien needs to be filed.

03

Individuals or businesses who want to protect the state's interest in their property against other creditors.

Video instructions and help with filling out and completing massachusetts cs tax lien

Instructions and Help about ma tax lien answer form

Fill ma lctl ans tax : Try Risk Free

People Also Ask about massachusetts cs tax lien

Is Massachusetts a tax lien or tax deed state?

What is a notice of Massachusetts tax lien?

What is a Massachusetts tax lien?

What is a release of Massachusetts tax lien?

Does Massachusetts sell tax lien certificates?

What IRS form do I need to release a tax lien?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is massachusetts cs tax lien?

A Massachusetts CS tax lien refers to a legal claim placed on a property or assets by the Massachusetts Department of Revenue (DOR) for unpaid state taxes. CS stands for "Chapter 62C Section 50" of the Massachusetts General Laws, which grants the DOR the authority to enforce tax collection through liens. This means that if a taxpayer fails to pay their state taxes, the DOR may file a tax lien to secure the debt and potentially force the sale of the property to collect the owed taxes.

Who is required to file massachusetts cs tax lien?

It is the responsibility of the Massachusetts Department of Revenue to file a tax lien against individuals or businesses who have unpaid state taxes.

How to fill out massachusetts cs tax lien?

To fill out the Massachusetts CS Tax Lien form, you can follow these steps:

1. Obtain the form: You can download the Massachusetts CS Tax Lien form from the Massachusetts Department of Revenue (DOR) website. It is called "Form TIR57C."

2. Provide your information: Fill in your personal information in the appropriate fields on the form. This includes your name, address, social security number, and phone number.

3. Provide tax information: Fill in the details of the tax debt that you owe. This includes the type of tax debt (such as income tax, sales tax, or withholding tax), the tax years involved, and the amount owed.

4. Determine priority: In certain cases, there may be multiple liens against your property. If this is the case, you will need to indicate the priority of the Massachusetts CS Tax Lien. The priority is usually determined by the date the lien was filed.

5. Sign the form: Ensure you sign and date the form. If you have a representative assisting you, such as a tax attorney or accountant, they may also need to sign the form.

6. Submit the form: Once you have completed the form, make a copy for your records and submit the original to the Massachusetts Department of Revenue. When submitting the form, check the DOR's website or contact them to find out the specific mailing address or fax number to send the form to.

Remember, the Massachusetts CS Tax Lien form is a legal document, so it's important to fill it out accurately and provide complete information to avoid any potential issues or penalties. If you are unsure about any aspect of the form, you may want to consult with a tax professional or attorney for guidance.

What is the purpose of massachusetts cs tax lien?

The purpose of the Massachusetts CS (Child Support) tax lien is to collect unpaid child support payments from individuals who owe past-due child support. The tax lien allows the state to place a lien on the delinquent parent's property, including real estate, bank accounts, and personal assets, in order to enforce child support obligations. The collected funds are then used to support the child's needs and provide financial stability for custodial parents or guardians.

What information must be reported on massachusetts cs tax lien?

When reporting a tax lien in Massachusetts, several pieces of information must be provided. This includes:

1. Taxpayer's Name: The full name of the individual or business against whom the tax lien is being filed.

2. Taxpayer's Address: The current address of the taxpayer.

3. Social Security Number/ Employer Identification Number: Depending on whether the lien is against an individual or a business, their respective identification numbers must be included.

4. Date of Assessment: The date when the tax liability was assessed by the Department of Revenue.

5. Amount of the Lien: The specific amount owed, including any interest, penalties, and fees associated with the tax liability.

6. Description of the Lien: A detailed description of the tax lien, including the tax year(s) in question and the type of tax owed (e.g., income tax, sales tax, etc.).

7. Filing Information: The name, address, and contact information of the person or entity filing the tax lien.

Additionally, a tax lien certificate, request for release, or similar documentation may also be required depending on the specific circumstances. It is important to consult the Massachusetts Department of Revenue or a tax professional to ensure accurate and complete reporting of tax liens.

What is the penalty for the late filing of massachusetts cs tax lien?

The penalty for the late filing of a Massachusetts Corporate Tax Lien is a fee of $100 for each month or part of the month that the lien remains unfiled, up to a maximum of $1,500.

Can I create an electronic signature for the massachusetts cs tax lien in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your ma lctl form in minutes.

How can I edit massachusetts cs tax on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing ma tax answer fillable.

Can I edit massachusetts tax answer on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign massachusetts lctl form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your massachusetts cs tax lien online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Massachusetts Cs Tax is not the form you're looking for?Search for another form here.

Keywords relevant to massachusetts tax lien answer form

Related to massachusetts lctlans online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.