What is form 944?

IRS form 944 allows small employers to file taxes once a year instead of quarterly. To qualify for this, their annual liability must not exceed $1,000. For all small employers, form 944 is a substitute for form 941 (Employer's Quarterly Employment Tax Return). Please note, household and agriculture employers can not use form 944.

Who should file form 944 2023?

The IRS form 944 is for small businesses with an annual liability of less than $1,000.

What information do you need when you file 944?

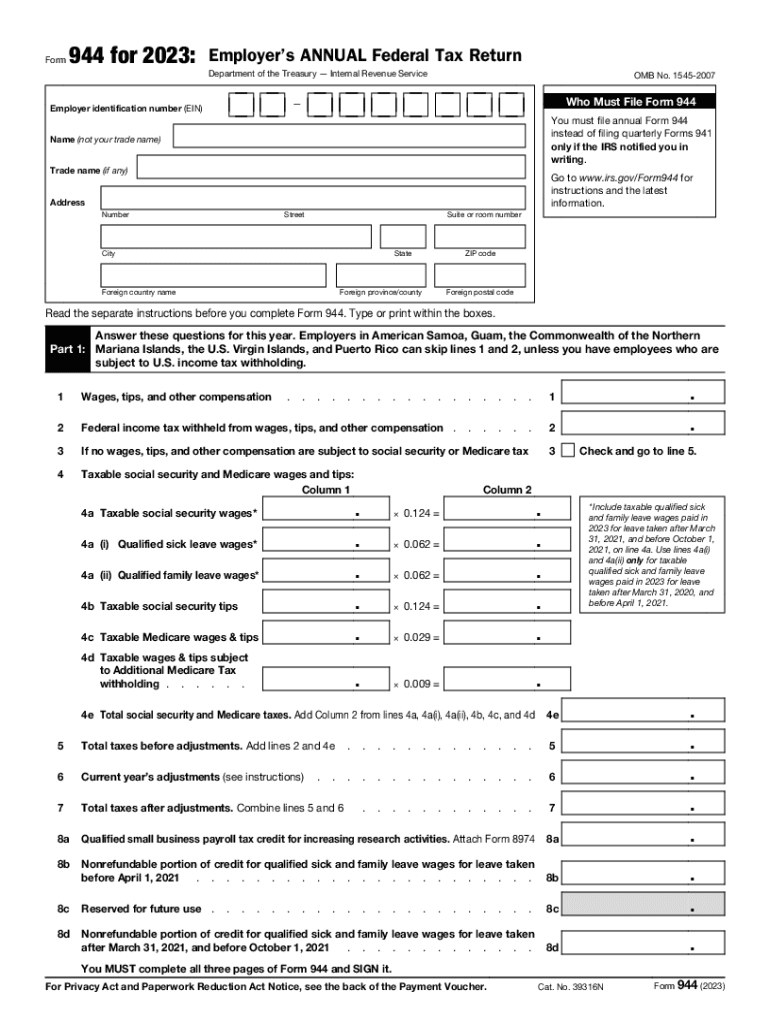

IRS form 944 is easy to complete. You will need to provide your contact information, EIN, business name, and address.

Employer's identification information is accompanied by:

- Part 1: wages, tips, and compensation

- Part 2: deposit schedule

- Part 3: report the business’s current status

- Part 4: third party contact information

- Part 5: your signature

How do I fill out form 944 in 2024?

Save time by filling out the 8332 form online. Use pdfFiller to complete and send the employer's annual federal tax return to the IRS in a few steps:

- Click Get Form above

- Fill out the 944 template

- Sign it in pdfFiller

- Click Done to save changes

- Select the file and click Send via USPS

- Provide the addresses and select delivery terms

- Click Send

pdfFiller will print and pass the form to the post office. It will be delivered within the timeframe you’ve selected.

Is form 944 accompanied by other forms?

You may send IRS form 944 without attachments. The IRS will request any additional documents via mail if any additional documents are required.

When is form 944 due?

For 2023, the completed form 944 is due January 31, 2024. If all deposits were made on time in full payment of taxes for the year, there is a time extension until February 10, 2024.

Where do I send form 944?

You can file 944 form electronically or by mail. If you choose to file by mail, there are two types of addresses where you may send your 944 form depending on whether or not you need to include payment. Check the addresses on the IRS official website.