Get the free access w2 form

Show details

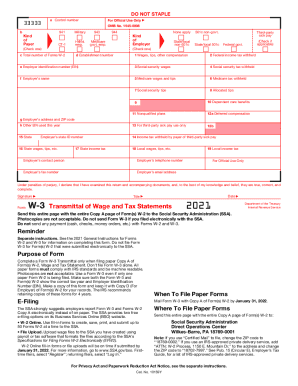

How to access pay stubs and W-2 forms online: 1. From any computer with internet access, go to the MPS website at http://www.mpsaz.org. Click on Departments”, then “Payroll”, then “MPS Employees

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your access w2 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your access w2 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit access w2 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit employees access w2 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

How to fill out access w2 form

How to fill out employees W-2?

01

Obtain the necessary forms: You will need copies of the W-2 form for each employee, which can be obtained from the Internal Revenue Service (IRS) website or your local IRS office.

02

Gather employee information: Collect all relevant employee information, including their full name, social security number, address, and employment status.

03

Calculate wages and benefits: Determine the total wages earned by each employee during the tax year, including any bonuses, tips, or other compensation. Additionally, include the value of any noncash benefits, such as health insurance or retirement contributions.

04

Withholdings and deductions: Subtract any applicable federal, state, and local taxes from the employee's wages. Include any other deductions, such as retirement plan contributions or child support payments, as required.

05

Complete the W-2 form: Transfer the calculated wages, benefits, withholdings, and deductions onto the W-2 form for each employee. Make sure to accurately enter the information in the correct boxes and use the correct codes.

06

Prepare additional forms: Depending on your state and local tax requirements, you may need to fill out additional forms or schedules, such as state W-2 forms or reconciliation documents.

07

Distribute copies: Provide each employee with a copy of their completed W-2 form by the required deadline, which is typically January 31st of the following year.

08

File with the appropriate agencies: Send the W-2 forms to the Social Security Administration (SSA) and the applicable state and local tax authorities. Make sure to file on time to avoid any penalties or fines.

Who needs employees W-2?

01

Employers: Employers are required to provide W-2 forms to their employees and file copies with the appropriate tax agencies, such as the IRS and the SSA.

02

Employees: W-2 forms are essential for employees to accurately report their income and claim any eligible tax credits or deductions on their personal tax returns.

03

Federal, state, and local tax authorities: These tax agencies rely on the information provided on W-2 forms to ensure accurate reporting of employee wages and income tax withholdings. Additionally, they use W-2 forms to verify taxpayer compliance and detect any discrepancies or underreporting.

Video instructions and help with filling out and completing access w2

Instructions and Help about employees w 2 form

Fill access w : Try Risk Free

People Also Ask about access w2

What's the difference in a W-2 and a w4?

How do I get an employee W-2 form?

Is it better to be a 1099 employee or W-2?

What is a W-2 Employee form?

How do I fill out a w4 for an employee?

Do employees have to fill out W-2 and w4?

Do employees need to fill out a W4?

Do employees need to fill out a W-2 form?

Do employees have to fill out W-2 and W4?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is employees w 2?

Employees W-2 is an Internal Revenue Service (IRS) form used to report an employee's annual wages and taxes withheld. W-2 forms are issued to employees by their employers and are typically due to be filed with the IRS by the end of January.

Who is required to file employees w 2?

Employers are required to file W-2 forms for all employees who earned wages during the taxable year.

What information must be reported on employees w 2?

A W-2 form contains the following information about an employee:

1. Name, address, and Social Security number.

2. Amounts of wages, tips, and other compensation.

3. Taxes withheld (federal, state, local, and Social Security taxes).

4. Employer's name, address, and identification number.

5. State wages, tips, and other compensation.

6. State income tax withheld.

7. Local wages, tips, and other compensation.

8. Local income tax withheld.

9. Retirement plan information.

10. Third-party sick pay (if applicable).

When is the deadline to file employees w 2 in 2023?

The deadline for filing employees' W-2 forms for tax year 2023 is January 31, 2024.

How to fill out employees w 2?

To fill out an employee's W-2 form, follow these steps:

1. Obtain the blank W-2 form: You can either download the form from the IRS website or purchase pre-printed forms from an office supply store.

2. Gather necessary information: Collect the necessary information for the employee, such as their full name, Social Security number, address, and employer identification number (EIN).

3. Company information: Enter your company's name, address, and EIN in the appropriate fields on the form.

4. Box 1: Report the employee's total wages, tips, and other compensation in Box 1.

5. Box 2: Enter the total federal income tax withheld from the employee's wages throughout the year in Box 2.

6. Box 3: Report the employee's total wages subject to Social Security taxes, up to the annual maximum, in Box 3.

7. Box 4: Enter the amount of Social Security tax withheld from the employee's wages throughout the year in Box 4.

8. Box 5: Report the employee's total wages subject to Medicare taxes in Box 5.

9. Box 6: Enter the amount of Medicare tax withheld from the employee's wages throughout the year in Box 6.

10. Boxes 7-9: These boxes are for reporting any tips, allocated tips, and advance EIC (Earned Income Credit). Use the instructions provided by the IRS to determine if applicable and fill in these boxes accordingly.

11. Box 10: Report any dependent care benefits provided to the employee during the year if applicable.

12. Boxes 12(a)-(d): Use these boxes to report any additional information or codes, such as contributions to retirement plans, non-taxable income, or other specific details. Refer to the IRS instructions for the appropriate codes.

13. Boxes 13-20: These boxes are optional and can be used to report various state and local tax information. Check the applicable boxes based on your state's requirements or consult the state tax agency for specific instructions.

14. State and local copies: If required by your state, make copies of the completed W-2 form and submit them to the respective state and local tax agencies, following their procedures and instructions.

15. Retain Copy D: Retain Copy D for your records, which serves as an employer's copy.

Make sure to double-check all information for accuracy before distributing the employee's W-2 form. It's recommended to review the IRS instructions for more detailed guidance or consult a tax professional if you have any specific questions or concerns.

What is the purpose of employees w 2?

The purpose of employees' W-2 forms is to report their annual wages, tips, and other compensation received from their employers. The W-2 form also includes information on the taxes withheld from the employee's paycheck throughout the year, such as federal income tax, Social Security tax, and Medicare tax.

The W-2 form is important for both the employer and the employee for various reasons:

1. Tax Reporting: The W-2 form helps employees accurately report their earnings and taxes withheld to the Internal Revenue Service (IRS) when filing their annual income tax returns.

2. Eligibility for Tax Refunds: The information provided on the W-2 form helps determine if the employee is eligible for any tax refunds or credits.

3. Social Security Benefits: The wages reported on the W-2 form are used to calculate an employee's eligibility and benefits under the Social Security program.

4. State and Local Tax Reporting: In addition to federal taxes, the W-2 form is also used to report earnings and withholding information for state and local income tax purposes.

5. Audit and Verification: The W-2 form serves as an important document for auditing and verification purposes by the IRS or other relevant tax authorities.

Ultimately, the purpose of employees' W-2 forms is to ensure accurate reporting of income and taxes, facilitate compliance with tax laws, and enable both employees and the government to fulfill their tax obligations.

What is the penalty for the late filing of employees w 2?

The penalty for the late filing of employees' W-2 forms can vary depending on the circumstances and the size of the employer. Here are some general guidelines:

1. If you file the W-2 forms within 30 days of the due date (January 31 for most employers), the penalty is $50 per form.

2. If you file the W-2 forms more than 30 days after the due date but before August 1, the penalty increases to $110 per form.

3. If you file the W-2 forms after August 1 or if you do not file the required forms at all, the penalty rises to $270 per form or the amount equal to the amount of tax you should have withheld, whichever is smaller.

It's important to note that if the late filing is due to intentional disregard of the filing requirements, the penalty may increase significantly. Additionally, state and local penalties may also apply. It is advisable to consult with a tax professional or the Internal Revenue Service (IRS) for specific penalties related to your situation.

How do I modify my access w2 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your employees access w2 form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I complete access w 2 online?

With pdfFiller, you may easily complete and sign employees access w 2 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit access paystubs on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign employees form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your access w2 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Access W 2 is not the form you're looking for?Search for another form here.

Keywords relevant to access form

Related to employees w

If you believe that this page should be taken down, please follow our DMCA take down process

here

.