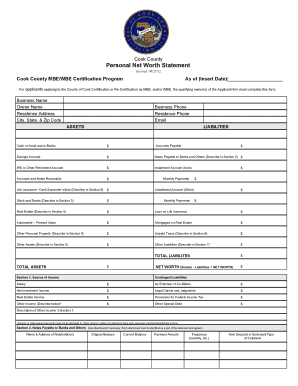

Get the free personal net worth statement template form

Get, Create, Make and Sign

Editing personal net worth statement template online

How to fill out personal net worth statement

How to fill out personal worth statement:

Who needs a personal worth statement:

Video instructions and help with filling out and completing personal net worth statement template

Instructions and Help about personal net worth statement blank form

Hi this is Steve for money plan SOS common today I want to show you how to create a net worth statement it's not something just millionaires need to do its something everybody should do especially when you're about to start a debt elimination plan this is a way to keep track of your progress, and it's probably a good thing to do every few months at least once a year once you've gotten yourself out of debt, but it's very simple to do it here's what you do get a piece of paper and just draw a big old cross on it and over on this side write the word own o W N and on the other side write down the word o w/e there you go you're set up now what of course do you need to put on this side things that you own let's just say simply say things like savings let's say you have you're a beginner emergency fund of $1,000, or maybe you've got a 401 K and let's say there's twelve thousand dollars in their okay, and then you've got maybe you bought a car and the car is worth today twenty thousand dollars and then a house maybe you bought a house the house is worth just say it's a two hundred thousand dollar house okay next thing you want to do is go over to the O side what do you owe on let's say you have credit cards and the credit cards you owe I'm just making these numbers up five thousand dollars okay and then over here you've got maybe student loans stud loan yeah let's make a joke out of that and let's say that on that you owe $10,000 okay and then maybe oh the car maybe you haven't paid it you know you didn't buy the car with cash, so maybe you've got a car loan and that is a balance of eighteen thousand dollars and then if you bought the house, and you have paid full price for it or didn't pay for it with cash which most people aren't able to do the first time out mortgage and let's say that you have a balance on the mortgage of $180,000, so that's what you owe on this side on this side then you want to add up your total now what does this all come down to two hundred and thirty-three thousand dollars on this side is what you own and then how much do you owe on all that stuff all the stuff over here we've got two hundred thirteen thousand dollars so what is your net worthwhile your net worth turns out to be 233 minus 2 13 which is $20,000 so if you were to sell everything today you would walk away with $20,000 at these current values and in liabilities on the debt site that's how you create a net worth statement now here's a bonus piece let's say you want to learn about equity what is equity you see this house it's $200,000, and we have a mortgage on it $180,000 you have an equity position of $20,000 in this scenario all of your wealth really is built into that house because this stuff all washes away the savings of 401 K in the car you cash it all out to pay off your credit card debt your student loans and your car loan you've got no net worth except for $20,000 in your house not a good thing so why don't we make a better situation of it all let's...

Fill personal net worth statement dbe : Try Risk Free

People Also Ask about personal net worth statement template

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your personal net worth statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.