Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

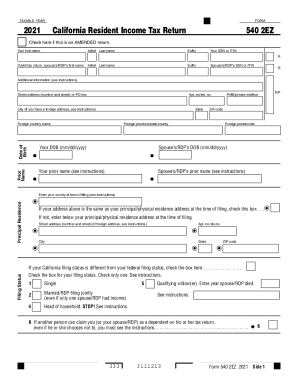

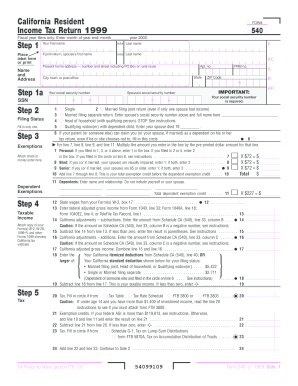

What is 540 2ez instructions?

540 2EZ is an online tax form for the state of California. It is a simplified version of the state's 540 personal income tax form and is designed to make filing taxes easier and faster for individuals who are not required to file the full 540 form. The instructions for 540 2EZ can be found on the California Franchise Tax Board website.

How to fill out 540 2ez instructions?

To fill out the 540 2ez form, follow these instructions:

1. Personal Information: Fill in your name, Social Security number, and spouse's name (if applicable), along with your address and the number of dependents you have.

2. Filing Status: Select your filing status from the options provided (Single, Married filing jointly, Head of Household, etc.)

3. Income: Report your income from various sources such as wages, self-employment income, interest, dividends, and rental income. Fill out the corresponding boxes on the form and follow the instructions for specific types of income.

4. Adjustments: If you have any adjustments to your income, such as student loan interest deduction or IRA contributions, enter the appropriate amounts in the specified sections.

5. Standard Deduction: If you are not itemizing deductions, claim the standard deduction based on your filing status and number of dependents.

6. Tax and Credits: Use the provided tax table or tax rate schedule to calculate your tax liability based on your taxable income. Enter the result in the designated box.

7. Credits: Report any applicable credits, such as the dependent credit, child and dependent care expenses, or credit for the elderly or disabled.

8. Withholding and Payments: Enter the total amount of taxes withheld from your paychecks and any estimated tax payments made throughout the year.

9. Refund or Amount Owed: Subtract your total payments from your tax liability to determine if you are owed a refund or if you still owe additional taxes.

10. Sign and Date: Sign and date the completed form.

These instructions should help you fill out the 540 2ez form accurately. However, it is advisable to consult a tax professional or refer to the official instructions provided by the state tax authority for further guidance.

What is the purpose of 540 2ez instructions?

The purpose of the 540 2ez instructions is to provide individuals with guidelines and explanations on how to fill out and file their California Resident Income Tax Return (form 540 2ez). These instructions help taxpayers understand the various sections, eligibility criteria, deductions, credits, and other relevant information required for accurately completing their state tax return. The instructions aim to simplify the process for individuals who have relatively simple tax situations and meet the criteria for using form 540 2ez.

When is the deadline to file 540 2ez instructions in 2023?

The deadline to file 540 2ez instructions in 2023 is typically on or around April 15th. However, it is always a good idea to check the official website of the California Franchise Tax Board or consult a tax professional for the most up-to-date and accurate information regarding tax filing deadlines.

What is the penalty for the late filing of 540 2ez instructions?

If you file your California Form 540 2EZ tax return late, you may be subject to penalties and interest charges. The exact penalties and interest rates can vary, and it's recommended to consult the California Franchise Tax Board (FTB) for the most up-to-date information.

Generally, the penalty for filing late is 5% of the tax due for every month (or part of a month) that the return is late, up to a maximum of 25% of the tax due. In addition, interest will accrue on the unpaid balance.

It's important to note that if you are due a refund, there is typically no penalty for filing late. However, you must file your return within three years of the original due date to claim your refund.

Can I sign the form 540 electronically in Chrome?

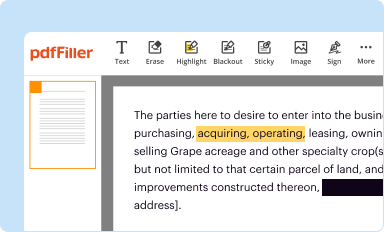

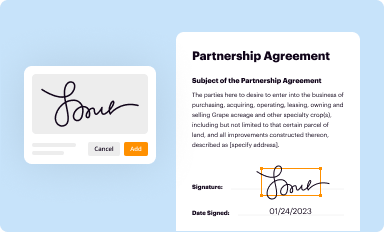

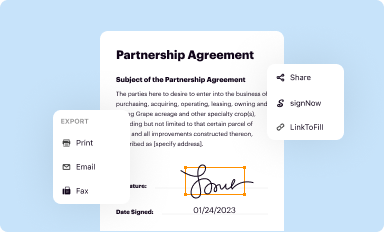

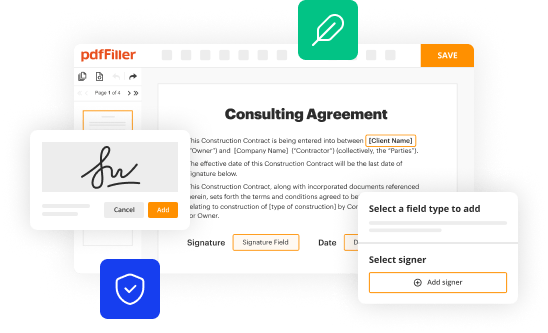

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your form 540 2ez in minutes.

How do I fill out the 540 2ez form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign 540 tax form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit 540 ez on an iOS device?

Use the pdfFiller mobile app to create, edit, and share 540 ez 2023 form from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.