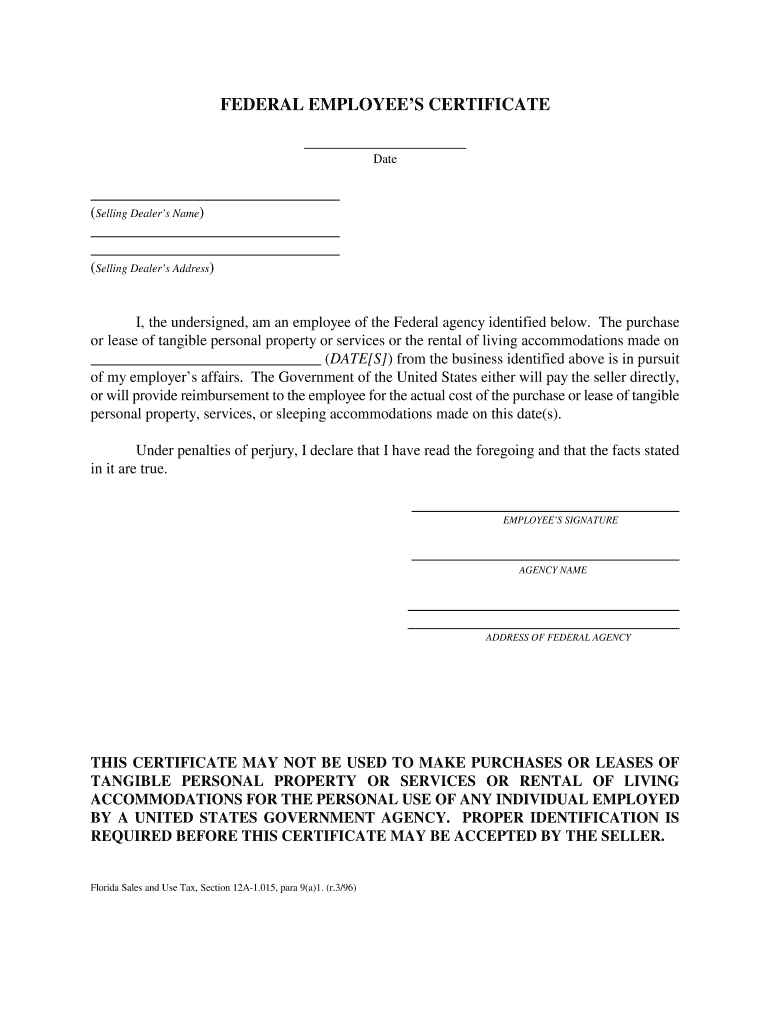

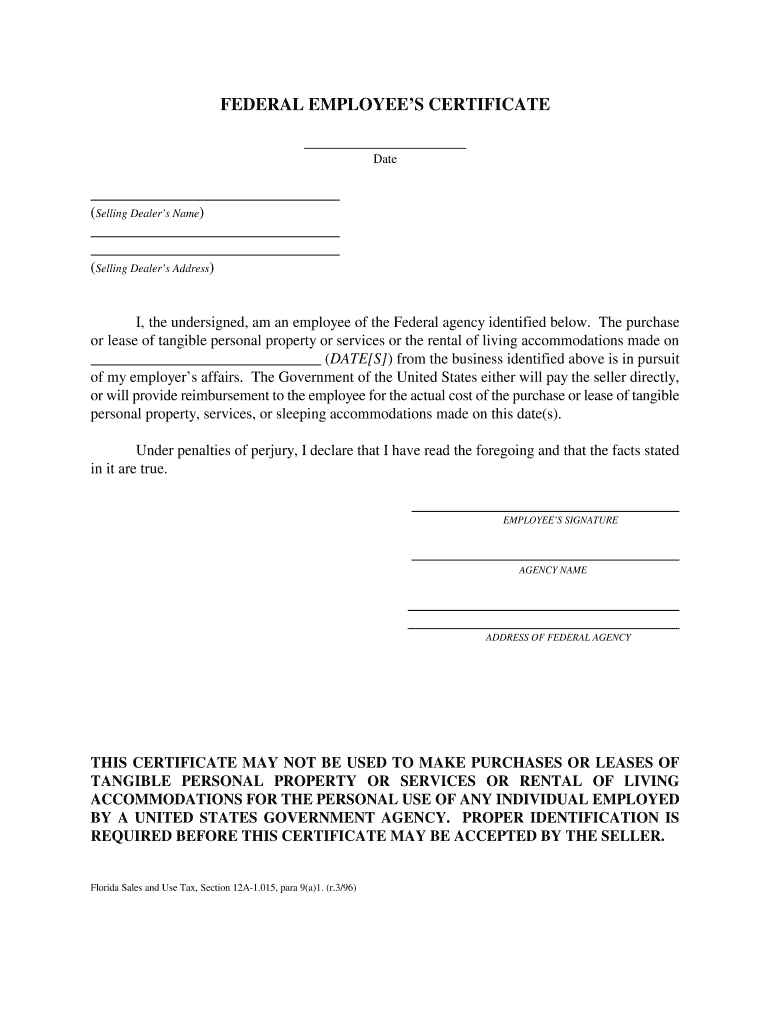

FL Federal Employee's Certificate 1996-2024 free printable template

Show details

FEDERAL EMPLOYEE S CERTIFICATE Date (Selling Dealer s Name) (Selling Dealer s Address) I, the undersigned, am an employee of the Federal agency identified below. The purchase or lease of tangible

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your florida federal certificate tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your florida federal certificate tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit florida federal certificate tax online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fl federal certificate tax form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out florida federal certificate tax

How to fill out Florida federal certificate tax:

01

Obtain the Florida federal certificate tax form from the official website of the Florida Department of Revenue.

02

Provide your personal information, such as your name, address, Social Security number, and taxpayer identification number.

03

Fill out the income section of the form by accurately reporting your total income, including wages, dividends, interest, and any other taxable income.

04

Deduct any eligible expenses from your income, such as business expenses, medical expenses, or any other applicable deductions.

05

Calculate your federal tax liability based on the information provided and fill out the tax due section accordingly.

06

Sign and date the form, ensuring that all the provided information is accurate.

07

If you are filing jointly as a married couple, both spouses must sign the form.

08

Make copies of the completed form for your records before submitting it to the Florida Department of Revenue.

Who needs Florida federal certificate tax:

01

Individuals who reside in Florida and have a federal tax obligation.

02

Businesses or self-employed individuals operating in Florida who are required to pay federal taxes.

03

Non-residents who earn income from Florida sources and have a federal tax liability.

Note: It is always recommended to consult with a tax professional or refer to the official guidelines provided by the Florida Department of Revenue for specific instructions and eligibility criteria related to the Florida federal certificate tax.

Fill federal employee certificate tax form : Try Risk Free

People Also Ask about florida federal certificate tax

How do I look up a Florida tax exempt certificate?

What is the difference between a w9 and tax exemption certificate?

What is a Florida sales tax certificate?

What is a US tax exemption certificate?

How do I get a US sales tax exemption certificate?

Do I need a tax certificate in Florida?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is florida federal certificate tax?

Florida Federal Certificate Tax is a tax imposed on all documents issued by the state of Florida. It is paid to the Florida Department of Revenue and is calculated at a rate of $0.70 per $100 of the amount stated on the document. This tax is used to fund state programs and services.

How to fill out florida federal certificate tax?

The procedure to fill out the Florida Federal Certificate Tax form depends on the type of form you are using. Generally, instructions will be included with the form. In most cases, you will need to provide information about yourself, such as your name, address, Social Security number, and filing status. You will also need to provide information about the type of income you are receiving, such as wages, dividends, interest, and capital gains. Finally, you will need to enter the amounts of your income, deductions, and credits, and then calculate the total tax due.

What is the purpose of florida federal certificate tax?

The purpose of the Florida Federal Certificate Tax is to provide the necessary revenues to the state of Florida to meet its operating expenses. It is a tax imposed on certain transactions involving the transfer of ownership of certain securities or other intangible personal property. The rate of the tax is currently 0.20% of the gross proceeds of the transaction, and the proceeds are deposited in the State Treasury.

What information must be reported on florida federal certificate tax?

The Florida Federal Certificate Tax requires employers to report employee wages paid, tips received, taxes withheld, and employer contributions to employee benefit plans. Employers are also required to report the total number of employees working in the state of Florida.

When is the deadline to file florida federal certificate tax in 2023?

The deadline to file a Florida federal tax return for the 2023 tax year is April 15, 2024.

Who is required to file florida federal certificate tax?

Individuals and businesses are required to file a Florida federal certificate tax if they receive income from federal sources within the state of Florida. This includes individuals and businesses that receive federal grants, contracts, or other payments. However, it's essential to consult with a tax professional or the Florida Department of Revenue for specific details and requirements related to your situation.

What is the penalty for the late filing of florida federal certificate tax?

The penalty for late filing of federal certificate tax in Florida varies based on the specific circumstances. However, generally, the penalty for failing to file on time is 5% of the unpaid tax for each month the return is late, up to a maximum of 25%. Additionally, if the return is more than 60 days late, the minimum penalty is either $205 or the balance of the tax due, whichever is smaller. It's important to note that these penalties can increase if the IRS determines that the late filing was due to fraud.

How can I edit florida federal certificate tax from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including fl federal certificate tax form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in florida federal certificate tax print?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your federal employee certificate to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an eSignature for the federal employee certificate tax in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your florida federal certificate form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Fill out your florida federal certificate tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Florida Federal Certificate Tax Print is not the form you're looking for?Search for another form here.

Keywords relevant to florida federal employee tax form

Related to florida federal employee form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.