Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Forms are an integral part of web development that allow users to input data and interact with websites or applications. A form typically consists of various field elements such as text input fields, checkboxes, radio buttons, dropdown menus, and buttons. These elements enable users to provide information or make selections, which can then be submitted to a server for processing.

Forms serve many purposes, ranging from simple search boxes to more complex registration or application forms. They are widely used on websites for purposes like contact forms, surveys, login or registration forms, newsletter subscriptions, and e-commerce checkout processes.

Form validation is another important aspect of web forms, ensuring that the data entered by users is accurate and complete. Validation rules can be implemented to check for required fields, valid email addresses, specific formats for phone numbers, or any other criteria.

Overall, forms provide a means of capturing user input, allowing websites to gather information and facilitate interaction with users.

Who is required to file forms?

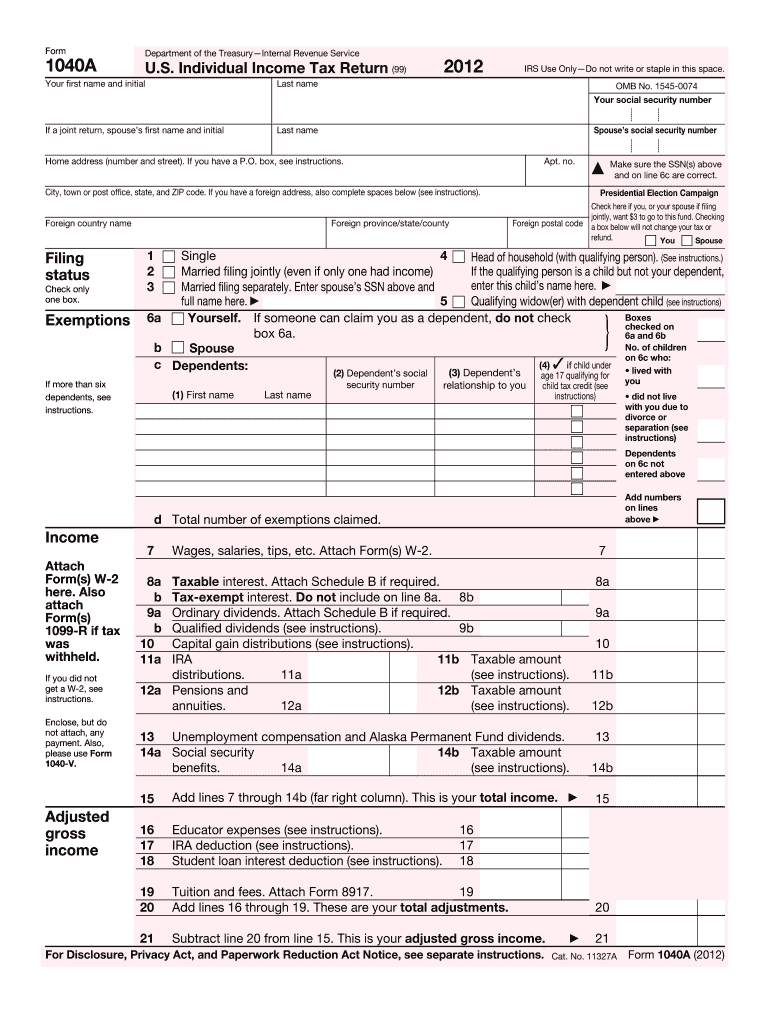

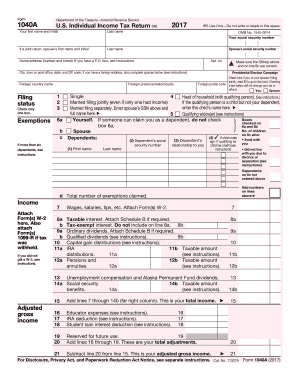

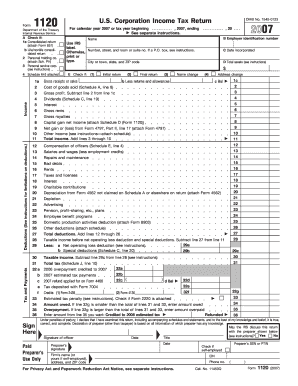

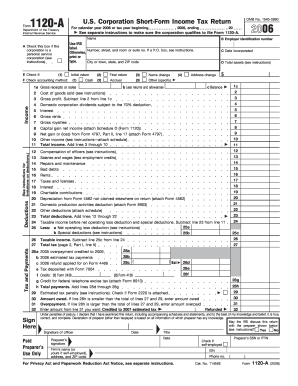

The requirement to file forms varies based on the type of form and the specific circumstances of an individual or organization. Generally, individuals, businesses, and organizations may be required to file various forms such as tax forms (e.g., income tax returns, employment tax forms), financial disclosure forms, immigration forms, business registration forms, and other legal documents. The filing requirement often depends on factors like income, employment status, business ownership, legal proceedings, and compliance with specific laws and regulations. It is advisable to consult relevant authorities or professionals to determine the specific forms that need to be filed based on individual circumstances and legal requirements.

Filling out forms is a straightforward process that can be done by following these steps:

1. Read the instructions: First, carefully read the instructions provided with the form. This will help you understand the purpose of the form and any specific guidelines for filling it out.

2. Gather the required information: Collect all the necessary information that you'll need to complete the form. This might include personal details like your name, address, date of birth, social security number, or any other data required for the form.

3. Use legible handwriting: If you are filling out a paper form, use clear and legible handwriting when completing it. Write in capital letters if necessary to ensure accuracy.

4. Enter information correctly: Fill in the appropriate fields with the requested information. Ensure that you provide accurate and current details, such as addresses and contact numbers.

5. Check for accuracy: Once you have filled out the entire form, review it to ensure that all the information you entered is correct. Verify spellings, dates, and any other relevant data.

6. Sign and date if required: Some forms may require your signature and date to be valid. If needed, provide your signature and write down the correct date on the designated spaces.

7. Attach any necessary documents: If the form requires supporting documents such as identification, transcripts, or certificates, make sure to attach them securely.

8. Make copies for your records: Before submitting the form, make copies of the completed form and any supporting documents for your personal records. This helps to retain a copy in case it is lost or you need to refer back to it in the future.

9. Submit the form: Submit the form as per the provided instructions. For paper forms, you may need to mail or hand-deliver them, while some forms can be submitted electronically through online platforms or emails.

Remember, it is crucial to follow all the instructions and provide accurate information to ensure your form is processed correctly. If you have any doubts or questions, it's often helpful to seek guidance from the form issuer or consult an expert.

What is the purpose of forms?

Forms are used to collect and record information from users in a structured and organized manner. The purpose of forms can vary based on the context, but some common purposes include:

1. Data collection: Forms allow users to input information, such as personal details, preferences, feedback, or survey responses, which can be stored and processed for various purposes.

2. User registration: Forms are often used to create user accounts, where individuals can provide their name, email, username, password, and other necessary information to establish an account.

3. Contact and communication: Forms serve as a means for users to easily contact individuals or organizations. By including fields for name, email, message, etc., users can send inquiries, feedback, or requests effectively.

4. Order placement and purchase: E-commerce websites utilize forms for users to provide details about their product preferences, payment information, shipping addresses, and other necessary information to complete a purchase.

5. Surveys and feedback: Forms can be used to design and distribute surveys to gather valuable feedback, opinions, or demographic information, which can be used for market research, product development, or decision-making purposes.

6. Job applications: Forms are often used by employers for job applications, enabling applicants to submit their qualifications, work history, education details, and other relevant information.

In essence, forms help streamline the process of collecting and managing information, enhance user experience, facilitate communication, and enable efficient data processing.

What information must be reported on forms?

The information that must be reported on forms can vary depending on the type of form and its purpose. However, some common information that is often required includes:

1. Personal Information: This typically includes full name, date of birth, gender, contact details (address, phone number, email), and social security number (or equivalent identification number).

2. Employment Information: This includes details about the current or previous employment, such as the name of the employer, job title, dates of employment, salary or income, and any relevant identification numbers (e.g., employee ID).

3. Financial Information: Forms may require reporting of financial details like income, assets, liabilities, and expenses. This can include information on bank accounts, investments, real estate properties, loans, credit cards, and other financial assets or liabilities.

4. Health Information: In certain medical forms, individuals might be required to report their health history, current medical conditions, medications, allergies, and emergency contacts. This information is usually protected and subject to privacy regulations.

5. Legal Information: Forms related to legal matters may require disclosure of information such as criminal records, previous legal proceedings, judgments, or any other relevant legal documentation.

6. Educational Information: Forms related to education often ask for details about academic qualifications, degrees earned, educational institutions attended, and transcripts.

7. Citizenship or Immigration Information: Some forms, particularly those related to citizenship, residency, or immigration, require reporting on one's nationality, country of birth, immigration status, passport details, and visa information.

It is important to note that the specific information required can vary significantly depending on the purpose and jurisdiction. It is best to consult the instructions provided with the form or seek professional advice when filling out important or sensitive documents.

What is the penalty for the late filing of forms?

The penalty for late filing of forms can vary depending on the specific form and jurisdiction. In general, late filing penalties may include monetary fines, additional interest charges, and potential legal consequences. It is advisable to check with the appropriate government agency or regulatory body regarding the specific penalties for late filing of forms in your particular situation.

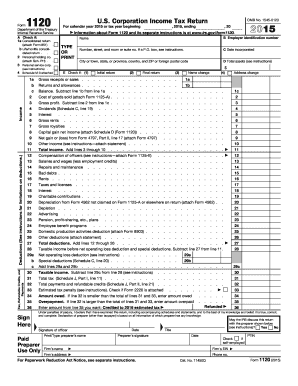

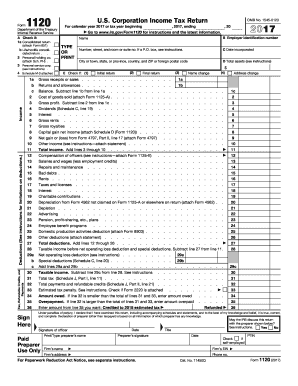

How can I edit 2012 forms - irs from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like 2012 forms - irs, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I fill out 2012 forms - irs using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign 2012 forms - irs. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit 2012 forms - irs on an Android device?

You can make any changes to PDF files, such as 2012 forms - irs, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.