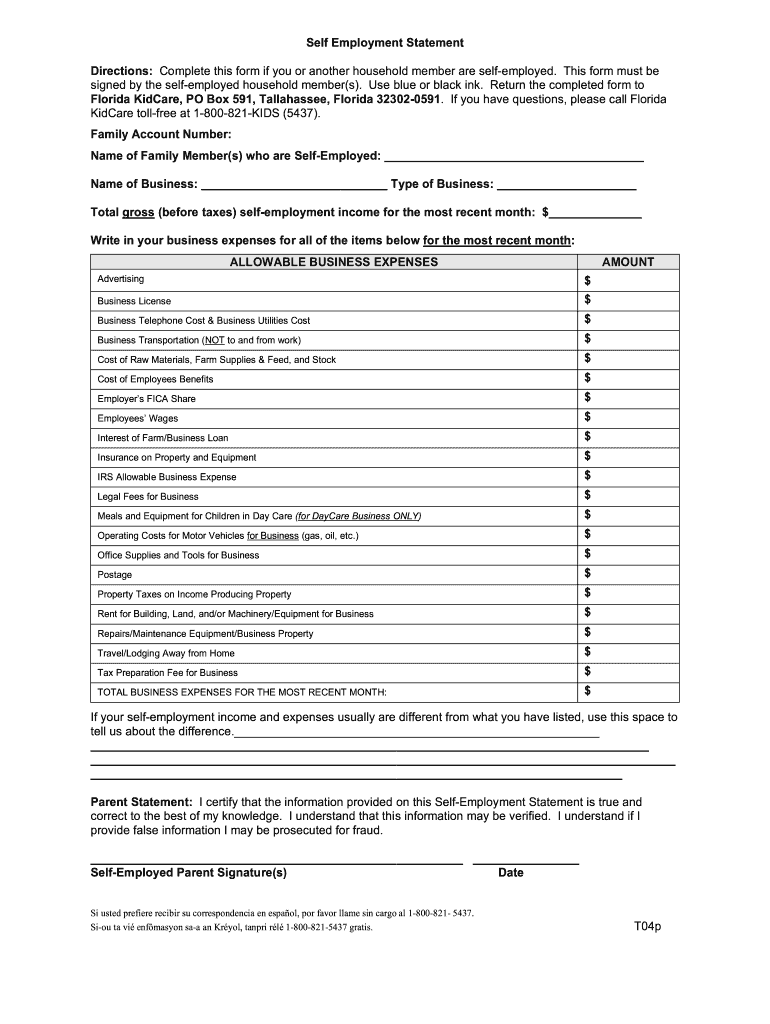

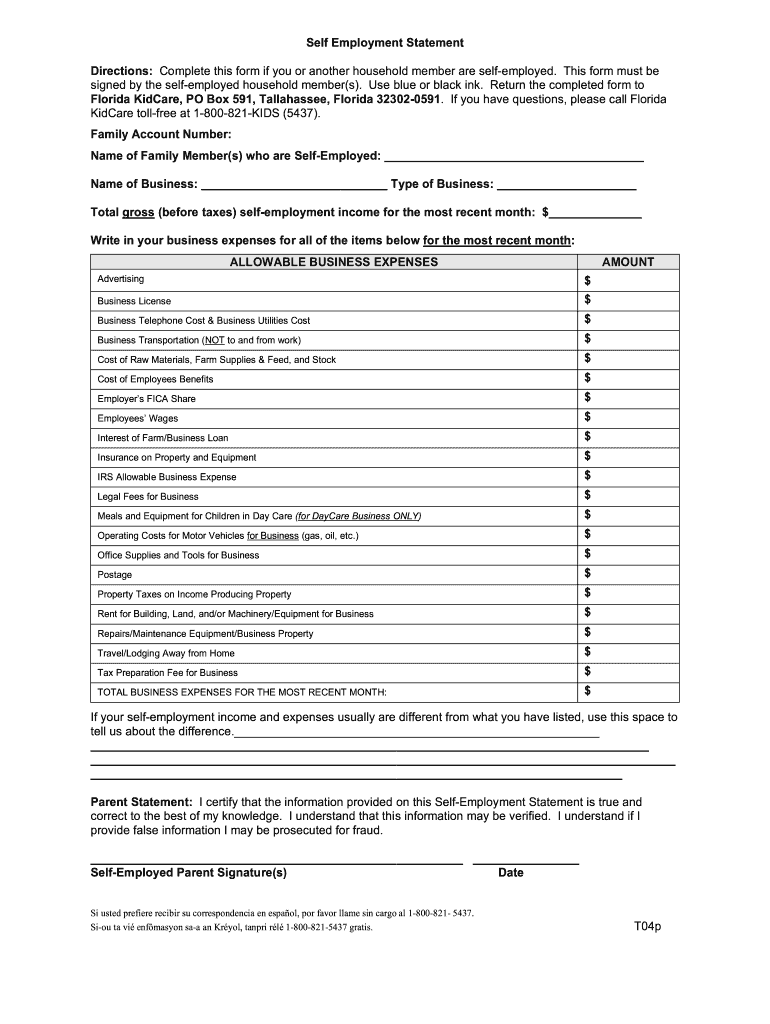

Get the free self employment form

Get, Create, Make and Sign

Editing self employment form online

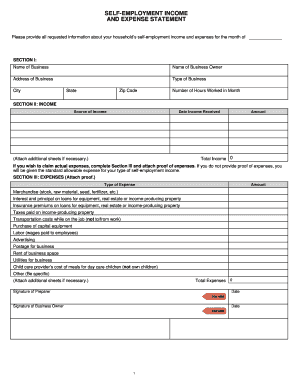

How to fill out self employment form

How to fill out self employment form pdf:

Who needs self employment form pdf:

Video instructions and help with filling out and completing self employment form

Instructions and Help about self employment statement form

Hi guys just that I do another quick video it's very easy for you to prove your income, or you know so like you know employment verification, or you know just whatever it is that you need to like verify when it's like income related when you're self-employed, and you just don't have a way to so paycheck stubs, or you know to verify employment you're your own boss, so you know if you're trying to get um like if you're trying to um I don't know get into like an apartment complex or whatever, and you know they want to verify that you know you have a way to pay them okay you run every month, and you know if you say yeah I'm self-employed you know most places and businesses okay yeah that's nice, and you know sounds great but can you verify that you know they want to see some actual concrete evidence that you're able to UM pay them back for whatever it is that uh that you're trying to get, so you're self-employed you don't really want to say yourself employed especially if you're really trying to get yes response the first time around you know you don't want to screw it up because you don't get any second chances so say you know you're filling out applications for different apartment communities or whatever, and you know they want to verify your employment all you have to do is sign up for a free fax number you can even use some effects and I just made a video on effects and how you can um get that so get your own fax number and all you have to do basically is give the people that you know landlords or apartment complexes, or you know even if you're trying to get a job, and you know maybe it didn't work out at your last job like how you thought it would or whatever, so you know if they want to send something to your previous employer to see how you did you know like when they do it back on check or whatever and say they want to send a form to them or whatever just to get an idea and if you're a good employee or whatever I have to do is get your fax number for the apartment community give them the fax number basically the fax is going to be sent to you, you fill it out, and then you fax it back to them, so they're thinking that um you know they're contacting your previous employer or your current employer you know that's what they think let them know yes name is Bob Evans and this is his fax number you know put that down on your rental application, or you know if you're applying for a job you know put that down yeah Bob Evans he was my previous employer for such-and-such company the fax is going to get sent to you through your affects number, and basically it's going to be sent to your email address, and then you print the form out you fill it out, and you send it back to them through fax and with fax you can receive faxes for free but when you want to send faxes for free all you have to do is go to Google type in send free how to send faxes for free from your computer basically you scan the documents or document you scan them upload them to your...

Fill form self employment : Try Risk Free

People Also Ask about self employment form

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your self employment form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.