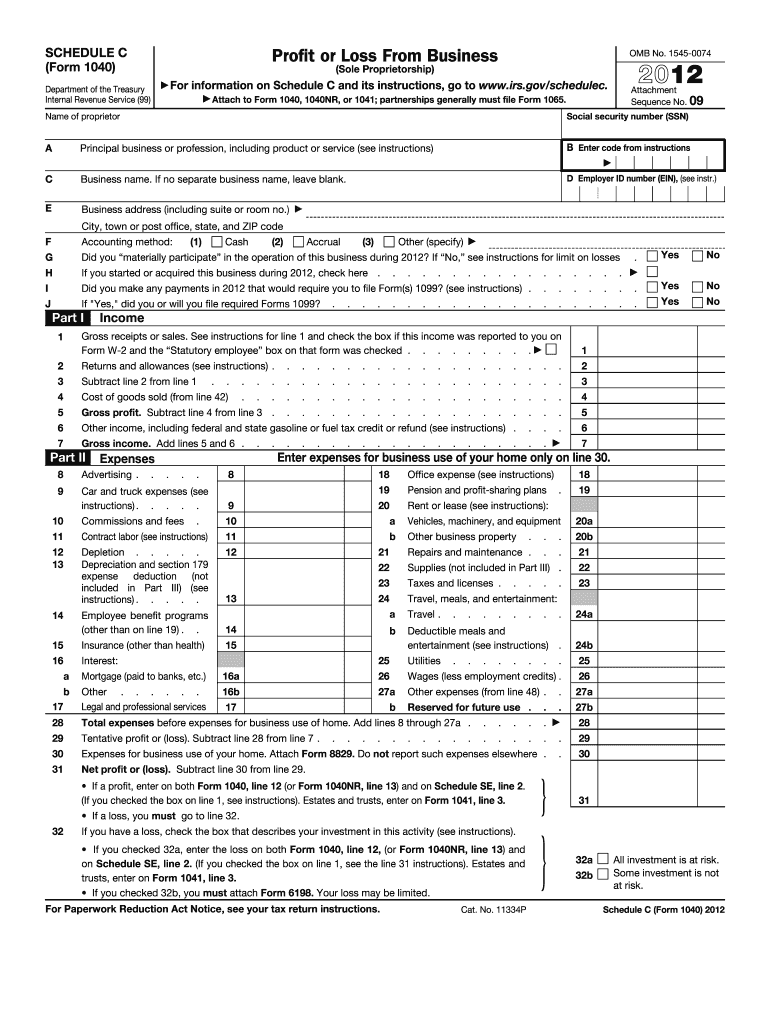

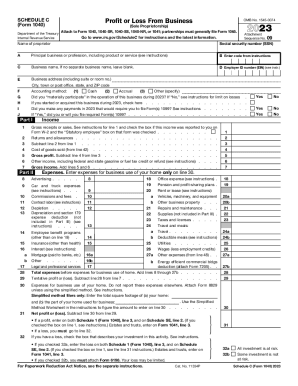

What is the 1040 Schedule C form?

The Schedule C tax form is an IRS report for sole proprietors to report their income or loss from their businesses. This is an attachment to the standard 1040 report, the U.S. Individual Income Tax Return.

Who should file the 1040 Schedule C form 2012?

All individuals who operate their businesses without employees or partners (e.g., freelance photographers) are considered sole proprietors. Therefore they must report their income and expenses to the IRS for 2012 and file their Schedule C tax form. This document can also be used by entrepreneurs who have just started their business with very little income, zero profit, or incurred losses.

Additionally, this form applies to small business owners who used to complete a separate Schedule C-EZ declaring their small income with no employees or inventory, with expenses less than $5000. (Business owners formerly had to submit a Net Profit from Business report, which the IRS has replaced with the Schedule C.)

Independent contractors and self-employed taxpayers also need to complete a blank Schedule C if they received a form 1099-MISC or 10-99-NEC instead of a regular W2.

What information do you need when you file the 1040 Schedule C form?

The Schedule C tax form comprises many different fields of various information. Regardless of how your business operates, you will need to provide the following data:

- Your full name as a proprietor

- Principal business details or profession, including product or service provided

- Your business name and full contact information

- Your social security number and your business’ ID number (EIN)

- Your financial results in the 2012 including gross receipts, returns, and other income (e.g., federal or local gasoline tax credits and refund)

- All expenses you had during the tax year in detail

How do you fill out the Schedule C tax form in 2013?

The 1040 Schedule C form can be filled out and filed either physically via mail services or electronically. The e-filing is available either through the IRS certified e-file provider or via pdfFiller, a professional PDF editor with advanced document sending capabilities. Here's how you can promptly draft and send your PDF report with pdfFiller:

- Click Get Form to open a fillable Schedule C template in pdfFiller's editor.

- Click on each fillable field to provide your details and check any necessary boxes.

- As you fill in your information, move to the following fields with the Next option.

- Check your answers and click Done when finished.

- Download your copy, print it out, or mail it to the IRS via USPS directly from pdfFiller.

Find detailed instruction on how to prepare the blank Schedule C form and what information to include in the report here.

Is the 1040 Schedule C form accompanied by other forms?

The Schedule C tax form should be attached to the 1040 Form, so you should file them together. Apart from that, depending on your situation, you may also need to submit documents such as:

- 1040 Schedule A to deduct interest, taxes, and casualty losses not related to your business.

- 1040 Schedule E to report rental real estate and royalty income or loss not subject to self-employment tax.

- 1040 Schedule F to report profit or (loss) from farming.

- 1040 Schedule J to figure your tax by averaging your farming or fishing income over the previous three years. Doing so may reduce your tax.

- 1040 Schedule SE to pay self-employment tax on income from any trade or business.

- Form 461 about having excess business loss.

- Form 3800 to claim any of the general business credits.

- Form 4562 to claim depreciation and amortization that started in 2012.

- Form 4684 to report a casualty, theft gain, or loss involving property used in your trade or business or income-producing property.

- Form 4797 to report sales, exchanges, and involuntary conversions (not from a casualty or theft) of trade or business property.

- Form 6198 to figure your allowable loss if you have a business loss and have amounts invested in the business for which you are not at risk.

- Blank 6252 to declare income from the installment agreement.

- Form 7202 on a refundable credit for self-employed taxpayers impacted by the pandemic.

- Form 8582 to figure your allowable loss from passive activities. Form 8594 to report certain purchases or sales of groups of assets that constitute a trade or business.

- Form 8824 to report like-kind exchanges.

- Form 8829 to claim actual expenses for business use of your home.

- Blank 8990 to define if your business interest deduction is limited.

- Form 8995 or 8995-A to claim a deduction for qualified business income.

When is the 1040 Schedule C form due date?

Your 1040 schedule C form is due at the same time as your tax return, by April 18, 2013.

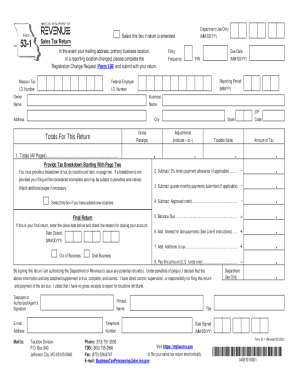

Where do I send a Schedule C tax form?

You must send your Schedule C tax form to the IRS with a regular mailing service. You can do it online via pdfFiller's direct option. When your document is ready, choose the Send via USPS feature to file your report right from the editor without printing the papers. You'll need to fill out a virtual envelope providing the address of your local IRS department. The valid addresses for different states are available on the last page of the official IRS 1040 PDF instructions.