Get the free payroll employee form

Show details

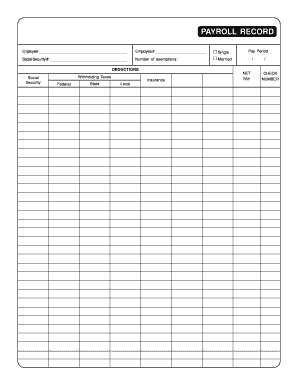

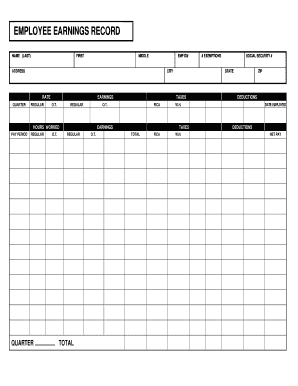

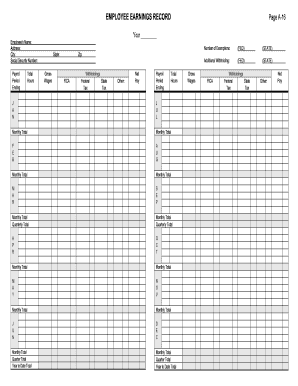

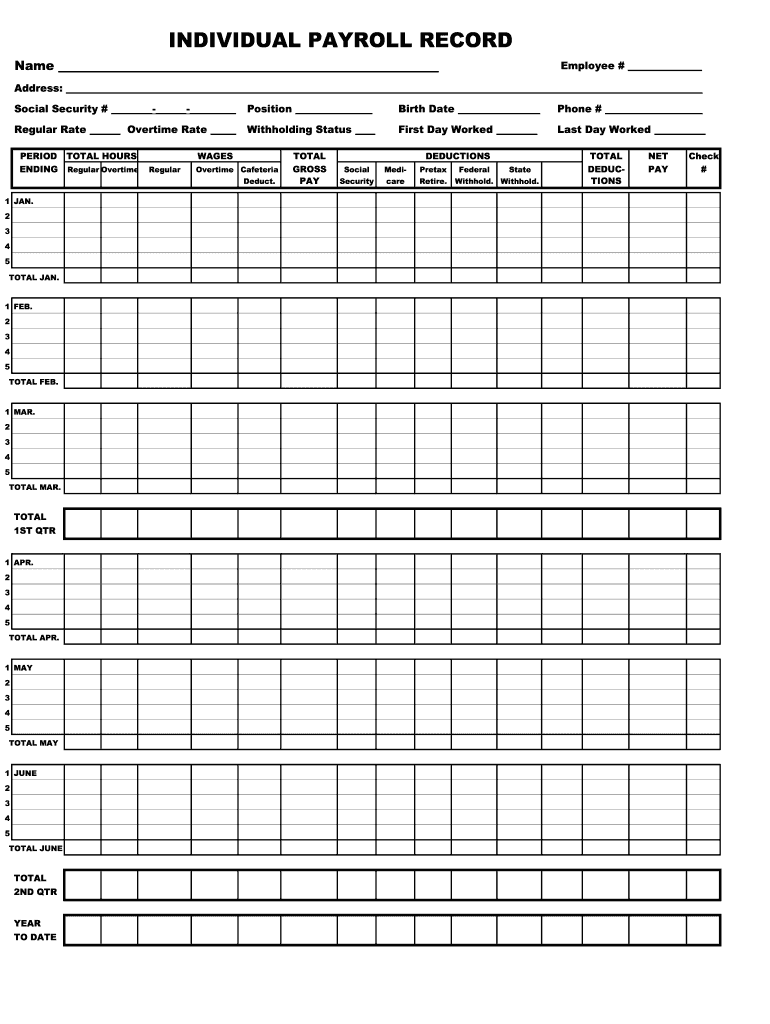

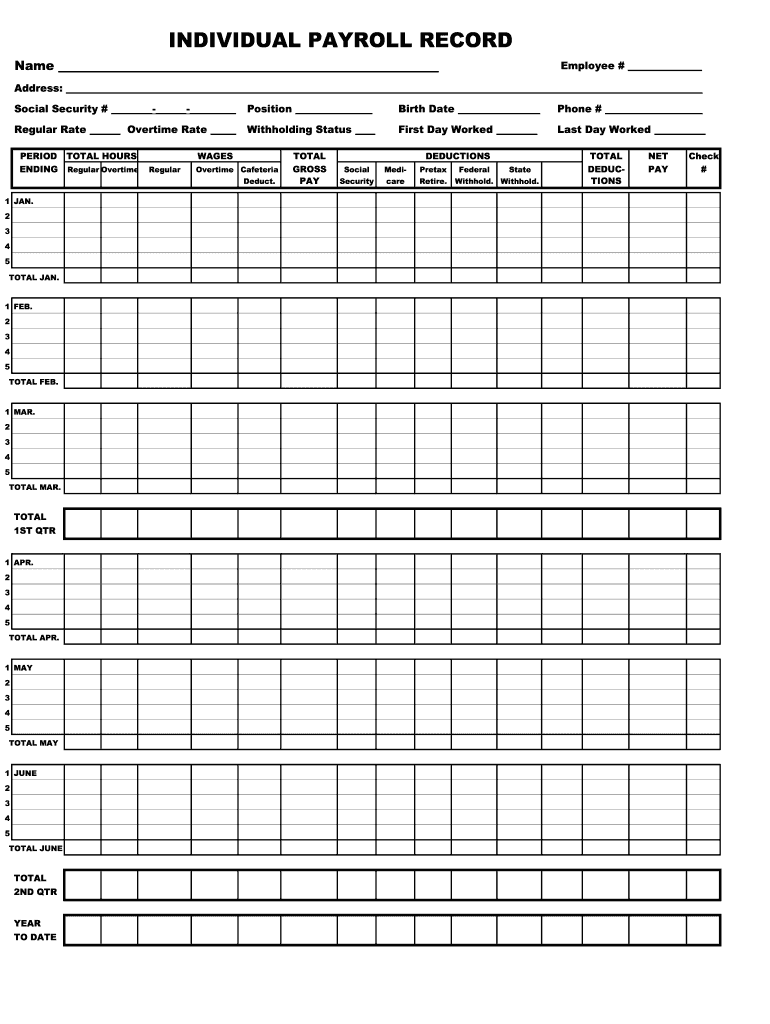

INDIVIDUAL PAYROLL RECORD Name Employee # Address: Social Security # Position Birth Date Phone # Regular Rate Overtime Rate Withholding Status First Day Worked Last Day Worked PERIOD TOTAL HOURS ENDING

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your payroll employee form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll employee form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payroll employee online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit payroll pay form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out payroll employee form

How to fill out payroll employee:

01

Obtain and review necessary employee information, such as name, address, social security number, and tax withholding forms.

02

Calculate regular wages based on hours worked and rate of pay.

03

Determine and apply any applicable overtime wages and calculate total compensation.

04

Deduct taxes and other withholdings, such as social security, Medicare, and voluntary deductions.

05

Calculate and record any additional earnings, such as bonuses or commissions.

06

Ensure accurate record-keeping of all payroll transactions.

07

Prepare and distribute employee paychecks or direct deposits.

08

Generate payroll reports for internal record-keeping and tax purposes.

09

File and pay all required payroll taxes with the appropriate government agencies.

Who needs a payroll employee:

01

Small and large businesses that have one or more employees and need to manage their payroll processes accurately and efficiently.

02

Non-profit organizations that have paid staff and need to comply with payroll regulations.

03

Any company or entity that wants to ensure proper payment, record-keeping, and withholdings for their employees.

Fill employee records : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file payroll employee?

Any employer who has employees working for them is required to file payroll taxes. This includes employers in the private sector, public sector, and non-profit organizations.

What is the purpose of payroll employee?

The purpose of a payroll employee is to process payroll information, including employee wages, deductions, and payments. They ensure that all payroll information is accurate and up-to-date, and that all payments are made on time. They also provide assistance to employees with questions or problems related to their pay.

What is the penalty for the late filing of payroll employee?

Penalties for late filing of payroll employee taxes can vary greatly, depending on the particular jurisdiction and the amount of taxes owed. Generally, the IRS imposes a penalty of 5 percent of the unpaid taxes for each month the taxes remain unpaid, up to a maximum of 25 percent. Other penalties and interest may also be applicable.

What is payroll employee?

A payroll employee is an individual who is employed by a company or organization to handle various tasks related to payroll processing and management. This typically includes calculating and disbursing employee salaries and wages, deducting necessary taxes and benefits, maintaining payroll records, preparing payroll reports, and ensuring compliance with relevant laws and regulations. The role of a payroll employee is crucial in ensuring accurate and timely payment of employees and maintaining payroll-related documentation.

How to fill out payroll employee?

To fill out a payroll employee, follow these step-by-step instructions:

1. Gather necessary information: Collect all relevant information about the employee, including their full name, address, Social Security number, tax filing status, and any additional tax withholding information provided by the employee.

2. Determine pay period: Decide on the pay period for which you are filling out the payroll. This could be weekly, bi-weekly, semi-monthly, or monthly, depending on your company's policy.

3. Calculate gross pay: Determine the employee's gross pay for the pay period. This is typically based on their hourly rate, salary, or commission. Multiply the number of hours worked by the hourly rate or use the set salary amount. If there are any additional earnings, such as overtime or bonuses, include them in this calculation.

4. Calculate deductions: Subtract any deductions from the gross pay. Common deductions include federal income tax, Social Security tax, Medicare tax, state income tax, local taxes (if applicable), and any voluntary deductions such as health insurance premiums, retirement contributions, or other benefits.

5. Determine net pay: Subtract the total deductions from the gross pay to calculate the net pay. This is the amount that will be paid to the employee after taxes and deductions have been subtracted.

6. Record payroll information: Fill out a payroll register or spreadsheet with the employee's name, pay period dates, gross pay, deductions, and net pay. Include any other relevant payroll information required by your company or local regulations.

7. Issue pay stubs: Provide the employee with a pay stub that shows their gross pay, deductions, and net pay. This can be done electronically or on a printed paper document. Make sure to include the pay period and any year-to-date information.

8. Report and remit payroll taxes: Depending on your jurisdiction, you may be required to report and remit payroll taxes to the appropriate tax authorities. This typically includes filing employer withholding tax returns and depositing the required tax amounts.

9. Keep accurate records: Maintain accurate records of all payroll information in accordance with legal requirements. This includes keeping copies of pay stubs, payroll registers, tax filings, and related documents.

It's essential to familiarize yourself with payroll laws and regulations in your specific jurisdiction to ensure compliance. Consider consulting with a professional accountant or using payroll software to streamline the process and minimize errors.

What information must be reported on payroll employee?

The specific information that must be reported on a payroll employee can vary depending on the country and local regulations. However, generally, the following information is commonly reported:

1. Employee Identification: Full name, address, social security number (or equivalent), date of birth, and contact details of the employee.

2. Employment Details: Start date, employment status (full-time, part-time, or temporary), job title or position, employee number (if applicable), and any changes in employment status.

3. Compensation Information: Gross wages or salary, hours worked (if applicable), overtime hours (if applicable), rate of pay, pay frequency (weekly, biweekly, monthly), and any bonuses, commissions, or other additional earnings.

4. Benefits and Deductions: Information about any benefits provided to the employee, such as health insurance, retirement plans, or other company-sponsored benefits. Deductions made from the employee's pay, such as income tax, Social Security contributions, insurance premiums, retirement plan contributions, or union dues, should also be reported.

5. Time Off and Leave: Accumulated and used vacation days, sick leave, or any other time off taken by the employee.

6. Withholding Information: The amount of income tax and other required payroll taxes withheld from the employee's pay, as well as any other voluntary deductions requested by the employee, such as insurance premiums or charitable contributions.

7. Year-to-Date Totals: The year-to-date (YTD) totals of earnings, deductions, and taxes for the employee should be provided.

8. Employment Termination: If an employee leaves the organization, the date and reason for termination must be reported.

It is crucial for businesses to comply with local labor laws and tax regulations to ensure accurate and timely reporting of employee information. It is recommended to consult with a payroll specialist or human resources professional to ensure compliance with specific reporting requirements in your jurisdiction.

How do I modify my payroll employee in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your payroll pay form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Where do I find payroll com?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific individual payroll record and other forms. Find the template you want and tweak it with powerful editing tools.

How can I fill out payroll record form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your individual payroll record template form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your payroll employee form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Com is not the form you're looking for?Search for another form here.

Keywords relevant to payroll support form

Related to company vacation

If you believe that this page should be taken down, please follow our DMCA take down process

here

.